Insight Focus

- Falling crude and weaker than expected polyester demand drives PTA and MEG futures lower.

- China’s October Golden Week sees markets closed until October 10th.

- PET resin export demand is clouded in uncertainty as availability lengthens.

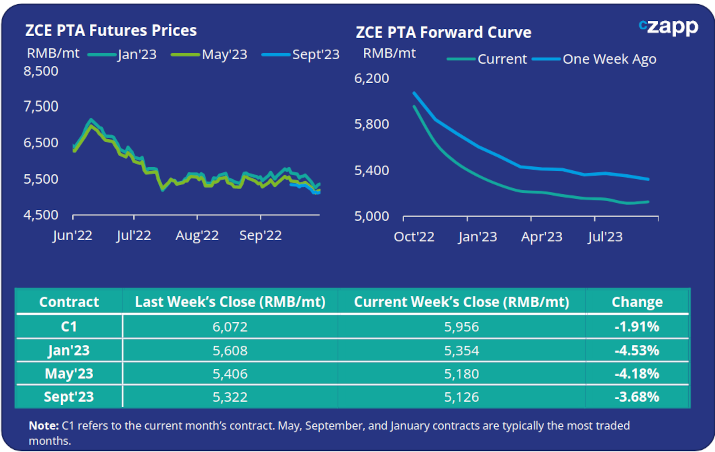

PTA Futures and Forward Curve

- PTA supply tightness has eased slightly as PTA plant operating rates gradually recovered following recent typhoon disruption.

- However, PTA demand is set to weaken following China’s National Golden Week holiday as polyester plants cuts production as peak season fails to materialise.

- In the short-term, PX supply tightness continues to constrain PTA production. However, weakening demand and greater PTA liquidity is expected to see the PTA-PX spread narrow in October.

- The PTA forward curve has steepened in backwardation with the Jan’23 contract closing last week at a RMB 602/tonne discount to the current month.

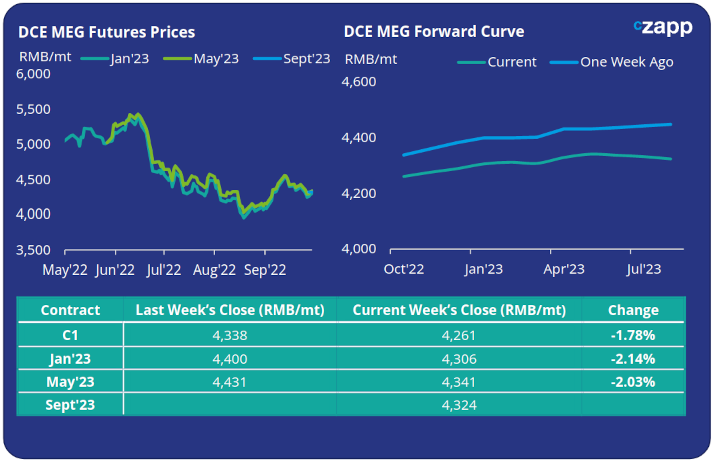

MEG Futures and Forward Curve

- MEG Futures turned bearish once again last week driven by falling crude prices and fears of a global economic downturn.

- MEG port inventories continued to decrease, in part due to a supercharged US dollar, with some supply switching to domestic coal-based units instead of dollar denominated imports.

- Downstream demand outlook has turned pessimistic, with polyester operating rates now in reverse and set to fall further following China’s National Golden Week holiday.

- The MEG forward curve remains in contango, although the curve has begun to flatten in recent weeks, with the Jan’23 contract at a small RMB 63/tonne premium to the current month.

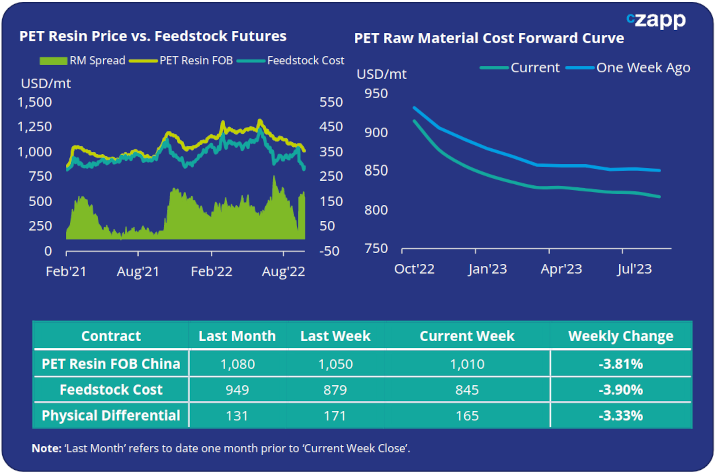

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices decreased last week averaging USD 1010/tonne by Friday, down around USD 40/tonne on the week, and USD 70/tonne for the month.

- The weekly average PET resin–raw material physical differential increased USD 4/tonne, from the previous week to USD 178/tonne. By Friday, the daily spread fallen back to around USD 165/tonne.

- Primarily driven by changes in the PTA outlook, the raw material forward curve moved lower and steepened in backwardation over the last week. The Jan’23 contract discount to the current month widened to USD 70/tonne.

Concluding Thoughts

- Chinese futures markets will be closed during the National holidays between 1st-7th October, reopening on Monday 10th October.

- On reopening, PET resin export prices look set to come under sustained downward pressure through Q4.

- Raw material fundamentals have turned negative following a weakening downstream demand outlook, and PET resin export demand is clouded in uncertainty.

- Availability has lengthened over the last month, with material still available for October and November shipment; price levels for Dec’22 were heard at a USD 20-30/tonne discount to the current level.

- Whilst the collapse in ocean freight favours Asian exports and could support improved demand, the relentless surge in the USD dollar has eroded some of their competitiveness into markets, such as Europe.

- The addition of new and restarted capacity coming onto the market in Q4’22 is also expected to add weight to this downward pressure.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

European PET Market View: Downward Slide in European PET Prices Set to Continue

PET Resin Trade Flows: Brazil seeks to Export More PET to North America