Insight Focus

- PTA futures flat on quiet upstream market, inventories begin to accumulate.

- PET resin export prices also remain steady, margins improve on tighter availability.

- Margins expected to increase as domestic and export demand picks up into March.

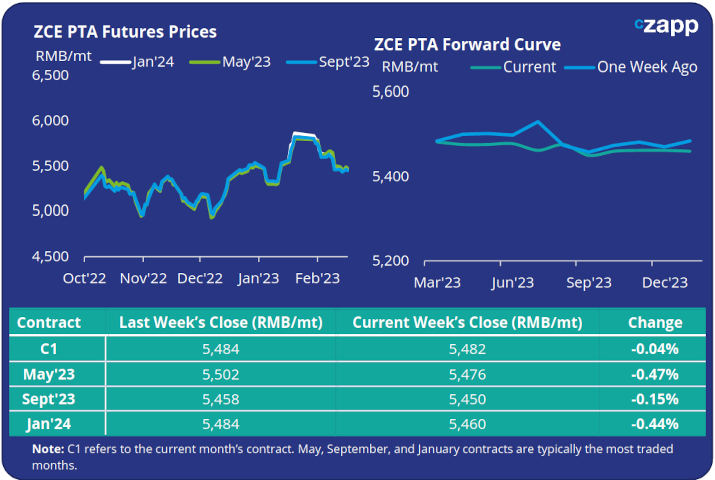

PTA Futures and Forward Curve

- PTA futures ended flat versus the previous week, as any fresh demand found itself balanced out against increased PTA availability.

- Over the past month, polyester polymerisation rates have continued to steadily recover, but have been outstripped by an increase in PTA plant operating rate and new PTA capacity.

- As a result, inventories are accumulating with PTA receipts in futures warehouses increasing over the past month. Although current levels are far below the 2021 highs.

- The current PTA forward curve is still relatively flat, with the May’23 contract now showing a small RMB 6/tonne discount to the current month’s contract.

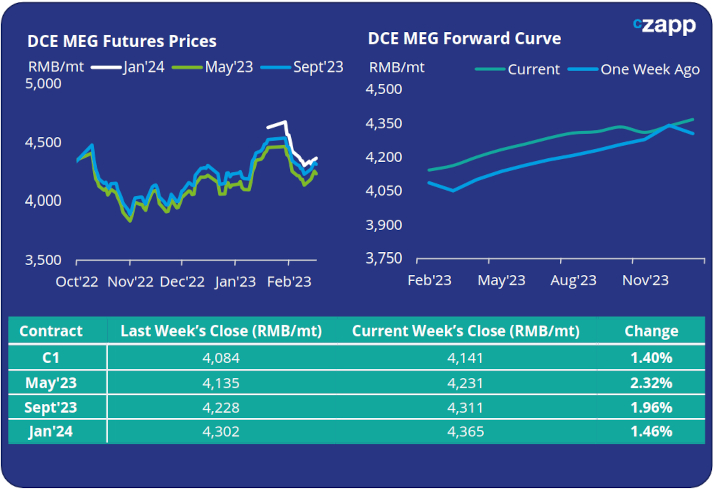

MEG Futures and Forward Curve

- MEG Futures recovered some lost ground through the back half of last week. Although the recent start-up of several new MEG plants in China has dampened trading sentiment.

- East China main port inventories continued to show inventory accumulation, following their typical seasonally upwards trend in February.

- Further production cuts at existing Chinese MEG producers are expected as some producers raised EO output due to poor margins on MEG.

- However, a series of Middle East shutdowns and a tighter US market following previous shutdowns is expected to see lower imports over the coming month.

- Therefore, new supply may be balanced out by reduced domestic and a drop in import supply in March-April, as well as a steady improvement in demand, as polyester operating rates rise.

- The MEG futures forward curve remains in contango, the May’23 contract now at a RMB 90/tonne premium to the current month’s contract.

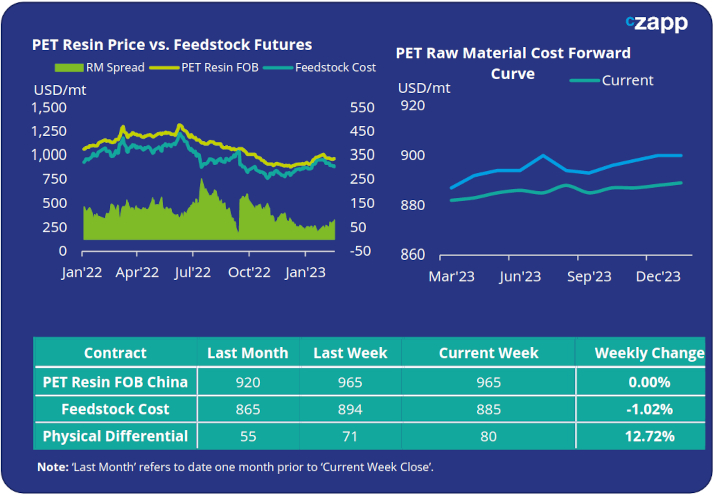

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices remained relatively flat through last week, closing Friday at an average price of USD 965/tonne, equal to that of the previous week.

- The weekly average PET resin physical differential to feedstock costs has started to show an upward trend, averaging around USD 77/tonne. By Friday, the daily spread had increased to USD 80/tonne.

- The PET resin raw material forward curve has flattened out over the past week. At Friday’s close, the May’23 contract was on par with the current month’s contract.

- PET resin export offers for H2’23 from some producers are also on par with current spot levels.

Concluding Thoughts

- Whilst PET export prices remain subdued following Chinese New Year, the physical differential between spot values and raw material futures continues to steadily increase.

- Tighter availability with producers being largely sold-out and lacking prompt shipment through February and March, is the key driver.

- Looking beyond the current order book, forward export demand is also beginning to show signs of improving as bottlers secure additional coverage for the summer months.

- Further modest improvement in the physical differential between raw materials and the PET resin export price is expected as we enter pre-season and domestic demand improves.

- However, upside to any forward premium for PET resin export prices is expected to be constrained by a series of new capacity additions.

- The first by Sanfame is expected to add its first 750kta PET resin line by early April, with the second 750kta line due early July 2023.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.