Insight Focus

- PTA futures continue to rally supported by temporary supply tightness and recovery in crude.

- Forward curve for raw material costs now heavily backwardated through 2023.

- Schedule and ramp-up of new capacity additions key to price outlook over the coming months.

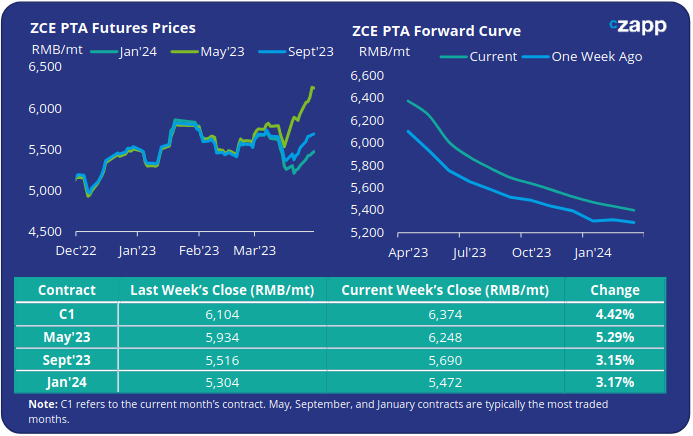

PTA Futures and Forward Curve

- PTA futures continued to add sizeable gains last week as crude oil prices strengthened, and PTA availability remained tight.

- Although producers Hengli Huizhou and Hongang have recently started production at new PTA units, other large PTA producers, including Ineos, Yizheng, OPSC and Weilian Chemical, continued scheduled maintenance, constraining overall supply.

- PTA markets also continued to see support from downstream polyester demand, as polymerisation rates remain high, at over 90%.

- Temporarily tighter PX and PTA availability enabled upstream markets to improve margins, with PX-Naphtha and PTA-PX spreads continuing to expand last week.

- Near-term PTA market tightness continues to be reflected in the forward curve, which is heavily backwardated over the next few months as PX and PTA flows normalise from May onwards.

- By Friday, the May’23 contract was at a RMB 126/tonne discount to the current month’s contract. Similarly, Sept’23 was at a 684/tonne discount, both increasing sharply in backwardation versus last week.

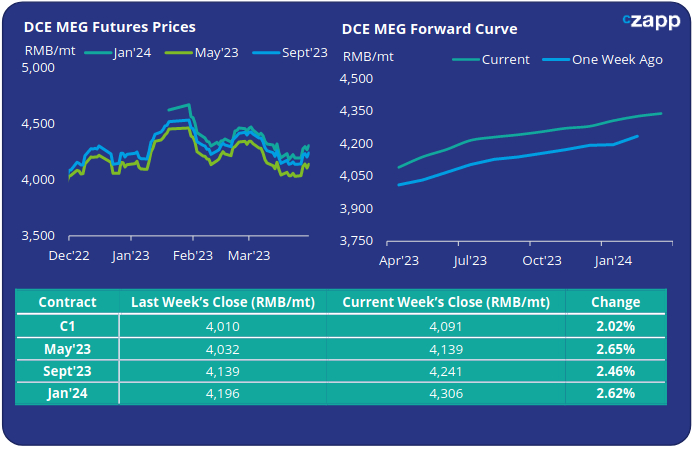

MEG Futures and Forward Curve

- MEG futures continued to drift slowly higher, however, trailed the rebound in crude and PTA prices, adding just over 2% at week’s close.

- Although the MEG market is experiencing some support from plant turnarounds, and other producers switching to ethylene oxide or cutting production due to poor MEG margins, spot availability is more than ample providing a drag on prices.

- East China main port inventories remained at high levels, around 1.05Mt, despite declining 0.9% from last week.

- Beyond the current maintenance period, further recovery in downstream demand is needed to break out of the current range.

- The current MEG forward curve shows a modest increase in forward prices through the rest of the year. By Friday, the May’23 contract was at a RMB 48/tonne premium to the current month’s contract; Sept’23 contract is at a RMB 150/tonne premium.

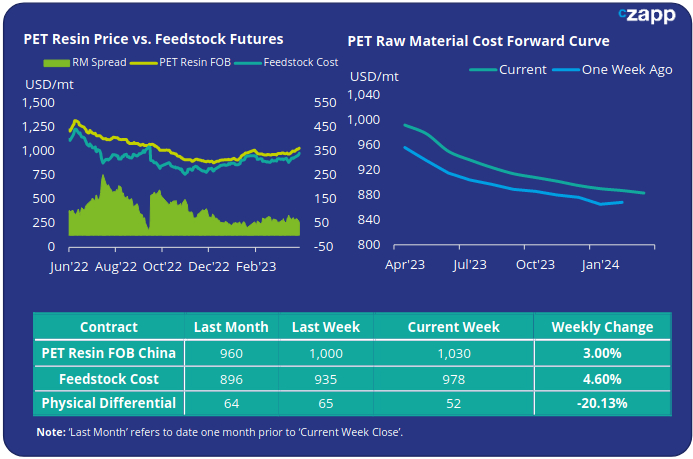

PET Resin Export – Raw Material Spread and Forward Curve

- Confronted with a sharp increase in raw material costs, Chinese PET resin producers pressed export prices higher through the week, with prices averaging USD 1030/tonne last Friday, up a further USD 30/tonne on the previous week.

- Despite the price increase, the weekly average PET resin physical differential to feedstock costs fell by USD 10/tonne to average USD 59/tonne for the week. By Friday, the daily spread had decreased to USD 52/tonne.

- The PET resin raw material forward curve continues to be steeply in backwardated through the next 12-month period. At Friday’s close, the May’23 contract trading at a USD 14/tonne discount to the current month’s contract, whilst Sept’23 had increased to a USD 78/tonne discount.

Concluding Thoughts

- Near-term strength in raw material pricing, largely due to the sharp rise in PTA prices, is resulting in low physical premium for spot resin over raw material futures.

- Despite good export order intake levels earlier in Q1, export sales have slowed, with buyers sitting on stocks unwilling to chase prices higher.

- Some Chinese PET resin producers report unusually weak export demand for this period running up to peak-season.

- Whilst one major producer is sold-out for export through April/May, others are still actively offering for prompt shipment in April.

- The publication of the EU’s much anticipated anti-dumping investigation on Chinese PET resin imports (HS 39076100) is seen to already be having an impact on European sales. Chinese PET resin exports to the EU totalled around 360k tonnes in 2022.

- With the raw material forward now heavily backwardated, many buyers will likely look to wait out the current elevated prices and tightness in the PTA market.

- Future PET resin export prices will largely be determined by the upcoming schedule, and ramp-up, of new PET resin capacity additions in China over the coming months.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.