Insight Focus

- Dragon Boat Festival shortens trading week, PTA future keep rangebound.

- PET resin export prices stable through week, China and GCC could see restocking post-holidays.

- Peak season looks to be a bust, with margins squeezed close to cost-level.

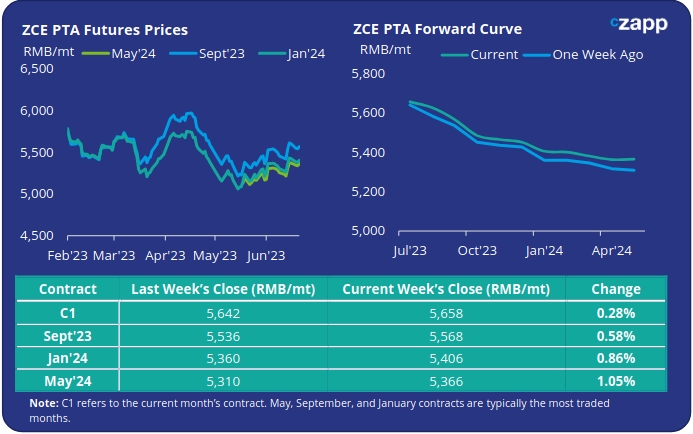

PTA Futures and Forward Curve

- PTA futures kept range bound, with a shortened trading week due to the Dragon Boat Festival national holiday.

- Although the downturn in crude oil prices through the second half of the week may filter through into Monday’s trading on reopening.

- PTA fundamentals remain relatively unchanged, with additional supply following turnarounds being kept in check by continuing high polyester operating rates, at least for the time being.

- However, the PTA-PX spread continues to feel the pressure from recent PX production issues and tighter supply, the possibility of lower PTA operating rates in the future.

- The forward curve remains backwardated, by Friday the Sept’23 contract was trading at a RMB 110/tonne discount to the current month.

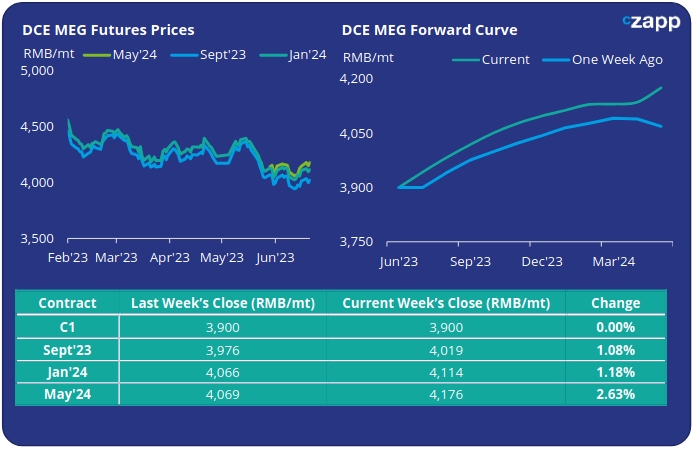

MEG Futures and Forward Curve

- MEG Futures experienced a partial rebound, with main contracts up around 1%, following last week’s slump.

- Restocking activities ahead of a China holiday have lent some support on demand, in conjunction with continuing high polyester operating rates.

- However, lengthening supply from the US and India and expectations of further domestic production increases continue to cap the market.

- Port inventory levels, whist remaining high, fell slightly by 0.5% last week, down to a total of 923k tonnes.

- The MEG forward curve continues to show prices steadily increasing over the next 12-months. By Friday the Sept’23 contract was holding a RMB 119/tonne premium to the current month.

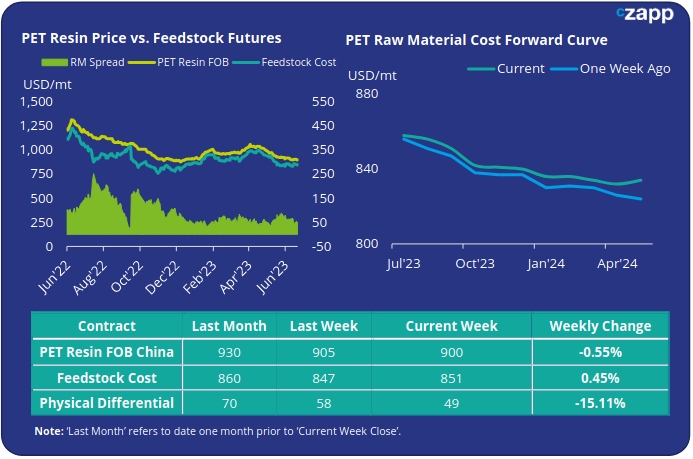

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET export prices were flat through last week, averaging USD 900/tonne FOB on Friday, down just USD 5/tonne on the previous week.

- Although the low end of the range has seen some heavy discounting for large volume deals, close to breakeven levels with some producers.

- The weekly average PET resin physical differential to future feedstock costs decreased by USD 7/tonne to average USD 52/tonne for the week. By Friday, the daily spread had dwindled to just USD 49/tonne.

- The raw material cost forward curve remained relatively unchanged, backwardated with costs expected to soften through the summer before flattening out in Q4’23.

- At Friday’s close, Sept’23 raw material costs were trading with at USD 7/tonne discount to July’23. Q4’23 costs are typically around USD 17/tonne lower than July futures contracts.

Concluding Thoughts

- Last week’s PET resin trading was shortened by a national holiday in China, the Dragon boat festival, with buyers still sitting on the sidelines due to recent upstream volatility.

- Chinese producers continue to face weak demand from various export markets, and increased competition from Indian and Middle Eastern producers.

- However, additional demand could be generated at home following the national holiday, and within the Gulf region after Eid, as converters look to replenish stocks.

- PET export margins are averaging close to multi-year lows with the summer season is increasingly feeling like it’s already over.

- Even with some potential near-term restocking, PET export prices are expected to remain weak, with further potential downside on the forward curve.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.