Insight Focus

PET resin and raw material futures have rallied as China announced bold economic stimulus polices. The market quietens ahead of the National Day holiday, but markets should be expected to open strongly after the holiday. Macro factors are key to PET price direction as raw material and PET forward curves show limited premiums.

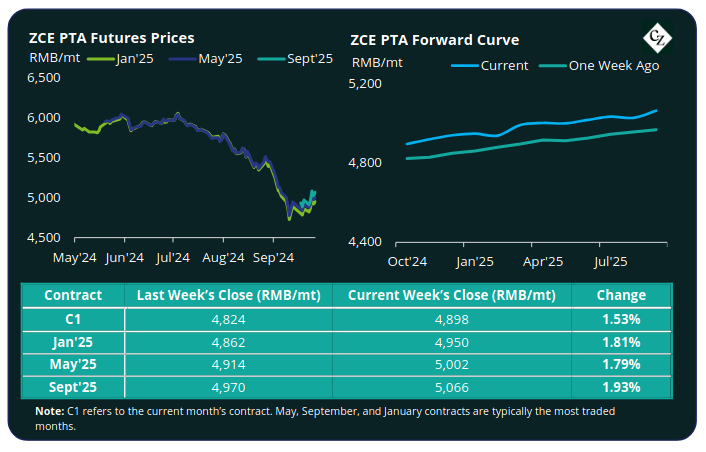

PTA Futures and Forward Curve

PTA futures changed course last week, bucking the precipitous downward trend they’ve faced over the last month to gain between 1.5% and 2%, driven in part by the introduction of fresh stimulus polices in China in a bid to counter an economic slowdown.

Crude oil prices experienced notable volatility last week, shaped by announcements on China’s new economic stimulus policies, Saudi Arabia’s production plans and escalating tensions in the Middle East.

Brent crude oil prices touched USD 76/bbl mid-week, before falling to USD 71.50/bbl Friday, ending the week down over 3% compared to the previous week’s close.

Planned economic stimulus boosted sentiment across the value chain, with the average weekly PX-N spread expanding by around USD 15/tonne. The PTA-PX CFR spread also improved by around USD 5/tonne to average USD 80/tonne last week.

PTA plant operating rates increased slightly, although unexpected shutdowns and delayed restarts meant that demand from downstream polyester and PET resin production rose faster, slowing PTA inventory accumulation.

Pre-holiday stocking ahead of Golden Week (October 1-7) and general improvement in downstream demand as inventory pressure ease, supported PTA fundamentals.

The PTA forward curve continues to show a carry; Jan’25 had increased slightly to RMB 52/tonne premium over the current month’s contract, with May’25 now at a RMB 104/tonne premium.

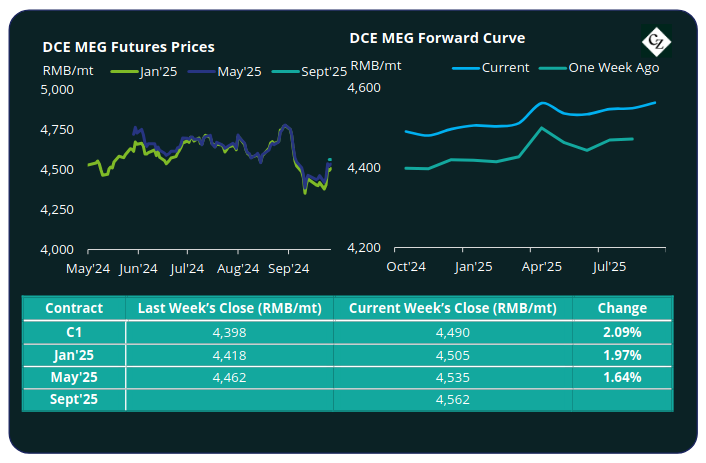

MEG Futures and Forward Curve

MEG Futures were also riding high on the back of China’s planned economic stimulus news and stocking ahead of the Golden week break. MEG Futures closed 2% up versus the previous week.

Despite East China main port inventories increasing by around 1.8% to 565,000 tonnes by last Friday, levels remain close to multi-year lows providing market support.

Although MEG may remain tight through October, port arrivals are expected to intensify leading to slight inventory accumulation through the back half of Q4’24, as ‘peak season’ fades.

The MEG forward curve is relatively flat through to the new year, with a slight forward carry through H1’25. The Jan’25 contract holds a RMB 15/tonne premium over the current month, with May’25 at a RMB 45/tonne premium.

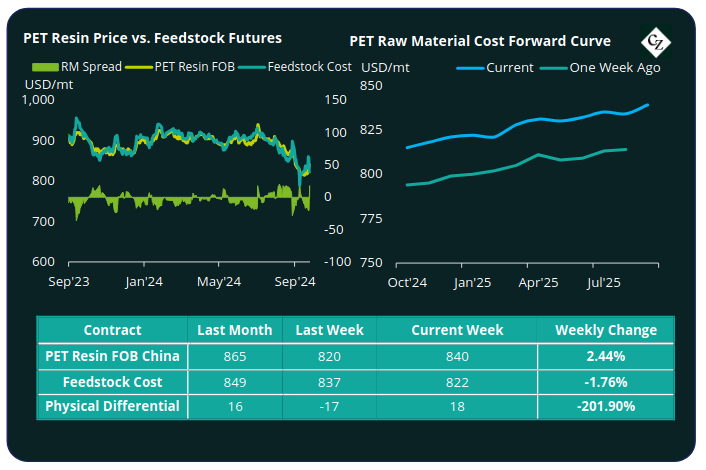

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices rebounded strongly on higher feedstock costs, averaging USD 840/tonne by Friday, up USD 20/tonne on the previous week.

The average weekly PET resin physical differential against raw material future costs increased by USD 2/tonne to minus USD 11/tonne last week. By Friday, the volatile swings in raw material pricing meant the daily differential had leapt to plus USD 18/tonne.

The raw material cost forward curve maintained its modest forward premium, with Jan’25 feedstock costs holding a USD 7/tonne premium over the current month, and May’25 a USD 15/tonne premium.

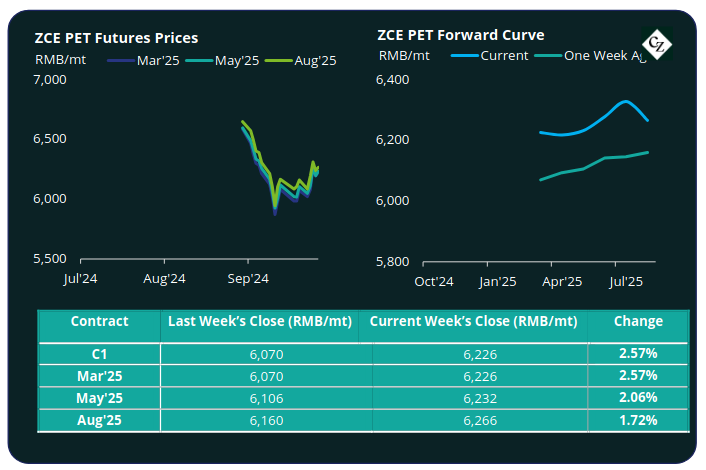

***NEW PET Resin Futures and Forward Curve

PET Resin Futures also rallied last week, with the Mar’25 contract, the first contract month of these new futures, adding 2.5% to reach RMB 6226/tonne (USD 888/tonne) by Friday.

The average weekly premium over Raw Material Futures increased to USD 21/tonne, recovering back to the same spread seen during the first week of trading at the beginning of the month. By Friday, the daily premium was USD 22/tonne.

The PET Resin Futures forward curve flattened somewhat compared to the previous week, with May’25 showing just a RMB 6/tonne premium (less than USD 1/tonne) and Aug’25 a RMB 40/tonne premium (USD 6/tonne).

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

Concluding Thoughts

Although the market quietened ahead of National Holiday, multiple macro-factors are in play that could see a strong upward move when markets reopen in a week’s time. The commodity and equity rally on China’s bold economic stimulus, coupled with tanks massing on the Lebanon border only adds to potential crude price volatility.

So, can Asian PET resin producers maintain or even build on the price rally?

The potential upside to PET resin export prices is clear, although with Saudi Arabia and other OPEC+ members seemingly abandoning their bid for USD 100/bbl, downside risk from increased production also remains.

Spot raw material spreads have significantly widened over the last few months. However, new PET resin capacity additions and oversupply continue to weigh on the forward physical differential to futures.

Both the raw material and PET futures forward curves show very little premium through to next year’s summer season, indicating that future pricing will largely be driven by the upstream.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.