Insight Focus

PTA and MEG futures fell sharply following crude’s turn in direction. PET Futures fell by USD 40/tonne. Asian PET resin export prices also adjusted quickly downwards, bringing added interested from buyers. Futures forward curves continue to show limited premiums and price direction should be dictated by crude.

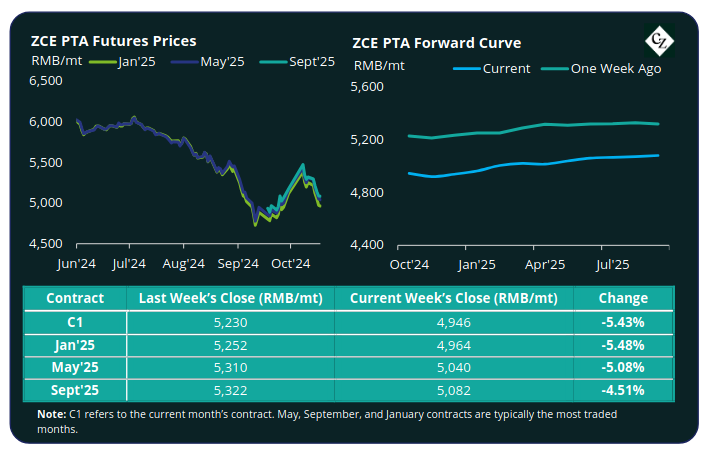

PTA Futures and Forward Curve

PTA futures faced heavy losses last week as main month contracts fell by over 5% largely driven by weakness in upstream pricing.

Crude bears took back the oil market after the EIA predicted a significant slowdown in China’s contribution to global oil demand, and war premium eased as an Israeli attack on Iranian oil infrastructure failed to materialise.

PX-N narrowed substantially by just under USD 20/tonne, as imports recovered and domestic operating rates also increased, weakening base fundamentals.

However, the PTA-PX CFR spread remained steady at USD 80/tonne, maintaining post-holiday improvement.

Looking forward, PTA supply/demand fundamentals could see improvement with increased polyester operating rates and some PTA plants moving into scheduled maintenance. However, any improvement will be constrained by relatively high port inventories.

The PTA forward curve remained relatively flat, with the Jan’25 holding a small RMB 18/tonne premium over the current month’s contract, and May’25 now at a RMB 94/tonne premium.

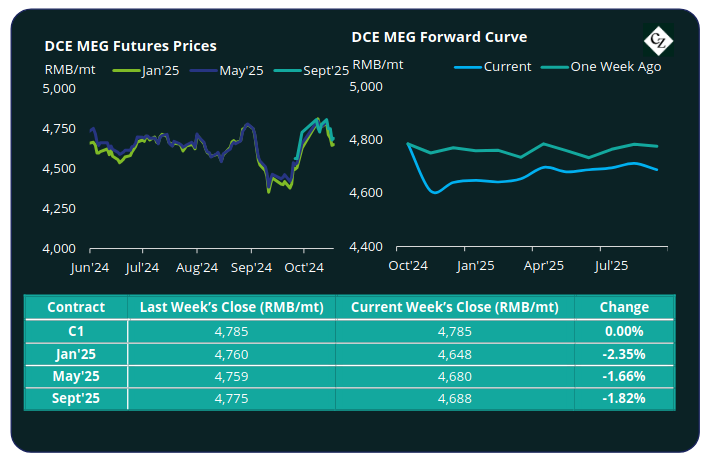

MEG Futures and Forward Curve

The main Jan’25 MEG contract lost over 2% last week, dragged down largely by the fall in crude oil prices, despite general destocking in the market.

Polyester operating rates further increased and are expected to remain at high levels though October’s peak season driving MEG consumption.

MEG fundamentals are expected to remain strong through October, supported by some plant maintenance shutdowns, although average operating rates at coal-based units have also increased.

East China main port inventories also increased by around 8.5% to 574,000 tonnes.

The MEG forward curve now shows a near-term weakness coming out of peak-season through the remainder of the year, before showing a forward premium through the first 9-months of 2025.

The Jan’25 contract holds a RMB 137/tonne discount over the current month. The May’25 contract is at a RMB 105/tonne discount over the current month.

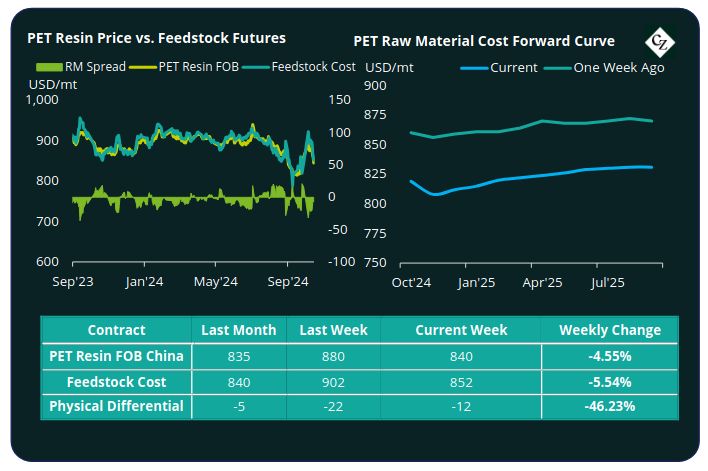

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices fell back sharply last week, with the average price losing around USD 40/tonne on the week, down to just USD 840/tonne by Friday.

The average weekly PET resin physical differential against raw material future costs increased by USD 13/tonne to negative USD 11/tonne last week. By Friday, the daily differential was negative USD 12/tonne.

The raw material cost forward curve displayed near-term weakness, with slight backwardation into the next month. The curve then moves upwards with May’25 feedstock costs USD 11/tonne higher than Jan’25. Sept’25 holds a USD 15/tonne premium over Jan’25.

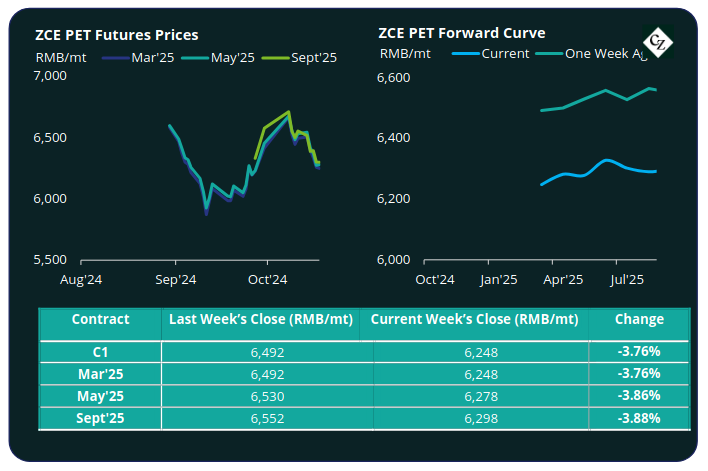

***NEW PET Resin Futures and Forward Curve

PET Resin Futures rapidly lost most of the gains made following the opening after Golden Week.

The Mar’25 contract, the first contract month of these new futures, fell to RMB 6,248/tonne (USD 879/tonne), down an equivalent of USD 40/tonne by Friday.

The average weekly premium over Raw Material Futures increased around USD 5/tonne to USD 18/tonne. By Friday, the daily premium was USD 18/tonne.

The PET Resin Futures forward curve holds on the slightest forward carry, with May’25 showing a USD 4/tonne premium and Sept’25 a USD 8/tonne premium, both slightly lower than last week.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

Concluding Thoughts

Asian PET export pricing faltered last week, with all post-holiday gains being erased on lower feedstock costs and slower seasonal demand.

That said, lower prices have brought added interest, particularly from buyers that may have missed out on the bargain prices seen just a few weeks ago.

Many will undoubtedly be waiting on the sidelines to see if crude continues to fall, creating another buying opportunity for PET resin in the coming week.

However, factory stocks are at relatively healthy levels with some PET resin producers reporting to be close to sold out for some grades, which may constrain further declines in PET resin prices.

Although resin prices have dropped, container availability has also tightened out of Asian origins, including Vietnam, with higher freight prices expected in November. Freight prices elsewhere across Asia should increase as we move into November due to the early 2025 CNY.

Both the raw material and PET futures forward curves continue to show only a modest USD 5-10/tonne premium through to next year’s summer season, meaning pricing will continue to be dictated by the volatile swings in crude oil.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.