Insight Focus

- Fears of a global slowdown and new COVID cases in China weigh on PTA, MEG futures.

- High summer temperatures result in electricity curbs and polyester production cuts.

- PET resin export margins rise on tight supply and lower feedstock costs.

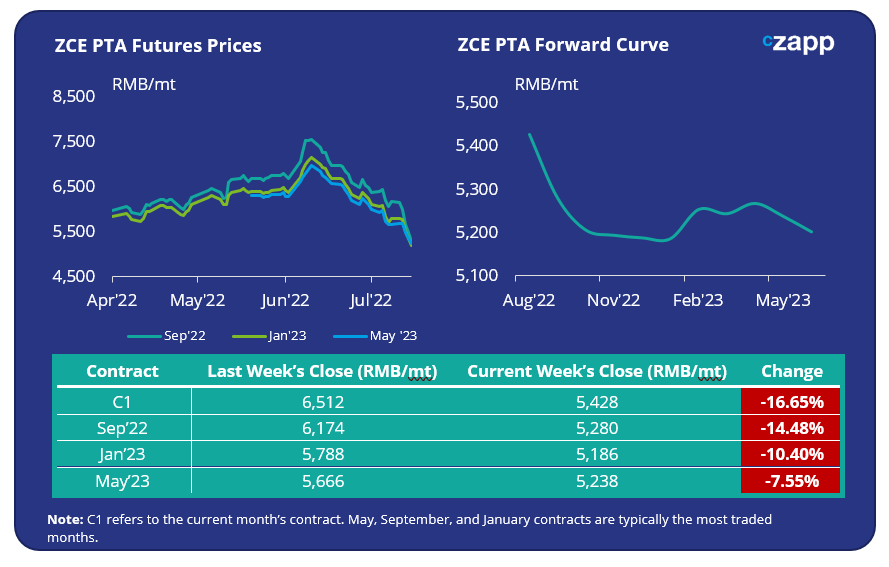

PTA Futures and Forward Curve

- PTA futures fell sharply again last week, driven by lower crude and upstream prices caused by heightened concerns about rising COVID cases in China and fears of a global economic slowdown

- Although someproducers still have maintenance plans in July, any reduction in supply may be more than offset by expected polyester production cuts, keeping the PTA market in oversupply.

- Polyester and downstream operating rates are already being reduced due to the extreme summer heat, typical of the summer months when electricity demand is at its highest.

- The backwardation of the PTA forward curve has steepened through Q3 2022.

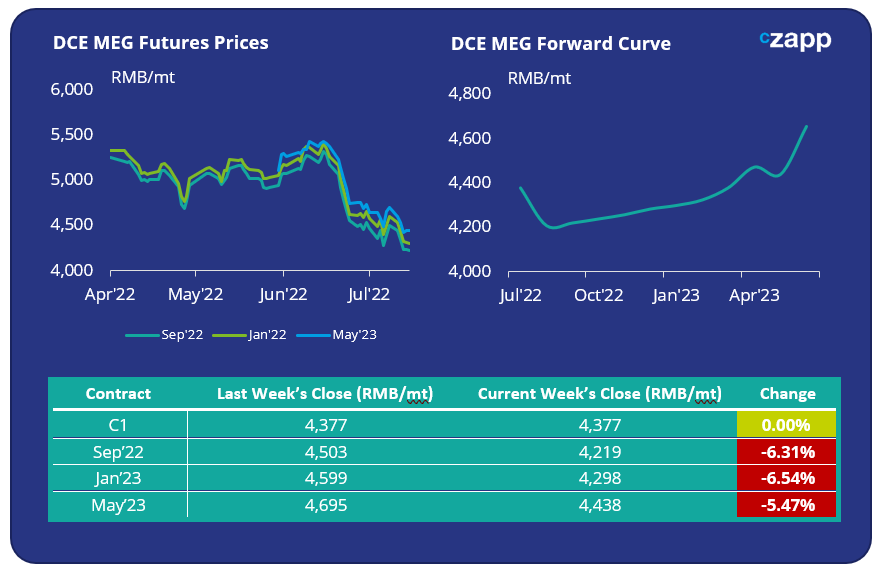

MEG Futures and Forward Curve

- MEG futures continued to nosedive last week, hitting a new year-to-date low due to the recent plunge in crude oil and weaker downstream demand from textiles.

- Whilst production cuts may lend support, high port inventories and slow off-peak demand continue to provide resistance, with any easing of the current oversupply unlikely before September.

- Future MEG contracts continue to trade at a premium to current prices.

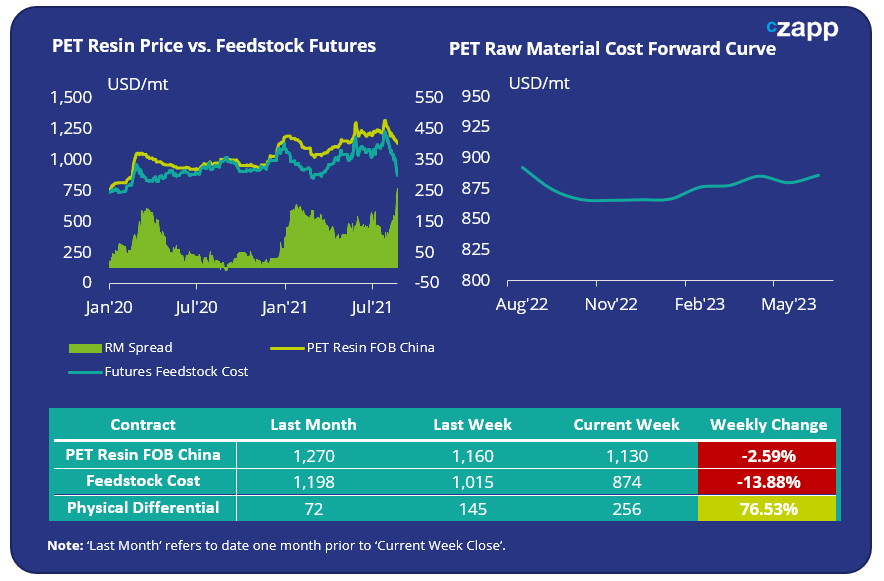

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices continued to soften through last week to around USD 1130/tonne by Friday, an average weekly decline of USD 30/tonne.

- Producer margins continued to rally on short supply, with the weekly average PET resin – raw material physical differential widening to USD 209/tonne, up USD55/tonne from the previous week’s average.

- By Friday the daily spread had risen to USD 256/tonne, a new record daily high. However, a modest downward correction may materialise early next week as the PET resin market catches up on raw material movement.

- Recent declines in both PTA and MEG futures means that the PET resin raw material forward curve has flattened out considerably. Whilst remaining backwardated through to September, from October onwards the forward curve now rises into 2023.

Concluding Thoughts

- Domestic restocking and increased buying interest for export over the last week has caused export margins to rebound to record highs because of lack of availability.

- Certain regions in China have also been experiencing extreme summer temperatures. Temperatures in Zhejiang, Jiangsu and Shanghai have recently reached over 42°C.

- Regional governments have restricted electricity use at factories, prioritising household use instead. As a result, at least one producer within the region has been forced to cut output temporarily.

- Despite high export margins, PET resin export prices are expected to fall through Q3 due to seasonality and backwardation in raw materials.

- Fears of a new lockdown in Shanghai are also rising as a new wave of COVID cases were detected, and any move to reimpose broader lockdown restrictions in Shanghai may dent demand recovery and cause upstream costs to plummet further.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

European PET Market Stumbles as Producers Left Blind on Costs

PET Resin Trade Flows: China’s PET Exports Surge as Logistics Ease Post-COVID

Asia PET Market View: Chinese Consumption Rebound Drives New PET Orders