Insight Focus

- Raw materials futures have recovered slightly since last week.

- MEG is still in downtrend with values close to the low for 2022.

- PET producer margins have narrowed to lowest since June.

PTA Futures and Forward Curve

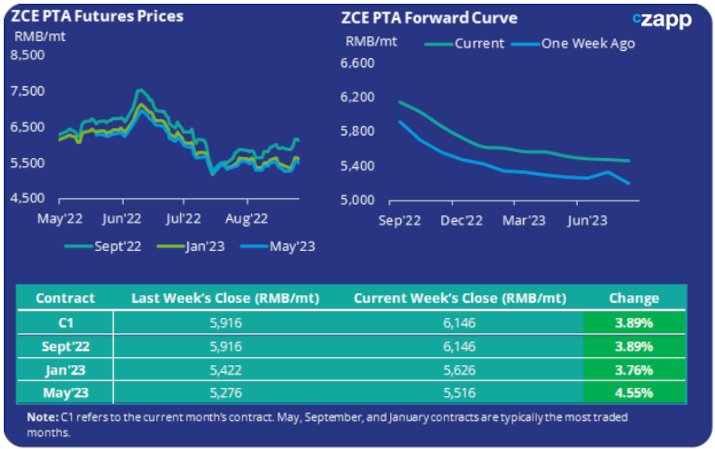

- Sept’22 PTA futures have recovered by almost 4% to above 6100RMB/mt over the last week of trading.

- The forward curve is still heavily backwardated into 2023 as all active contracts to Aug’23 see gains.

- This shape is still reflective of a supply reduction in the near term as PTA plant operating rate remains low.

- Downstream demand remains subdued but is expected to gradually improve through Q3 as polyester operating rates forecast to rise.

MEG Futures and Forward Curve

- Alongside PTA, MEG futures have also recovered to the 26th of August, with the Sept’22 contract close to 4000RMB/mt – In general MEG prices remain in downtrend whilst the market is in oversupply.

- Inventory is however forecast to fall by over 300k tonnes through the rest of Q3 as operating rates remain low, especially in coal-based units.

- The MEG forward curve in contango reflects forecasts of a pick-up in downstream demand as we head later into the year, with the Jan’23 contract now close to 4100RMB/mt.

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices are flat at 1080USD/mt since the previous update.

- However, the slight recovery in PTA and MEG prices has meant that the feedstock cost has risen by almost 3%, to 958USD/mt.

- As such the physical differential has narrowed to just above 120USD/mt, the lowest since June.

- The PET resin raw material forward curve is still strongly backwardated in 2022, before flattening through H1’22.

Concluding Thoughts

- There is still an oversupply in the raw material’s markets particularly in MEG, and whilst lower operating rates and falling inventory is beginning to have an effect this story is set to continue in the near-term.

- Weaker demand, hindered further by covid lockdowns means PET resin export prices have continued in downtrend through August – as such margins have tightened for producers as overall feedstock costs move sideways.

- Despite this monthly total PET chip exports are up 50% on the year rising to over 400k tonnes for July. For PET bottle chips July saw exports up 9% to 5.1k tonnes.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

What Europe’s Deepening Energy Crisis Means for PET Resin

PET Supply Chains Groan Under Global Heatwaves

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs