Insight Focus

- PTA futures stabilise, ample supply constrains upside despite strong demand from polyester.

- PET resin export prices stabilse after drop, some converters restock on new lows.

- Imminent new PET resin capacity set to test new price levels and margin recovery.

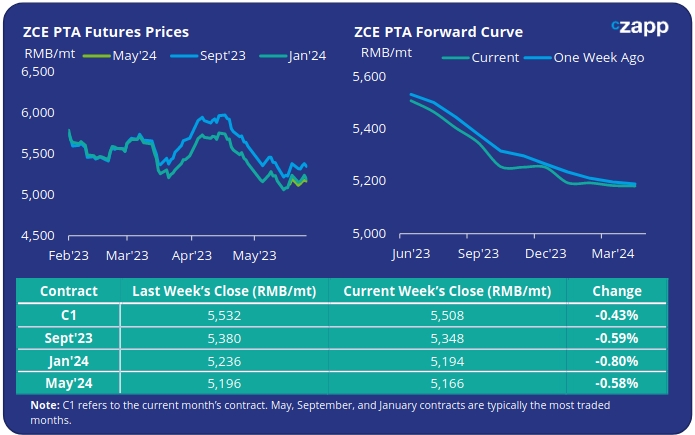

PTA Futures and Forward Curve

- PTA Futures softened slightly last week, whilst crude oil showed only very modest gains.

- PTA demand remains relatively stable supported by high polymerisation rates. However, these rates may begin to ease later in June due to increasing textile inventories and scheduled turnarounds.

- At present, ample supply constrains upward movement in PTA spot prices, with continued near-term pressure from accumulated inventory.

- PTA prices are expected to track PX costs closely in the near-term, with the upside to PX prices also likely to be capped by increasing domestic production and availability of imports.

- The forward curve remains backwardated, with the spread between June and Sept contracts increasing very slightly; by Friday, the Sept’23 contract was trading at a RMB 160/tonne discount to the current month.

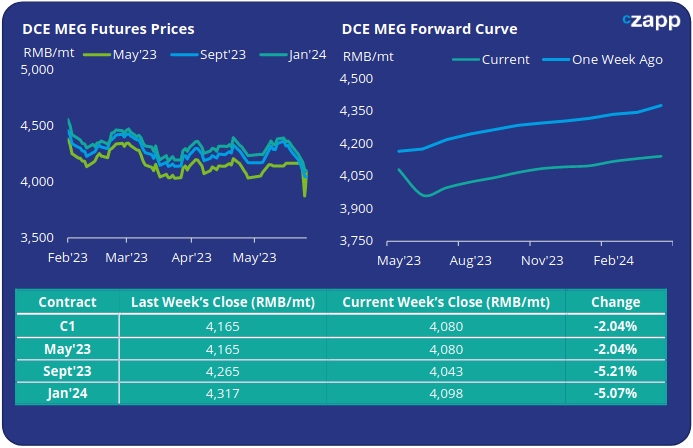

MEG Futures and Forward Curve

- MEG Futures faced sizable declines, with the main Sept’23 contract falling by over 5% on the previous week.

- Slower offtake and some late-May arrivals resulted in an increase in port inventory levels least week. Port inventory increased 3.5% last week, retracing back over the 1Mt level.

- However, expectations are for port inventories to follow the recent trend in decreasing through May-June given ample domestic supply, and RMB depreciation.

- As with PTA, high, stable polyester operating rates are lending support to MEG demand. However, high inventories and the start-up of new capacity weighs on market sentiment.

- In terms of new capacity, Sanjiang Chemical has successfully started its 1 Mmt/year MEG unit in Jiaxing.

- By Friday, the current month spread to the Sept’23 contract went negative, with Sept’23 now holding a RMB 27/tonne discount, not premium.

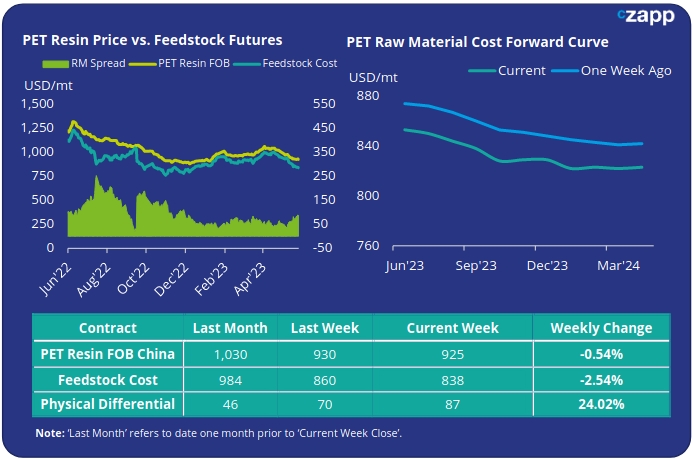

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET export prices stabilised last week with prices averaging USD 925/tonne on Friday, down by just USD 5/tonne on the previous week.

- The weekly average PET resin physical differential to feedstock costs increased by USD 16/tonne to average USD 84/tonne for the week. By Friday, the daily spread had continued to recover and was at USD 87/tonne.

- The shape of the current PET resin raw material forward curve showed little change over the last week. Whilst still backwardated raw material costs look set to stabilise from Sept’23.

- At Friday’s close, Sept’23 raw material costs were trading with only a USD 15/tonne discount to Jun’23.

Concluding Thoughts

- The upward trend in the physical differential between future feedstock costs and resin prices continues to solidify.

- The recent decline in PET resin prices, combined with improving domestic demand, has prompted an increase in enquires, with some restocking by converters.

- Bargain hunters are coming back to the table. PET resin producers are seemingly reluctant to discount further, at least for the time being.

- However, further upside to PET export margins is likely to be constrained by the imminent launch of new capacity by Sanfame and others.

- Combined with a backwardated forward curve for raw materials, PET resin export prices may move soften through the coming months, depending on crude and the macroeconomic environment.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.