Insight Focus

PTA and MEG futures remain subdued. Both have been impacted by high port inventories despite polyester peak season. Asian PET resin export prices continued to decrease, eroding PET resin producer margins.

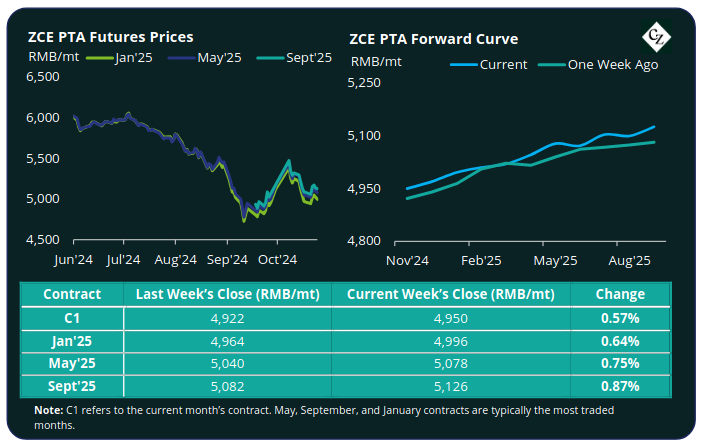

PTA Futures and Forward Curve

PTA futures experienced a minor rebound last week, with main contract months up just over 0.5%.

After facing steep declines over the last fortnight, crude oil prices posted a weekly gain as geopolitical uncertainty remains a central focus of oil traders. By Friday Brent crude oil prices had gained over 4% on the previous Friday’s close to over USD 76/bbl.

Both the PX-N and PTA-PX spreads narrowed slightly, with the average PTA-PX CFR weekly spread easing to around USD 78/tonne.

Looking forward, PTA supply/demand fundamentals could see improvement based on some scheduled maintenance. However, any improvement will be constrained by ample supply availability, despite high polyester operating rates.

The PTA forward curve moved from flat into contango, with the Jan’25 premium increasing to RMB 46/tonne over the current month’s contract. May’25 has a RMB 128/tonne premium.

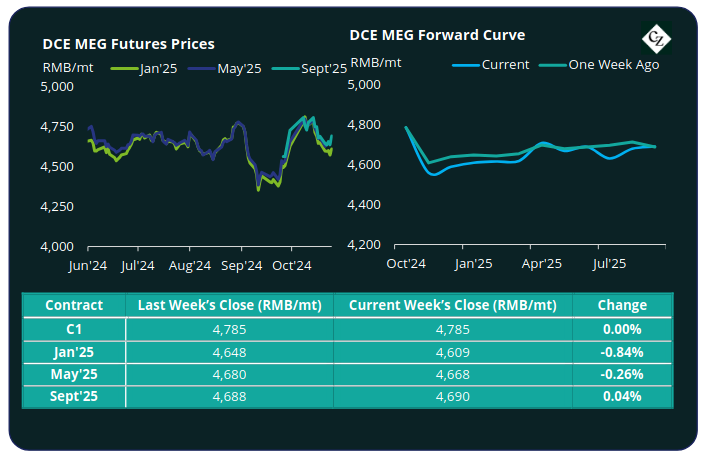

MEG Futures and Forward Curve

The main Jan’25 MEG contract fell by around 1% last week with rising port inventory levels dampening market sentiment.

East China main port inventories increased by around 8.3% to 621,000 tonnes, although still at comparatively low levels overall. Deep sea arrivals are expected to keep high through the reminder of October.

That said, high polyester operating rates also remain strong supporting from the demand-side, alongside some plant maintenance shutdowns supporting near-term MEG SD fundamentals.

The Jan’25 contract holds a RMB 176/tonne discount over the current month, with the remaining 2024 contracts holding a short-term premium.

Beyond this the curve shows a slight forward premium, with the May’25 contract holding a RMB 59/tonne premium over Jan’25.

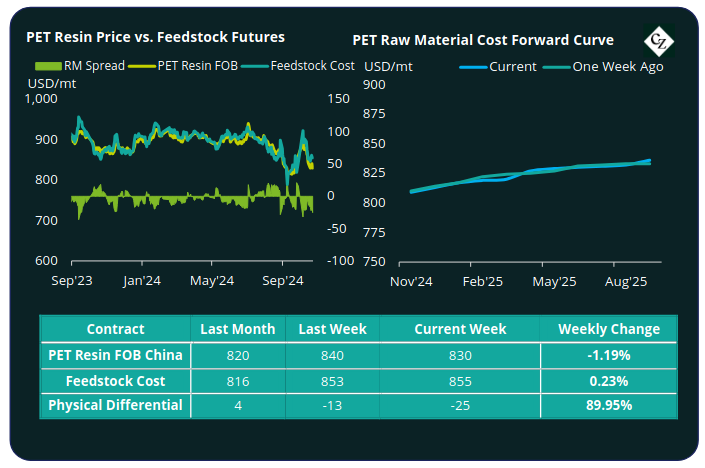

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices continued to weaken last week before steadying, with an average price of USD 830/tonne by Friday, down USD 10/tonne on the week.

The average weekly PET resin physical differential against raw material future costs fell further by USD 9/tonne to negative USD 20/tonne last week. By Friday, the daily differential was negative USD 25/tonne, the lowest point since early September.

With its near-term weakness, the raw material cost forward curve shows a steeper forward premium through 2025. Although Jan’25 only holds a USD 8/tonne premium over the current month, this premium has grown to USD 20/tonne for May’25 and USD 27/tonnes for Sept’25.

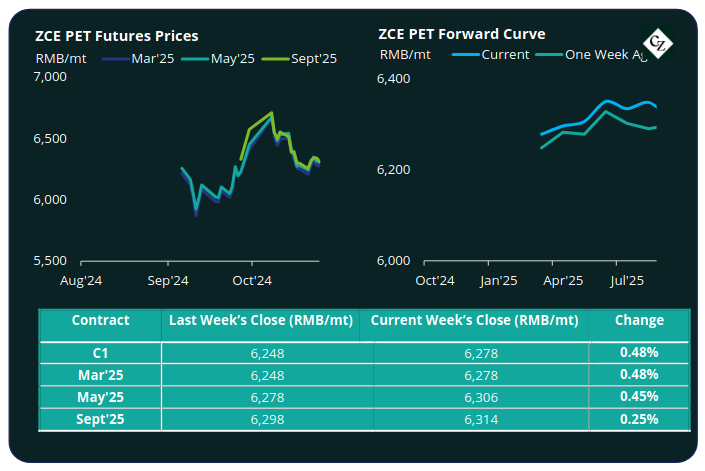

***NEW PET Resin Futures and Forward Curve

PET Resin Futures steadied with a slight rebound from the previous week’s lows, up around 0.5% on the week.

The Mar’25 contract, the first contract month of these new futures, fell to RMB 6,278/tonne (USD 882/tonne, up an equivalent of USD 4/tonne) by Friday.

The average weekly premium over Raw Material Futures increased by just USD 2/tonne to USD 20/tonne. By Friday, the daily premium was USD 22/tonne.

The PET Resin Futures forward curve continues to show just the slightest forward carry, with May’25 showing a USD 3/tonne premium and Sept’25 a USD 5/tonne premium, over the main Mar’25 contract.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

Concluding Thoughts

Chinese PET resin export prices steadied around USD 830-840/tonne FOB last week, supported from further declines by rising crude and added demand.

Despite the recent price weakness, spot prices from some Chinese producers were still USD 20-25/tonne higher than levels offered mid-September.

Support comes from domestic restocking and added export demand from lower prices, particularly from buyers who missed the previous lows.

However, ample supply and structural over-capacity are still major factors that have resulted in the physical difference retreating over the last few weeks.

Looking forward, the raw material cost forward curve has started to show a steeper forward premium through 2025. PET resin futures are yet to respond to this weekly change.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.