Insight Focus

- PTA Futures continued to post weekly declines as macroeconomics weigh on upstream costs.

- New PET supply weakens sentiment and keeping margins low, amid weak demand.

- Further price drops expected with raw material forward curve showing a downward trend.

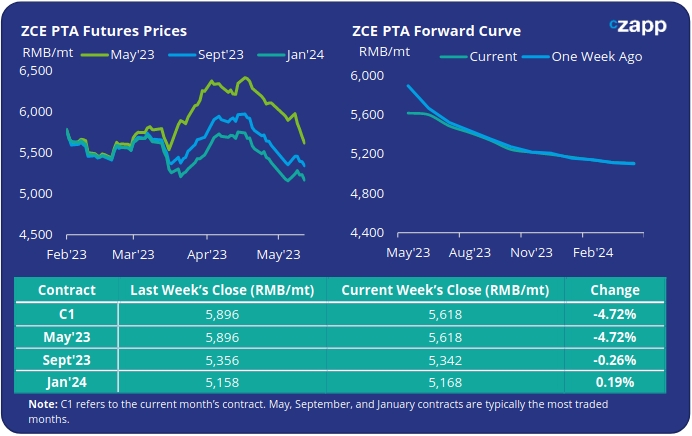

PTA Futures and Forward Curve

- PTA Futures market performed relatively poorly because of bearish macroeconomic sentiment, with the current month falling nearly 5%, although the main Sept’23 contract was only slightly below the previous week’s close.

- Despite an attempted recovery in crude oil prices through the first half of the week, gains looked to have begun to unwind by Friday, also reflected in PTA prices through last week.

- PX-PTA spread remains steady at some of the highest levels seen so far this year, as a result PTA operating rates remain high despite a downturn in polyester production.

- For now, margins may see some near-term support from those producers still to carry out maintenance turnarounds mid/late May.

- However, from June onwards we expect to see a recovery of supply for both PX and PTA and a potential further inventory accumulation.

- The forward curve remains backwardated, near-term strength has eased, and the curve has reduced in steepness; by Friday, the Sept’23 contract was trading at a RMB 276/tonne discount to the current month.

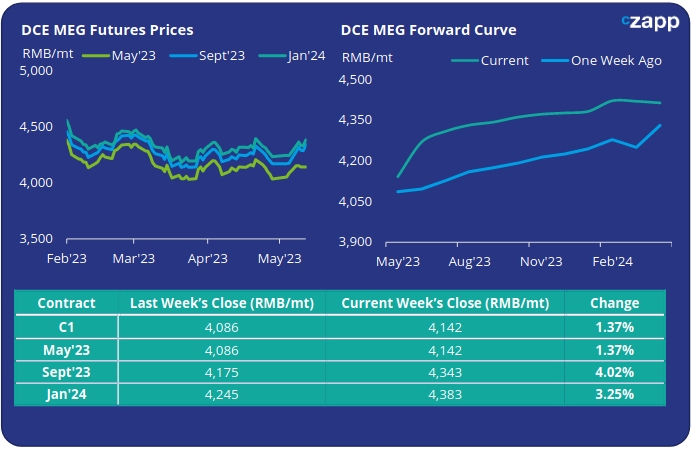

MEG Futures and Forward Curve

- May MEG Futures showed modest gains last week, whilst the main forward month of Sept’23 strengthened by around 4% week-on-week. Domestic supply cuts combined with falling port inventories buoyed market sentiment.

- Chinese domestic MEG supply is expected to decrease in May with several producers shutting down for maintenance.

- Whilst port inventories saw further declines, falling by 5.2% last week to around 952k tonnes, the lowest point since Jan’23 and a multi-year low for the month of May.

- MEG fundamentals now hinge around whether supply cuts can outstrip the fall in downstream polyester rates, as fibre and textile demand continue to be dampened by weak global macroeconomics.

- The current MEG forward curve shows an increase in forward prices through the rest of the year. By Friday, the Sept’23 contract had increased to a RMB 241/tonne premium over the current month’s contract.

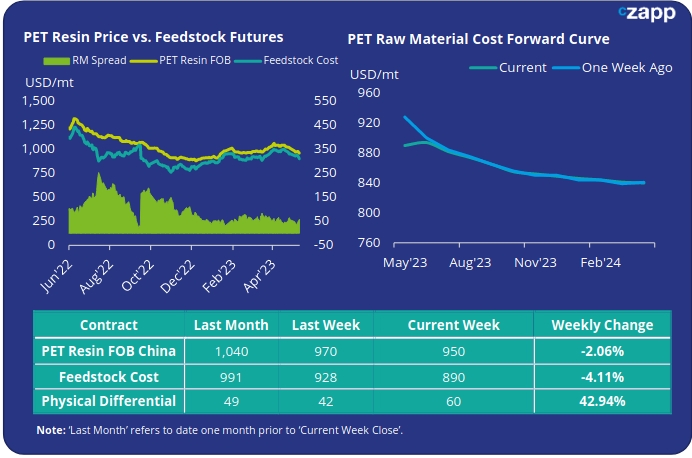

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET export prices continue to weaken through last week, with prices averaging USD 950/tonne on Friday, down USD 20/tonne on the previous week. Current price levels represent a decline of around USD 90/tonne over the last few weeks.

- The weekly average PET resin physical differential to feedstock costs increased by USD 6/tonne to average USD 51/tonne for the week. By Friday, the daily spread was at a USD 61/tonne.

- Although the current PET resin raw material forward curve continues to be backwardated through the next 12-months, given the recent price drop the curve has begun to flatten through the back half of the year.

- At Friday’s close, the Sept’23 contract was trading at a USD 25/tonne discount to the current month’s contract.

Concluding Thoughts

- After much talk over the last few months around impending new capacity, both Sichuan Hanjiang (Baosheng) and Wankai have now started new lines.

- Baosheng is now running full on the first of its two 300k tonne lines, having previously been scheduled for Q4’22, and Wankai is also running its newest 600k tonne addition in Chongqing.

- New additions and expected future capacity, including Sanfame’s first 750k tonne line due in June, is weighing on sentiment and an increasing concern for PET resin producers given weakness in the export market.

- Current margins remain low, far below traditional levels at peak buying season.

- However, whilst order intake remains weak recent lower PET resin export prices have stimulated some deals, with producers willing to discount on current lows to secure forward volumes.

- And although demand for Chinese resin into EU countries has slowed, the strengthening of the Euro versus US Dollar has increased competitiveness of other Asia origins, who are vying for market share with increasingly aggressive prices.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.