Insight Focus

- Stronger crude values supported higher PTA futures versus the pre-holiday close.

- PTA and MEG faces weakening downstream polyester demand on reduced production.

- PET resin export demand remains slow, optimism remains for 2023 growth.

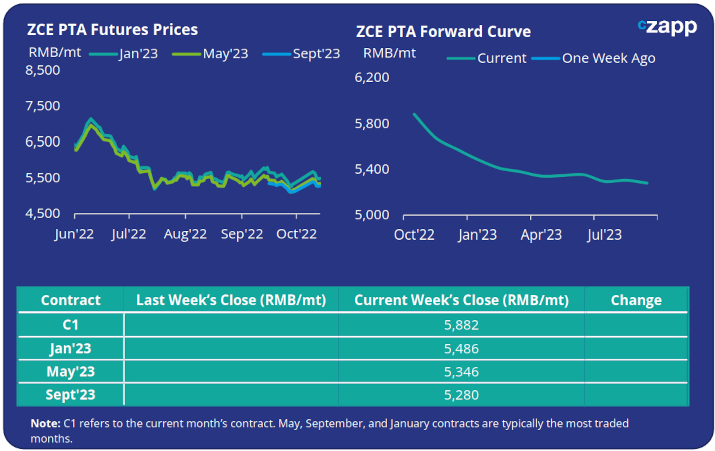

PTA Futures and Forward Curve

- Although moving lower through the week, PTA Futures finished higher than the pre-holiday market close.

- PTA supply tightness has eased slightly with higher PTA plant operating rates. However, continues to be constrained by tight PX supply.

- PTA demand has weakened following China’s National Golden Week holiday as polyester plants reduced production, with only limited restocking.

- Overall, weakening demand and greater PTA liquidity is expected to keep pressure on PTA-PX spreads.

- The Jan’23 contract closed last week at a RMB 400/tonne discount to the current month.

MEG Futures and Forward Curve

- MEG port inventories increased bucking the trend in recent weeks as downstream polyester demand continues to slow.

- As expected, polyester operating rates further reduced following the National holiday, and with supply slowly recovering the market looks set to lengthen adding pressure on MEG prices.

- Several new Chinese MEG plants are also due to start-up in the coming months.

- The MEG forward curve remains in contango, although flatter in recent weeks, with the Jan’23 contract now on par with the current month.

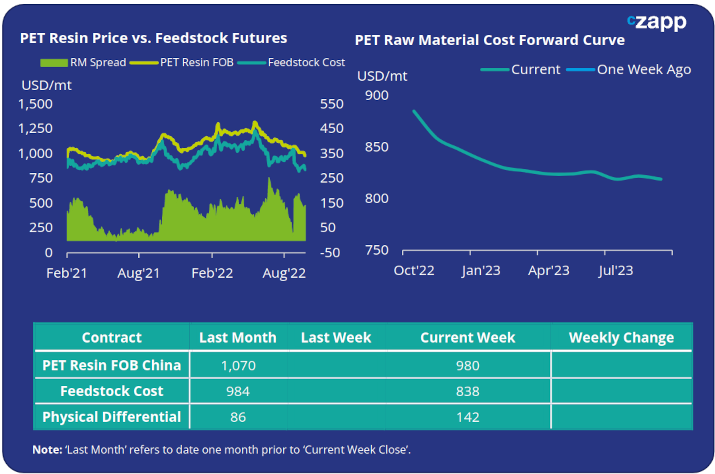

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices weakened on last week, averaging USD 980/tonne by Friday, down around USD 30/tonne on the pre-holiday market close, and USD 90/tonne for the month.

- The weekly average PET resin–raw material physical differential also declined by USD 43/tonne on softer demand, to USD 135/tonne. By Friday, the daily spread was around USD 142/tonne.

- The raw material forward curve remains in backwardation with the Jan’23 contract discount at USD 47/tonne.

Concluding Thoughts

- New sales and order intake at major PET exporters remains soft, with producers keen to hear new bids and discounting to fill orders.

- Price levels for Dec’22 were heard at a USD 40-50/tonne discount to the current level.

- The addition of new and restarted capacity coming onto the market in Q4’22 is expected to add weight to this downward pressure.

- European buyers have indicated a willingness to import greater volumes into the region in Q1’23 but this has yet to translate into any noticeable change on the Asian sales side.

- Latest financial results from PepsiCo, showed a continued strong beverage volume growth within Latin America and the Africa, Middle East, South Asia regions. All key target markets for Chinese producers.

- Even if European Q1 demand is weaker than anticipated, many other target regions are still in COVID recovery mode and should continue to provide a good foundation for Chinese PET export growth in 2023.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.