Insight Focus

- Crude rallied once again last week, sending PTA and MEG futures higher.

- PET resin export prices also jumped, with prices now looking to have bottomed out.

- Price rises weren’t enough to recover margin, as producers remain under severe pressure.

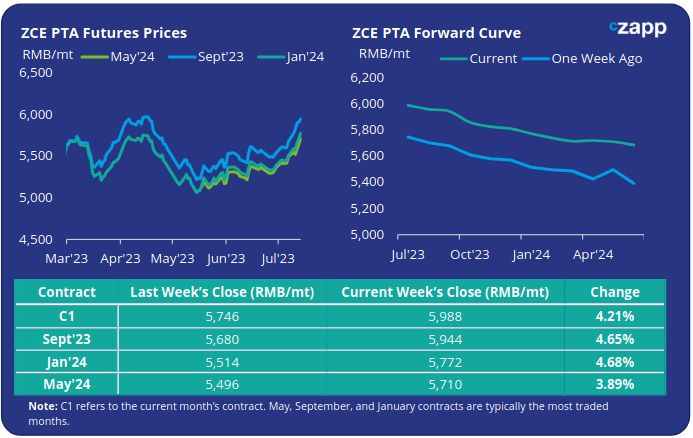

PTA Futures and Forward Curve

- PTA futures continued to rally last week as oil prices reached their highest levels in over a month, with Brent moving above $81 by Friday.

- Bullish sentiment was driven by several factors, including supply disruptions in Libya and Nigeria, OPEC+ production cuts, and signs of lower Russian oil exports.

- In terms of PTA fundamentals, polyester plant operating rates continued to remain high supporting demand; supply is facing a short-term reduction, via lower operating rates and turnarounds, resulting in some destocking and limiting supply pressure.

- Whilst sufficiently liquid, Yisheng Hainan’s 2 Mtpa PTA unit unexpectedly reduced production, in addition to several plants including Jiaxing Petrochemical’s 1.5 Mtpa plant now entering scheduled maintenance.

- However, upward momentum on PTA prices may be challenged as new supply (2.5 million tons/year PTA plant in Huizhou) gradually comes into the market over the next month.

- The weakening yuan and any potential deterioration in the global economy could put downward pressure on prices in the second half of the year.

- Although lifted higher versus the previous week, the forward curve still shows a steady downward slope over the next 12-months. By Friday the Sept’23 contract was trading at a RMB 44/tonne discount to the current month; Jan’24 at RMB 216/tonne discount.

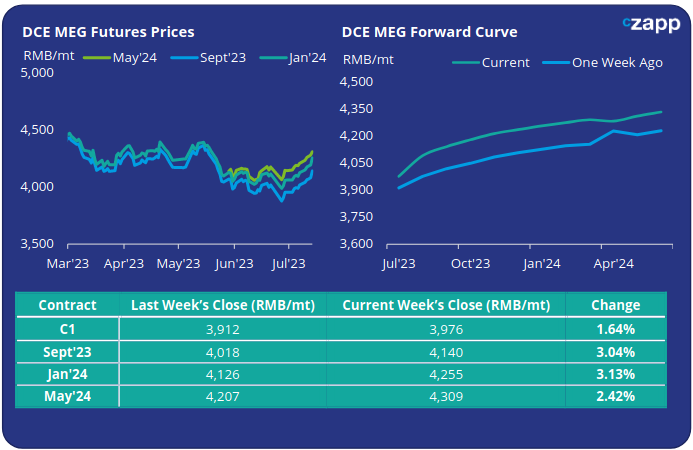

MEG Futures and Forward Curve

- MEG futures similarly advanced off the back off stronger crude, having risen nearly 7% over the last two weeks.

- Ample availability continues to constrain further advances, with port inventories reapproaching the million-tonne mark once again; last week port inventories increased 0.44% last week to 993k tonnes.

- Although more deep-seas cargoes are expected through July, slower recovery in domestic production and restocking activities by traders and buyers, help improve the supply demand picture.

- Future price direction will not only rely on crude’s path over the coming months but whether the high polyester operating rates can sustain in the face of slow textile offtake.

- The MEG forward curve continues to show prices steadily increasing over the next 12-months. By Friday the Sept’23 contract was holding a RMB 164/tonne premium to the current month; Jan’24 holding a RMB 279/tonne premium.

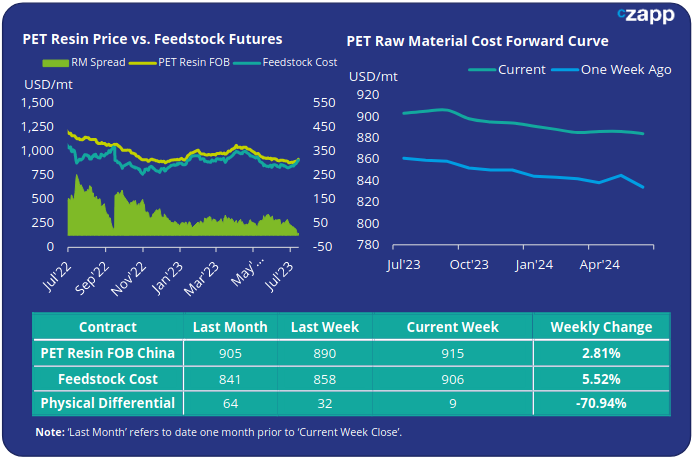

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices rebounded strongly with the move in raw material costs, increasing by USD 25/tonne to an average of USD 915/tonne by Friday.

- Despite the rise, raw materials futures outpaced resin prices, meaning the weekly average PET resin physical differential to future feedstock costs narrowed even further, down USD 24/tonne to average USD 11/tonne for the week. By Friday the daily spread had fallen further to just USD 9/tonne.

- The raw material cost forward curve shows a gradually declining cost based through the remainder of the summer and into Q1’24.

- At Friday’s close, Sept’23 raw material costs continued to trade on relative par with the current month, with a small premium of USD 3/tonne; Jan’24, the next main contract month, was at a USD 12/tonne discount.

Concluding Thoughts

- Although the forward curve continues to indicate a steady reduction in raw material costs over the remainder of the year, an increasingly bullish crude sentiment has potentially created a market bottom for PET export prices.

- PET resin export prices have risen USD 25/tonne over the last week, and there’s currently only a USD12/tonne downside to future raw material costs into Jan’24,

- Therefore, prices look to have already reached a near-term low, having highlighted a potential bottom in last week’s report.

- That said, demand remains lacklustre; high inventories in key target markets limit further shipments.

- Additional new capacity expected over the coming months is expected to see competition intensify into the off-season in the Northern Hemisphere, keeping margins at cost level.

- However, beyond this there is a glimmer of optimism. If the global economy avoids a damaging recession, and existing stocks are run down, Q1’24 could offer an opportunity for demand and margin recovery.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.