Insight Focus

PTA and MEG futures declined over the previous week despite MEG inventories in East China main ports shrinking. The PET resin export margin over feedstock costs returns to positive, though remains historically small.

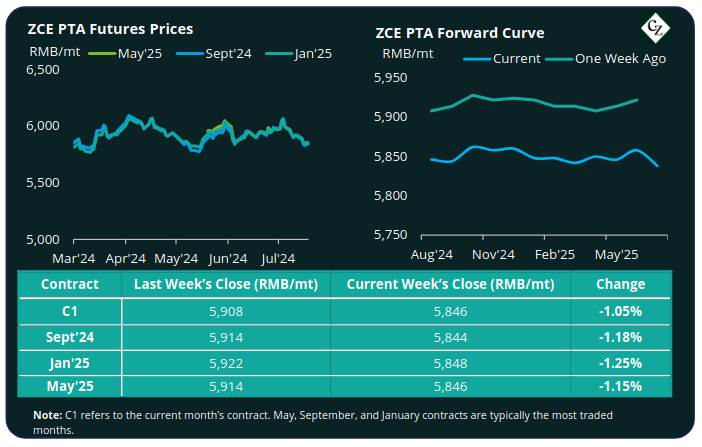

PTA Futures and Forward Curve

PTA futures dipped for a second week in a row, with the front month falling by just over 1% and the main contracts falling by an average of 1.19%. This means the current Aug’24 contract closes the week down to RMB 5846/tonne.

Brent crude oil traded broadly sideways around USD 85/barrel over the same period.

The PTA forward curves remain flat out at least to Jun’26, however the Sept’24 contract now trades at a slight RMB 2/tonne discount to the front month.

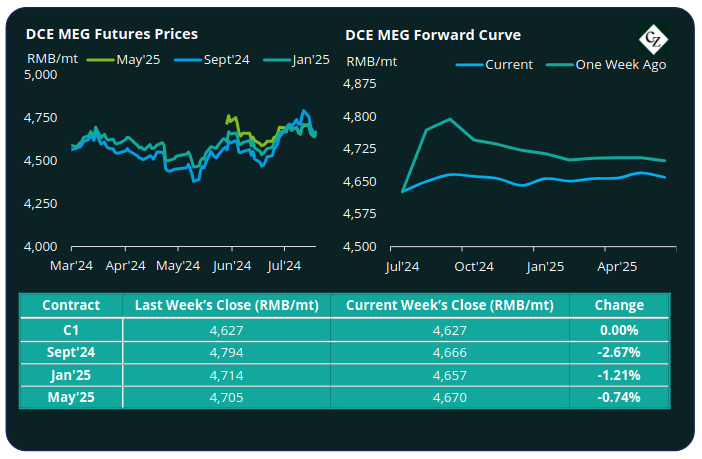

MEG Futures and Forward Curve

Current month MEG futures are unchanged over the last week, remaining at RMB 4627/tonne, though the main contracts (Sept’24, Jan’25, May’25) each fell. The Sept’24 futures weakened by 2.67% to RMB 4666/tonne.

This is despite East China main port inventories declining a further 6.2% to 595,500 tonnes, with daily offtake rates at Zhangjiagang port declining too.

With front month prices stable the MEG futures forward curve has flattened from backwardation, with the Sept’24 contract now only trading at a narrow RMB 20/tonne premium to the current month.

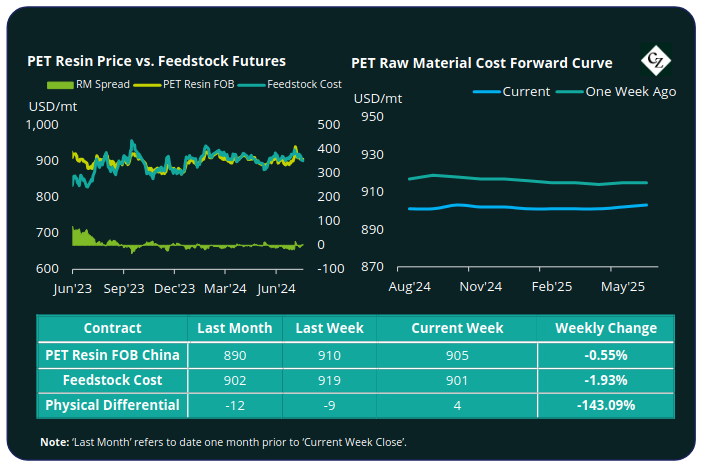

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices fell over the last week to USD 905/tonne, down USD 5/tonne from the previous week.

However, with raw material futures costs declining more sharply, down 2% to USD 901/tonne means that the PET resin physical differential has improved back to positive, now USD 4/tonne.

The raw material costs forward curve remains flat, though cheaper across the board than the previous week.

Concluding Thoughts

With PTA and MEG prices falling over the last week, the current industry remains clearly over-supplied, further evidenced alongside the poor PET Resin FOB margins over feedstock costs, which remain historically slim. That is even if they have returned to positive this week.

Looking forward, with the raw material forward curve still flat over the next year, this could mean that PET resin export prices could weaken further as the spreads decline.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.