Insight Focus

- PTA futures lifted by an easing of COVID restrictions, supported by tight PX supply.

- PET export prices close week flat-to-soft; margins narrow on higher feedstock costs.

- PET export prices near a potential market bottom, but demand remains elusive.

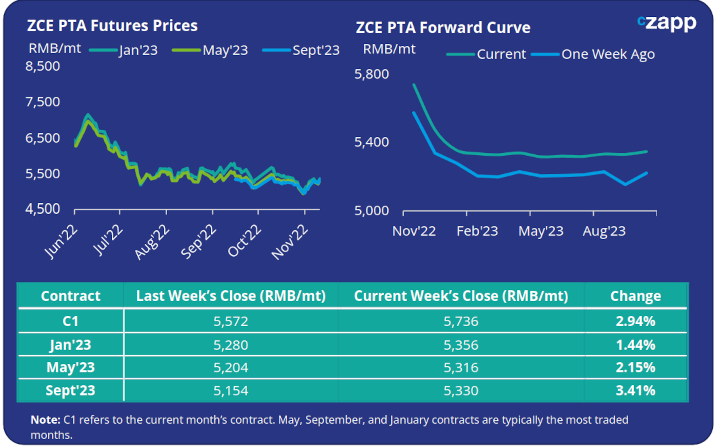

PTA Futures and Forward Curve

- PTA futures closed higher last week, driven in part by volatile crude and tight PX supply.

- Crude prices rose Friday as China announced the easing of some COVID restrictions; fears that rising COVID cases will prompt futures lockdowns continue to create a volatile market.

- PX supply remains tight, supporting near-term prices. However, new PX and PTA supply is expected to ease constraints over the coming months, whilst downstream polyester plants continue to cut rates.

- The PTA forward curve remains heavily backwardated in the very near-term. At last week’s close, the Jan’23 contract traded at a 380RMB/mt discount to the current month.

MEG Futures and Forward Curve

- Volatility in the crude and petrochemicals markets created by uncertainty around China’s future COVID approach saw MEG futures soften last week with the Jan’23 contract down 1.4%.

- MEG supply from the Middle East to Asia, is expected to tighten through November and December, with producers, MEGlobal and Sabic, announcing production cuts and maintenance turnarounds.

- Other Chinese producers, including CNOOC and Shell Petrochemical also plan to shut units due to poor margins.

- However, weakening downstream polyester demand is expected keep the market fundamentals in oversupply in the near-term.

- Any upward momentum in the near-term looks set to remain limited; the Jan’23 contract closed last week at a small RMB 72/tonne premium to the current month.

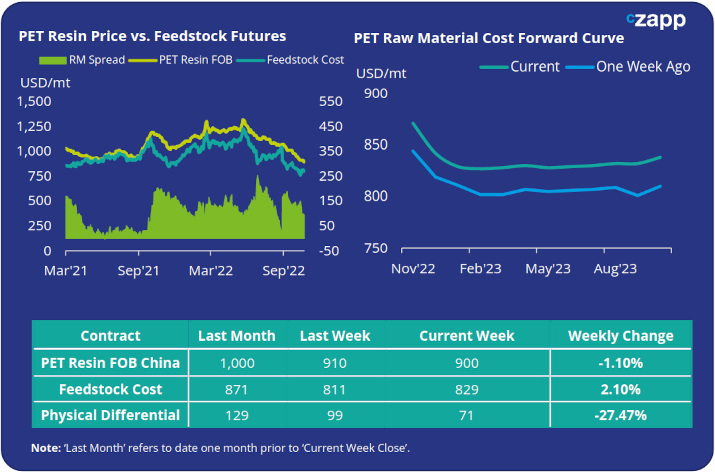

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices remained soft, falling USD 10/tonne on the previous week to USD 900/tonne on average.

- Producers have also discounted heavily in recent weeks, with deals as low as USD 850/tonne, although prices firmed towards the end of last week.

- The weekly average PET resin physical differential to feedstock costs contracted sharply, down over USD 40/tonne last week, to USD 90/tonne. A further rise in crude and upstream prices on Friday meant the daily spread closed the week at just USD 72/tonne.

- The PET resin raw material forward curve remains in backwardation with the Jan’23 contract showing a USD 42/tonne discount to the current month.

Concluding Thoughts

- PET resin feedstock differentials continue to be squeezed, with PET export prices failing to respond to the upward movement in feedstock costs over the last week.

- Even with producers negotiating 2023 orders, a combination of an uncertain macroeconomic climate and price volatility continues to feed into buyer hesitancy.

- Most Asian origins have ample supply and can ship within 4-weeks, a big change from where we were earlier in the year.

- Backwardation in the feedstock forward curve continues to indicate future discounts on the current price levels are likely to be seen in Q4’22 before the cost profile flattens out into 2023.

- One potential scenario is that lower price levels, combined with additional clarity on future downstream demand, will stimulate fresh export demand towards year end.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.