Insight Focus

- Higher prices driven by crude cloud reality of low margins and weak demand.

- The raw material forward curve remains flat, moderately backwardated into 2023.

- PET producers face weak domestic demand and difficulties in exporting due to lockdowns.

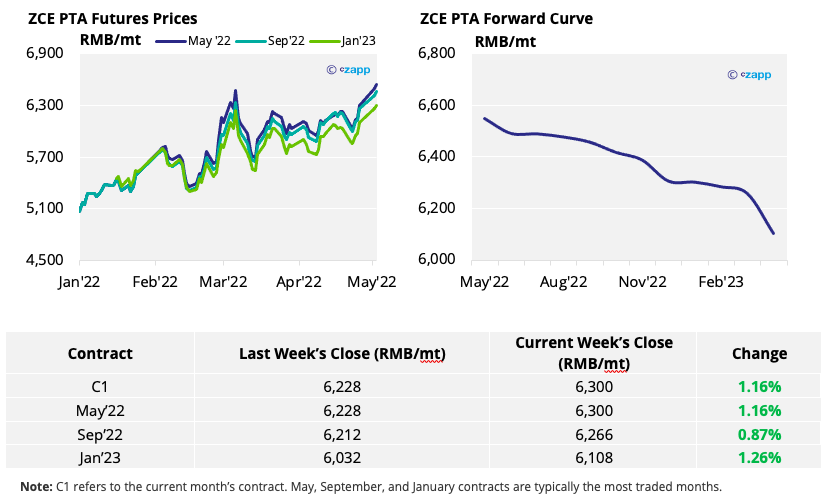

PTA Futures and Forward Curve

- PTA Futures ended higher last week, following the recent crude rally, although margins remain low and at around breakeven for producers.

- Severe COVID-controls across China are impacting demand from the polyester industry, whilst supply is expected to grow in May as producers come off maintenance, keeping margins suppressed.

- The PTA 12-month forward curve remains backwardated, steepening over the past week with higher near-term prices falling away into 2023.

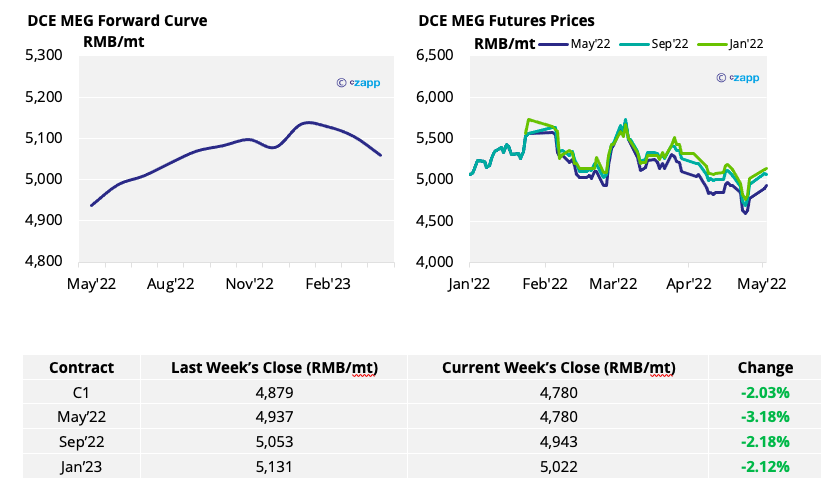

MEG Futures and Forward Curve

- MEG futures recovered over the week, driven by higher upstream costs.

- Ample supply and high port inventory for MEG will continue to weigh on prices. Whilst COVID controls constrain demand in the near term.

- MEG forward curve remains in contango with future contracts, trading at a premium to current levels. Although futures prices for the first part of 2023 have now eased.

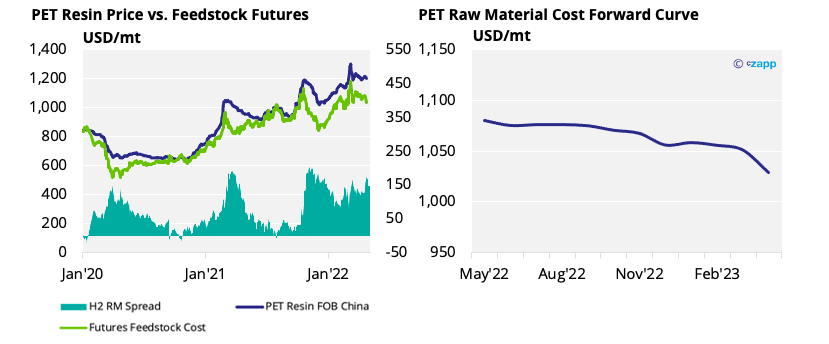

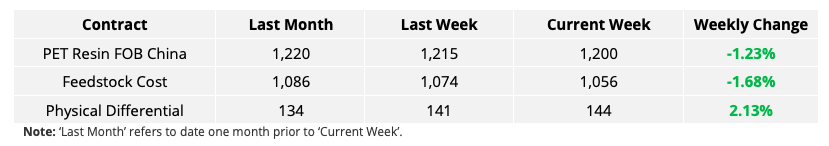

PET Resin Export – Raw Material Spread and Forward Curve

- Export prices for Chinese PET resin have increased modestly on the week to 1225 USD/mt.

- However, the physical differential ended the week relatively flat at 145 USD/mt.

- The PET export-raw material forward curve remains flat, slightly backwardated over the next 12 months.

Concluding Thoughts

- Chinese PET Resin FOB values are expected to remain around current levels, with a flat near-term forward curve for raw materials and firm physical differential.

- PET producers’ priorities lie with attempting to export significant existing orders. However, lockdowns and COVID controls, continue to make logistics and container movement difficult.

- Jiangyin is now under lockdown, home to the Sanfame Group with 2.1m tonnes of capacity, around 15% of China’s total PET resin capacity.

- In the short-term, restrictions may constrain export supply, supporting high margins.

- However, an extended period of weak domestic demand could pressure overall PET resin sales, and force producers to divert more supply to export.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

European Buyers Under Pressure as PET Prices Hit New Highs

PET Resin Trade Flows: China’s COVID Response Slows Exports

Chinese PET Industry Faces Biggest COVID Outbreak Since 2020

European PET Market Rocked by War in Ukraine

Explainers That May Be of Interest…