Insight Focus

- PTA and MEG futures drop following weakening demand and new COVID lockdowns.

- PET raw material forward curve shows lower cost base achievable in Q4 and into 2023.

- PET resin exports face recessionary headwinds as prices and margin continue to weaken.

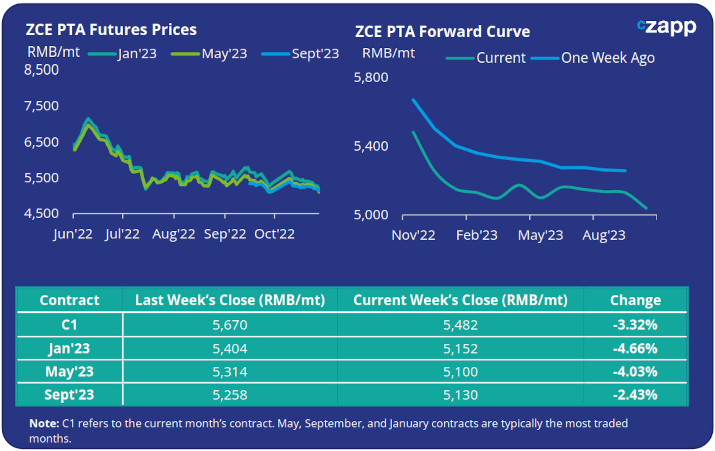

PTA Futures and Forward Curve

- PTA futures slumped towards the end of last week, with the Nov’22 PTA down over 3%, amid weakening demand and a wave of new COVID lockdowns across China.

- A modest increase in PTA liquidity and weakening PTA demand, following lower polyester operating rates, is expected to keep pressure on prices and PTA-PX spreads.

- The PTA forward curve is now heavily backwardated in the near-term. The Jan’23 contract now trades at a 330RMB/mt discount to the current month.

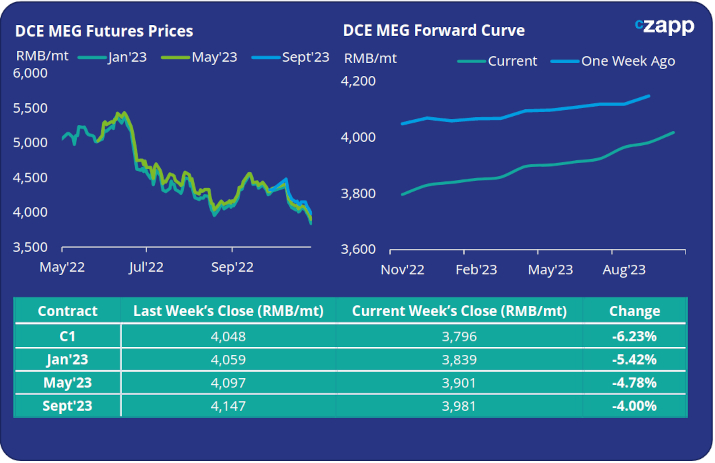

MEG Futures and Forward Curve

MEG futures dived last week, pressed by weakening downstream demand and concerns around China’s continuing zero-COVID policy as dozens of cities go back into lockdown.

Operating rates and supply have gradually recovered in recent weeks, new capacity at Yulin Chemical’s new coal-to-chemical mega complex is expected to come on-stream by end of October.

Supply recovery comes at a time when downstream textile demand is dwindling, and the bottling sector begins off-season shutdowns.

The MEG market looks set to remain under pressure, although the Jan’23 contract closed last week at a small RMB 40/tonne premium to the current month.

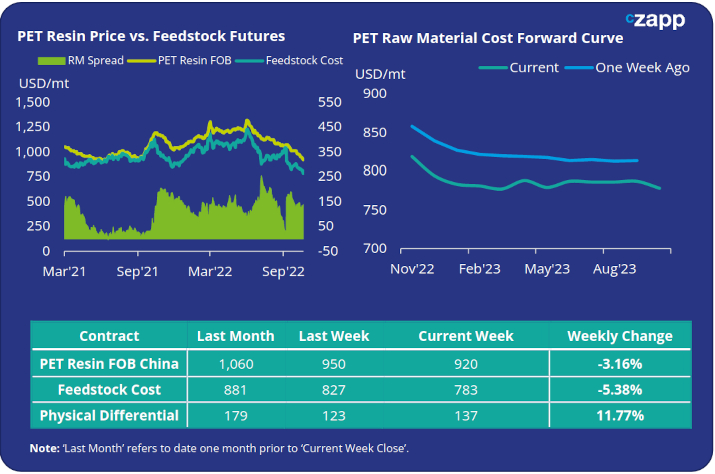

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices fell further last week, declining 30 USD/mt on the previous week and to 920USD/mt, with sub-900 USD/mt prices now in sight.

- The weekly average PET resin physical differential to feedstock costs also steadily declined by USD 8/tonne on softer demand, to USD 128/tonne. By Friday, the daily spread was around USD 126/tonne.

- The PET resin raw material forward curve remains in backwardation with the Jan’23 contract showing a USD 36/tonne discount to the current month.

Concluding Thoughts

- Whilst the forward curve for feedstock costs remains backwardated, a large part of this discount is likely to be seen in Q4’22 before the cost profile flattens out into 2023.

- Greater interest in Asian exports is being shown by some large foreign buyers. However, new order intake remains sluggish with the demand outlook threatened by a potential new global recession.

- The addition of new production capacity over the coming months will add to the downward pressure, with H1 2023 margins expected to be lower than those in 2022.

- Current fundamentals indicate that prices could be expected to fall below the USD 900/tonne level over the coming month, potentially catalysing a round of fresh buying activity.

- A worsening of China’s current COVID outbreak and lockdown restrictions could also risk weakening domestic sales, even in the off-season, lengthening availability and forcing producers to discount further.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

European PET Market View: European PET Producers Facing Losses Contemplate Further Shutdowns

Plastics and Sustainability Trends in September 2022

PET Resin Trade Flows: Korean PET Exporters Eye Greater European Share in 2023

Will Plummeting Ocean Freight Boost Asian PET Export Demand?