Insight Focus

- PTA and MEG margins continue to be squeezed as demand weakens and new capacity starts-up.

- Market bottom effectively reached for PET resin feedstock costs.

- Future PET resin export demand remains uncertain, with ample availability.

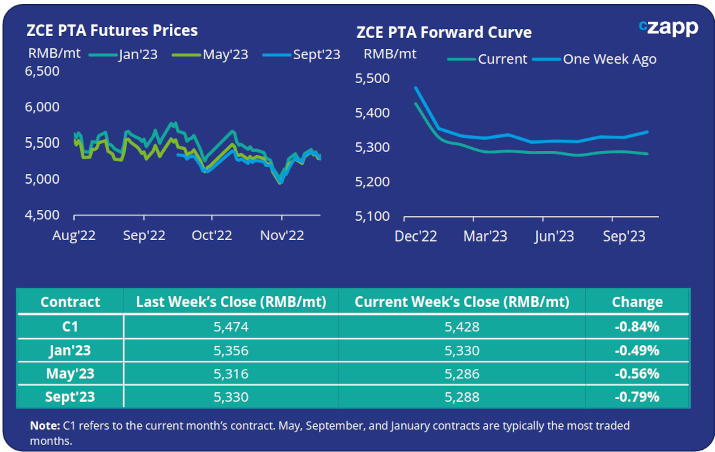

PTA Futures and Forward Curve

- PTA futures end the week marginally down, tracking a pullback upstream prices as new lockdowns and weaker than expected retail and industrial data coming out of China weighed on the market.

- Downstream polyester plants continued to cut rates, dampening PTA demand. However, some improvement in downstream polyester fibre sales has begun to whittle down inventory levels.

- The expected start-up of new PX and PTA production is expected to enable higher run rates at existing PTA plants as well as adding new capacity to the market; PTA margins expected to remain low.

- The current PTA forward curve is backwardated through to year end before flattening out in Q1, with the Jan’23 contract now trading at a reduced discount of 98RMB/mt to the current month.

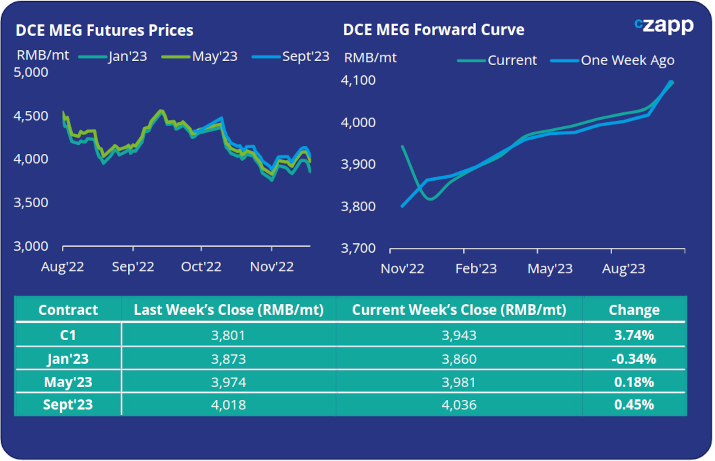

MEG Futures and Forward Curve

- MEG futures gained last week, with the current month’s contract closing nearly 4% higher, as lower inventories and a more bullish global commodities market lifted the market.

- Although sellers took the opportunity to raise prices, and recoup margins, MEG fundamentals remain bearish.

- Start-up of Yulin Chemical’s new coal-to-chemical mega complex will gradually supply MEG into the domestic market, amid weakening demand and reduced polyester production.

- Whilst port inventories are expected to continue to decrease through to year-end, due to reduced supply MEG supply from the Middle East to Asia, weak demand will continue to weigh on margins with pricing tracing upstream commodities over the short-term.

- The Jan’23 contract closed last week at a RMB 83/tonne discount to the current month, looks rangebound through the rest of Q1’23.

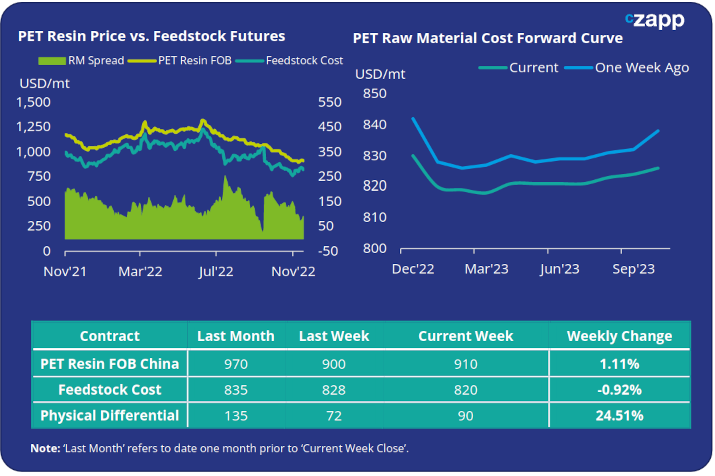

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices increased marginally on last week’s close, increasing USD 10/tonne on to an average price of USD 910/tonne.

- Some improvement in export demand was heard. However, overall export demand remains weak with producers very keen to hear firm bids, and with ample availability.

- The weekly average PET resin physical differential to feedstock costs narrowed, down USD 9/tonne last week, to just USD 81/tonne. By Friday, the daily spread was around USD 89/tonne.

- The PET resin raw material forward curve shows only a slight reduction into the new year, with the Jan’23 contract showing a marginal USD 10/tonne discount to the current month (December); indicative of a market bottom in near-term price curve for raw materials.

Concluding Thoughts

- PET export prices saw a modest delayed response to the previous week’s upward movement in feedstock costs.

- However, crude prices retreated through the end of last week, falling heavily on Friday. After-hours- PTA Futures trading on Friday was also rattled by the fall in crude.

- As a result, raw materials and PET export prices are expected to face renewed downward pressure next week.

- No material increase in PET resin export demand has been observed; most Asian origins have ample supply and can ship within 4-weeks.

- Despite all the media reports on the global economic recession, many PET buyers, even in Europe, are seemingly less pessimistic, and don’t expect to see a major contraction in 2023.

Whilst buyers continue to control stock levels at present, lower PET resin export prices and a growing confidence on future demand may stimulate fresh export demand.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.