Insight Focus

- Increased polyester operating rates provide PTA and MEG markets with near-term support.

- Recent fall in PET prices stimulate fresh demand as bottle-grade PET resin sales improve.

- Raw material forward curve continues to show downward trend through Q3’23.

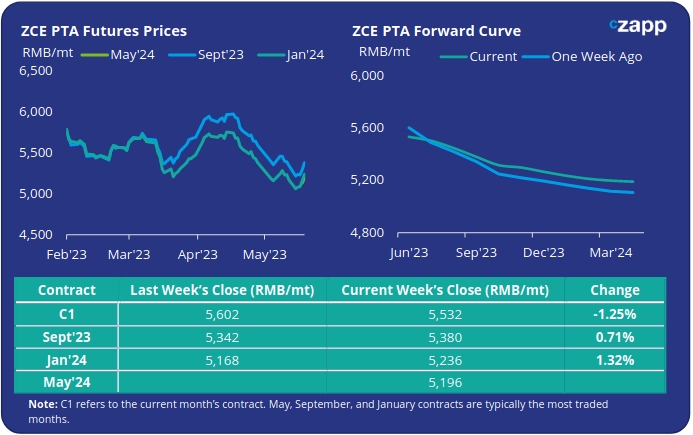

PTA Futures and Forward Curve

- Oil prices notched up their first weekly gain in a month on renewed optimism that the US will avoid default, signs emerge of strong fuel demand in the US ahead of driving season.

- PTA Futures showed modest price gains with the main Sept’23 contract up by just under 1% on the week.

- Polyester operating rates were once again the rise, as domestic polyester and bottle-grade PET resin sales improve, beverage companies prepare for summer demand.

- However, PX supply is expected to further increase with several plants restarts, potentially lessening support for PTA prices.

- Whilst there is ample PTA supply, the PX-PTA spread may also see some near-term support from those producers still to carry out maintenance turnarounds mid/late May.

- However, from mid-June onwards we expect PX and PTA supply to expand, although improving downstream demand may help limit potential inventory accumulation.

- The forward curve remains backwardated, near-term strength continues to ease with the curve reducing in steepness; by Friday, the Sept’23 contract was trading at a RMB 152/tonne discount to the current month.

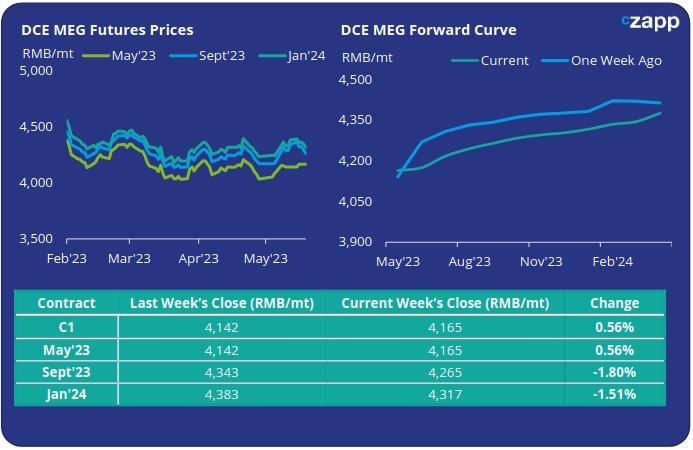

MEG Futures and Forward Curve

- MEG Futures for the main forward month of Sept’23 fell by 1.8% last week. Despite continuing poor margins, further supply cuts and increased downstream demand may begin to improve overall fundamentals.

- Although Chinese domestic MEG production has faced significant cuts already, more reductions are expected in May and June, as several other producers move into maintenance.

- The degree to which these have/or have not already been factored into the market though is debatable.

- And although port inventories increased slightly last week by 1,7% last week to around 968k tonnes, expectations are for port inventories to also continue to decrease.

- Prices may keep firm in the near-term. However, rising supply in the coming months may constrain further price gains.

- By Friday, the current month spread to the Sept’23 contract had narrowed, with Sept’23 holding a RMB 100/tonne premium.

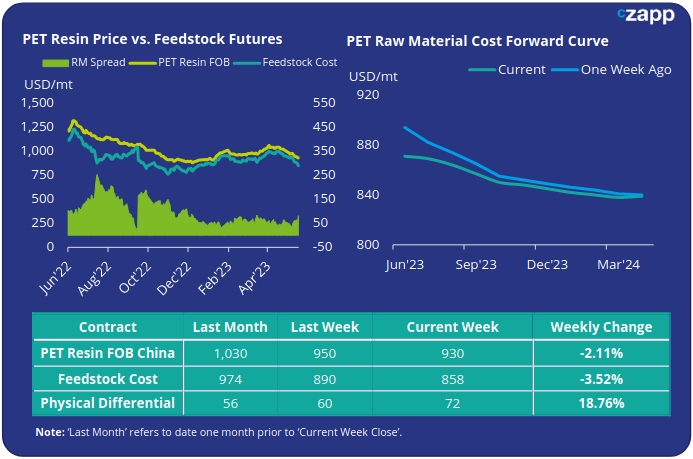

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET export prices continue to decline last week, with prices averaging USD 930/tonne on Friday, down a further USD 20/tonne on the previous week.

- The weekly average PET resin physical differential to feedstock costs increased by USD 17/tonne to average USD 68/tonne for the week. By Friday, the daily spread was at a USD 71/tonne, the highest daily level since mid-March this year.

- The current PET resin raw material forward curve has begun to flatten out considerably, with the expiration on May contracts. Over the next 12-months, whilst still backwardated prices look set to stabilise into Q4’23.

- At Friday’s close, Sept’23 raw material costs were trading with only a USD 15/tonne discount to Jun’23.

Concluding Thoughts

- After months of low margins an upward trend in the physical differential between future feedstock costs and resin prices may be emerging.

- Whilst a seasonal breakout in the spread is yet to be confirmed, the recent fall in PET resin prices has stimulated domestic restocking as beverage companies prepare for peak season.

- Improving domestic demand and a reallocation of export volume to the home market is likely to provide support to PET resin export margins as supply is diverted.

- Buyers have also shown increased interest in placing export orders, particularly within European, Middle Eastern, and East African markets.

- Stabilisation in the raw material forward curve, coupled with a modest improvement in export margins, may see PET resin export prices firm into June.

- However, imminent new capacity from Sanfame and others, will continue to weigh on sentiment.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.