Insight Focus

- Front month PTA futures rose over the last week following crude strength.

- Rising inventories at main ports mean front month MEG futures continue to slide.

- Despite rising PET resin FOB export prices, margins have become negative.

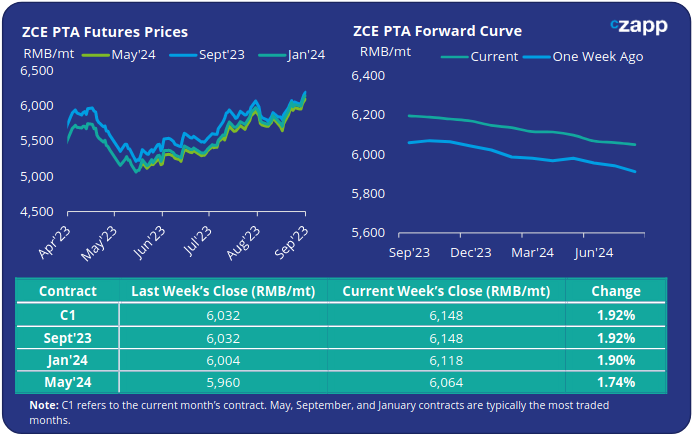

PTA Futures and Forward Curve

PTA futures strengthened over the last week, the main Jan’24 contract extending by around 2.2% to almost 6200RMB/tonne. This is in part due to concerns over logistics from typhoon weather and increased polyester factory operating rates.

This upwards move also follows crude oil’s own move higher over the previous week of trading.

By Friday the Jan’24 contract was trading at a 48USD/tonne discount to the current month, down from 38USD/tonne the previous week.

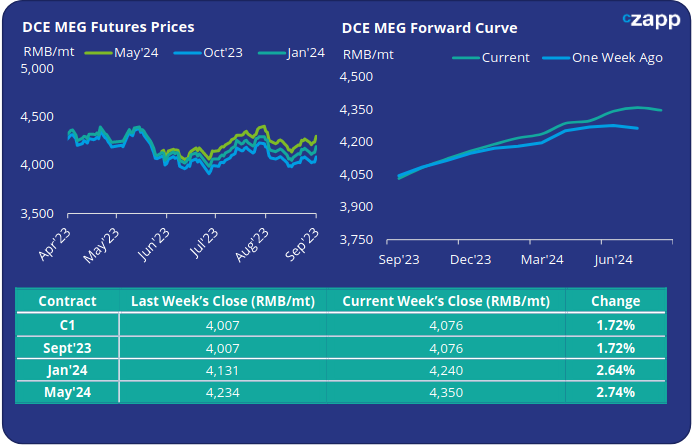

MEG Futures and Forward Curve

Front month MEG futures continued to drift slightly lower, with the current month falling by just over 0.3%, settling at just over 4030RMB/tonne by Friday.

Inventories at the main ports continue to rise, up almost 4.6% on Friday from the previous week. This takes total inventory to 1,138k tonnes.

This said, the main Jan’24 contract did rally slightly, extending by over 0.4% to almost 4200RMB/tonne.

Peak polyester season is rapidly approaching; from late-Aug to October consumption of port inventory is expected to increase, with import arrivals easing from late-Sept.

Despite this, the MEG forward curve still remains in contango over the next 12-months. By Friday the Jan’24 contract extended to a 158RMB/tonne premium to the current month.

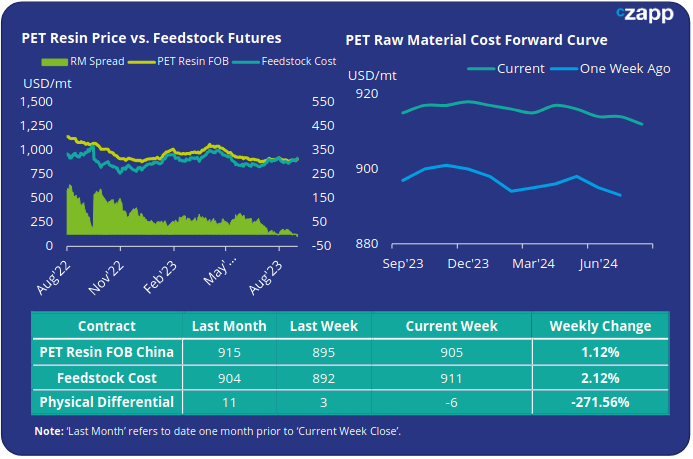

PET Resin Export – Raw Material Spread and Forward Curve

Raw material feedstock costs rose over 2% over the previous week, reaching 905USD/tonne by Friday, whilst Chinese PET resin export prices also strengthened, by just over 1% to 911USD/tonne.

This means that the physical differential moves further negative, to a slight loss of 6USD/tonne.

The raw material cost forward curve has across all contracts until at least July’24 and remains backwardated until the end of H1’24.

Concluding Thoughts

Supported by recent strength in the crude oil market, analysts foresee a tightening market ahead with minimal downside risks if OPEC+ keeps production levels controlled.

Should crude prices continue to trade higher toward the end of the year, raw material costs for polyester producers would rise too.

The physical differential between future raw materials and PET resin exports still remains close to historic lows. However large plant sizes, greater downstream integration, and discounted oil supplies, means cost of production is also lower than 12 months ago.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.