Insight Focus

- PTA and MEG futures rise on another weekly gain for the crude oil markets.

- High polyester operating rates underpinning PTA demand under pressure.

- PET resin export margins turn negative as new capacity weighs on market.

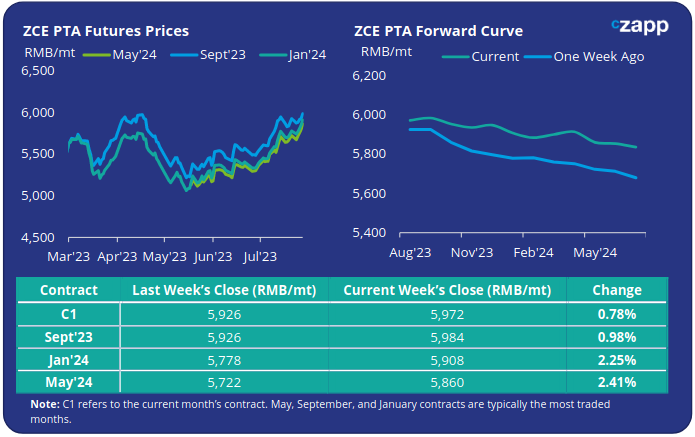

PTA Futures and Forward Curve

- PTA futures continued to rally, driven upwards by further crude oil gains, as Brent crude surpassed $84/bbl and WTI approached the $80/bbl threshold.

- Major financial institutions are now predicting oil prices to rise to between $86-92/bbl by year-end, as record-high oil demand and lowered supply leads to a large market deficit.

- PX prices moved higher last week tracking crude oil movement, maintaining a high PXN spread, averaging over $435 for the week.

- PTA fundamentals weakened though, as a series of expected plant restarts increased supply-side pressure, with the PX-PTA spread narrowing to a 4-month low.

- On the demand side, weak downstream polyester demand and accumulated inventories could place downward pressure on the operating rate of polyester plants, particularly traditional post-peak textile season (Sept/Oct).

- The forward curve’s downward slope has flattened slightly over the past week; by Friday the Jan’24 contract was trading at a reduced RMB 64/tonne discount to the current month.

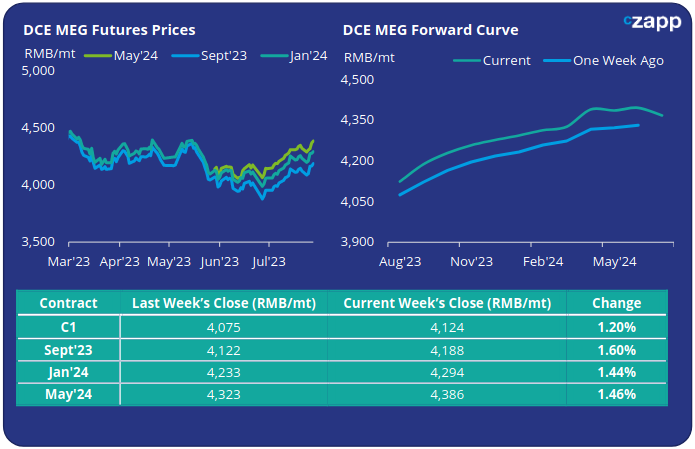

MEG Futures and Forward Curve

- MEG Futures increased on the back off stronger crude, main contract months were up 1.45-1.6% last week.

- Market fundamentals continued to show improvement, as some units shut for maintenance; operating rates are expected to soften in August.

- Although main port inventories decreased 2% to 986k tonnes, breaking a string of consecutive weekly increases, port inventories remain high.

- Future price direction will not only rely on crude’s path over the coming months but whether the high polyester operating rates can sustain in the face of slow textile offtake.

- The MEG forward curve remains in contango over the next 12-months. By Friday the Jan’24 contract was holding a RMB 170/tonne premium to the current month.

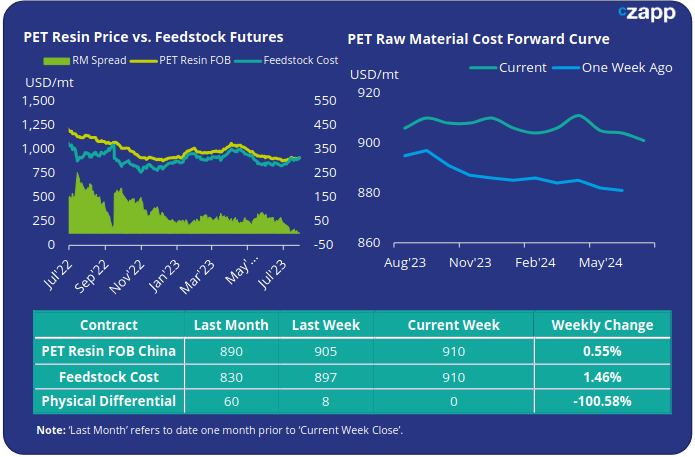

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices made a very slight move upwards towards the back of last week, to an average of USD 910/tonne representing a USD 5/tonne increase.

- The weekly average PET resin physical differential to future feedstock costs fell further, down USD 8/tonne to average USD 4/tonne for the week. However, by Friday the daily spread had fallen into negative territory, a new multi-year low.

- The raw material cost forward curve is no longer backwardated; at Friday’s close, Jan’24 raw material costs on par to the current month’s contract, the next most liquid contract months of March and May were also on par with current levels.

Concluding Thoughts

- Declining export sales and soaring feedstock costs have crushed the physical differential to future raw material prices.

- With a negative differential, and a loss-making spread to spot raw materials, many will eagerly be looking towards the off-peak maintenance season in September, through to November.

- Recent new capacity additions have weighed heavy on the market, with Sanfame bringing both its 750k tonne line on-stream in quick succession.

- Further additions from Yisheng (500kta) and Billion (600kta) are expected in H2’23, potentially compounding oversupply issues and keeping margins low.

- As a result, PET resin export prices are expected to track raw material costs closely through to Q1’24.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.