Insight Focus

- PTA Futures flat declined as PX prices weakened, crude rebound may filter through into recovery.

- PET resin export prices gave ground, as demand quietened, and spreads dropped back.

- Next wave of new capacity looms, threatening to disrupt improving SD balance.

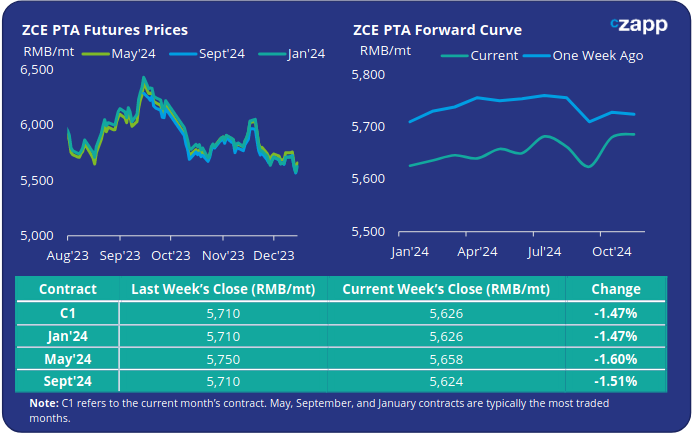

PTA Futures and Forward Curve

PTA Futures followed PX prices lower last week, as prices retreated by around 1.5%.

Crude oil prices were on course to snap their seven-week losing streak on Friday as a combination of demand optimism and rising geopolitical risk added to upward pressure.

According to the EIA’s latest December Short-Term Energy Outlook, crude oil prices may see upward pressure in the coming months as OPEC+ cuts hit home, and global oil inventories decline. However, projections of higher non-OPEC supply led by the US may act as a limiting factor on further price gains.

Whilst the PX-Naphta spread continued to be squeezed due to ample supply and demand weakness, the PTA-PX spread remained broadly unchanged, averaging USD 100/tonne.

Tighter PTA supply in some locations caused by the recent cold wave impacting logistics, particularly in Northern China, and continued high polyester operating rates, has also supported PTA fundamentals.

However, the combination of new production units and increasing PTA operating rates may result in downward pressure over the next month. Maintenance schedules may help to counterbalance, but the PTA market is still expected to face downside pressure.

By Friday, the PTA forward curve was in flux with a slight forward premium through to mid-2024; May’24 had a RMB 32/tonne premium over the main Jan’24 contract.

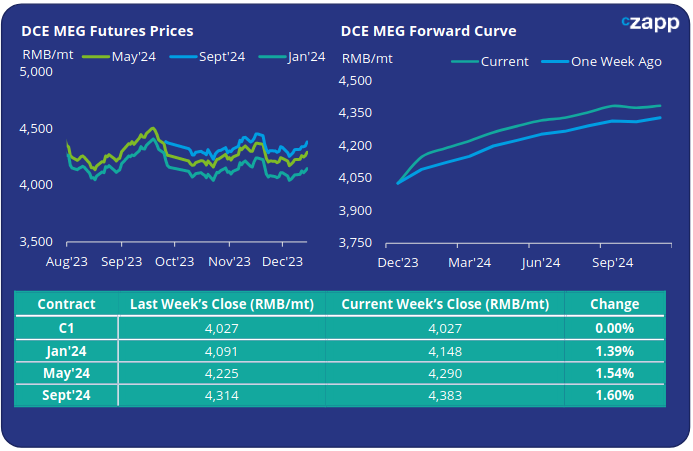

MEG Futures and Forward Curve

MEG Futures rose by around 1.4% on modest inventory draw down but keep rangebound overall.

Main East Coast port inventories continued to see a slow decline, down 0.8% last week to 1,154k tonnes.

Higher arrivals and a slowdown in offtake over the last couple of months has meant port inventories are now at multi-year highs for this time in the season. Although, traditional seasonality has been less evident since 2021.

MEG fundamentals are lacking any major driver to pull the market out of this stagnant price range.

Whilst fundamentals have improved marginally over the last month, high inventories, and a rebound in arrivals in early December will keep margins pinned and prices within a low range through into 2024.

The MEG forward curve remains in contango over the next 12-months; the May’24 futures premium widened slightly to RMB 142/tonne over Jan’24.

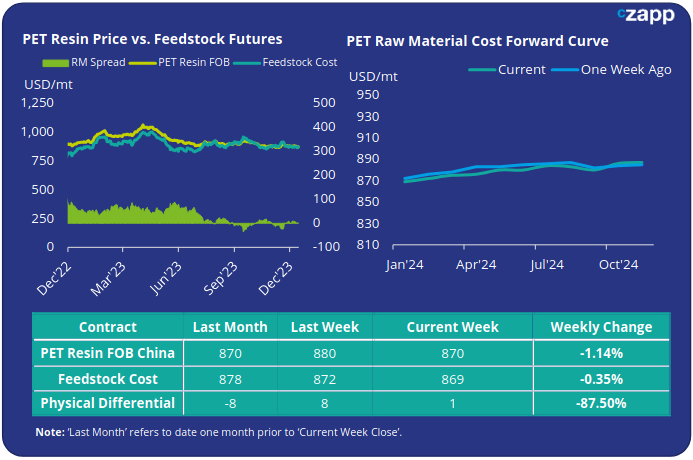

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices felt the cold chill of winter mid-week and prices fell back USD 10-15/tonne through the week, settling at USD 870/tonne last Friday.

The weekly PET resin physical differential also declined, down USD 5/tonne to average just USD 2/tonne for the week. By Friday, the daily spread was around USD 1/tonne.

The raw material cost forward curve remained relatively unchanged, in a slight contango position through to mid-2024. The May’24 and Sep’24 contracts were both at a USD 11/tonne premium to Jan’24.

Concluding Thoughts

After showing some upward momentum in the last few weeks, PET raw materials spreads dipped once again with a demand slowdown as many export markets moved into the quieter Christmas and New Year period.

With the market in off-season, forthcoming new capacities additions are only likely to exacerbate inventory pressure through the supply chain, constraining margins and keeping operating rates pinned down in the near-term.

New capacities including Yipu New Material (300kta), Anhui Haoyuan (600 kta), and Xinjiang Tunhe (60kta) are expected to come onstream over the next month. Whilst Yisheng Hainan (600kta), which begun production in November is expected to start commercial, on-spec production over the next month.

Despite this near-term threat, the supply/demand balance is expected to steadily recover with both domestic and export demand emerging out of the low season and re-entering the build-up to peak season from March onwards.

Further discussion on the PET resin price outlook can be found here.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.