Insight Focus

- PTA and MEG futures were buoyed by further easing COVID restrictions in China.

- Whilst PET export prices edge upwards, future margins have narrowed sharply on quieter market.

- PET resin demand expected to experience post-CNY rebound, potential EU ADD poses downside risk.

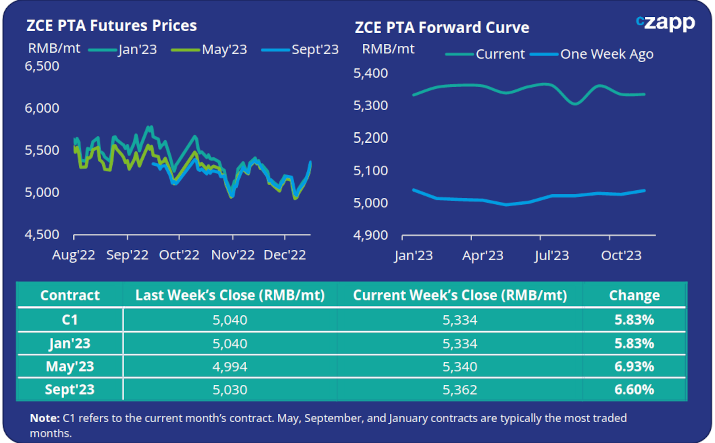

PTA Futures and Forward Curve

- PTA futures rebounded sharply from the previous week’s losses, spurred by the easing of COVID restrictions.

- Although inventories at bonded warehouses remain low, the narrow PX-PTA spread remains constrained by current weak downstream polyester demand.

- The reopening of China has led to some restocking from downstream fibre manufacturers, fundamentals nevertheless remain weak.

- In the near-term, additional PX supply from newly started plants may help to improve PX liquidity, enabling PTA producers to recoup some margin. Although additional PTA supply may also limit any potential upside.

- The current PTA forward curve is now flat through much of 2023, with the May’23 contract effectively trading at a rollover to the Jan’23 level.

MEG Futures and Forward Curve

- MEG futures posted another strong week on crude oil gains and positive sentiment on the continued reversal of COVID restrictions in China.

- Chinese main port inventories continued to rise, with the market now clearly trending into the off-season with the traditional increase in port levels.China’s reopening now presents a potential turning point for the market. Travel and spending are expected to increase during the Spring Festival, prompting restocking of resin and fibre, and generating stronger demand for PTA and MEG.

- However, after 2 years of zero-COVID, job losses and fewer support programs, strength of consumer spending is expected to be weaker than the rebound experienced in Q2 2020.

- Nevertheless, a supply glut from new MEG capacity and the high port inventories may constrain price rises.

- The MEG futures forward curve has strengthened with the May’23 contract now at a RMB 125/tonne premium to the main Jan’23 contract.

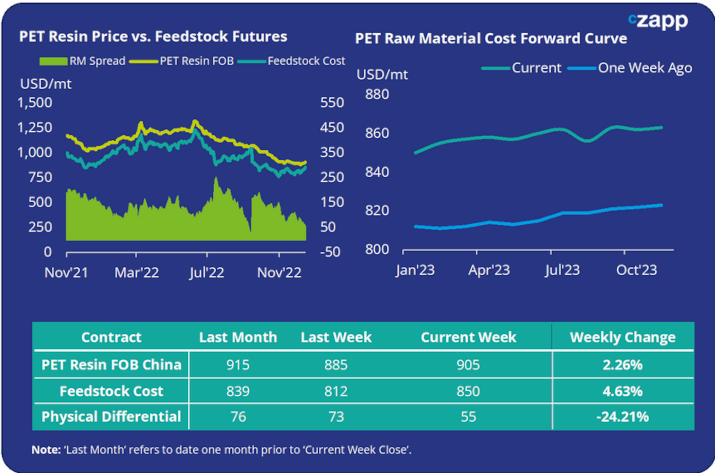

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices were saw increases of around USD 20/tonne last week, ending the week at an average price of USD 905/tonne.

- The weekly average PET resin physical differential to feedstock costs fell sharply last week, down USD 18/tonne on average, to USD 62/tonne. By Friday, the daily spread had declined to just USD 55/tonne.

- The PET resin raw material forward curve, whilst remaining relatively flat through much of 2023, has moved USD 40-45/tonne higher versus the previous week. At Friday’s close, the May’23 contract was showing a small premium of around USD 7/tonne to the Jan’23 contract.

Concluding Thoughts

- Despite signs of improvement in domestic and export demand in recent weeks, the physical differential between raw materials and spot resin prices slumped last week.

- Weakening PET resin spreads may be indicative that short-term buying patterns have quietened, following typical seasonal trends.

- With the quieter Christmas period now approaching, and only a short window between then and the Chinese New Year, export sales are now largely focused on post-Spring Festival shipment.

- PET resin availability is expected to tighten further following Chinese New Year, with increased export delivery and potential strong restocking by domestic buyers now COVID restrictions have begun to ease.

- However, any potential new EU ADD may challenge future Chinese export demand, in a year that could see an additional 4.5MMt of new PET resin capacity in China.

Please note the next PET Raw Material Futures Report will be published on the 9th January 2023 due to the Christmas Holiday break.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.