Insight Focus

- PTA Futures continue to rise as Chinese economic indicators show signs of recovery.

- PET resin export prices follow raw materials higher, forward spread narrows further.

- Margins expected to remain constrained going in Q2 ahead of new capacity additions.

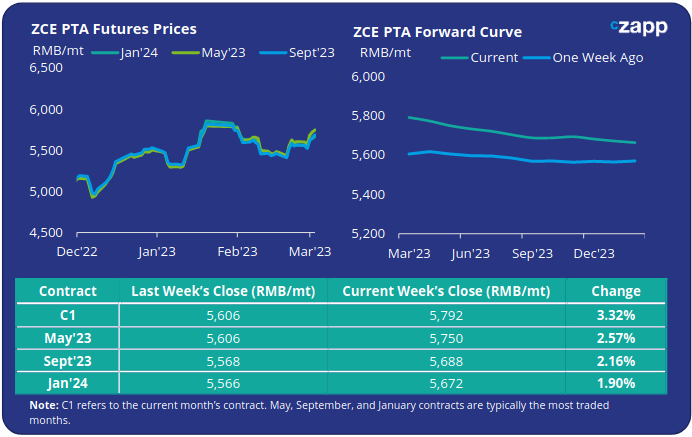

PTA Futures and Forward Curve

- PTA futures continued to move higher last week as oil prices gain on first signs of a rebound in Chinese oil demand.

- China’s manufacturing PMI also rose to 51.6 in February from 49.2 in January, after six-months of contraction, a welcome sign and potential catalyst for markets

- PTA market fundamentals are also showing some signs of improvement. Whilst inventory levels have increased since the beginning of the year, many PTA plants have planned turnarounds in March and April.

- And downstream, polyester operating rates continue to increase, despite relatively weak textile orders.

- New polyester capacity additions are also expected in March, which will increase PAT demand. However, new PTA capacity will allow for ample supply, constraining any rebound in margins.

- PTA forward curve has become slightly backwardated over the last week, with the May’23 now at a RMB 42/tonne discount to the current month’s contract.

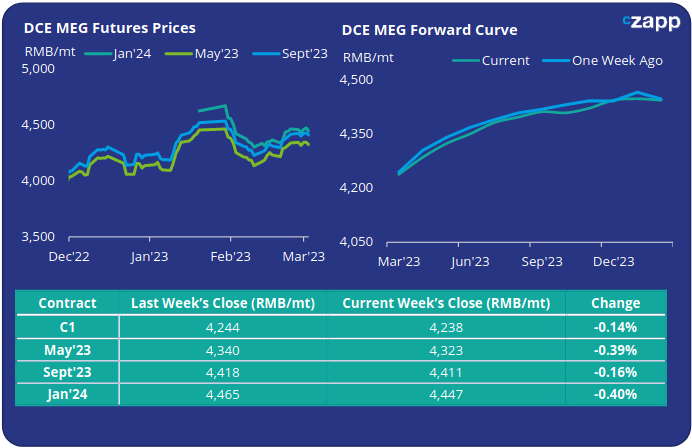

MEG Futures and Forward Curve

- Contrary to the PTA market, MEG Futures were relatively flat on the week, with high inventory and ample availability leading to heavy selling, limiting upside potential.

- East China main port inventories decreased 3.4% last week to 1.056 MMt, remaining close to maximum capacity.

- However, further production cuts at existing Chinese MEG producers are expected, with Chinese coal-based producers also entering turnaround season in March.

- Whilst market fundamentals remain weak, higher polyester operating rates lend support to MEG demand. The upward movement in China’s coal price may also lend price support.

- The MEG futures forward curve remains in contango, the May’23 contract now at a RMB 85/tonne premium to the current month’s contract.

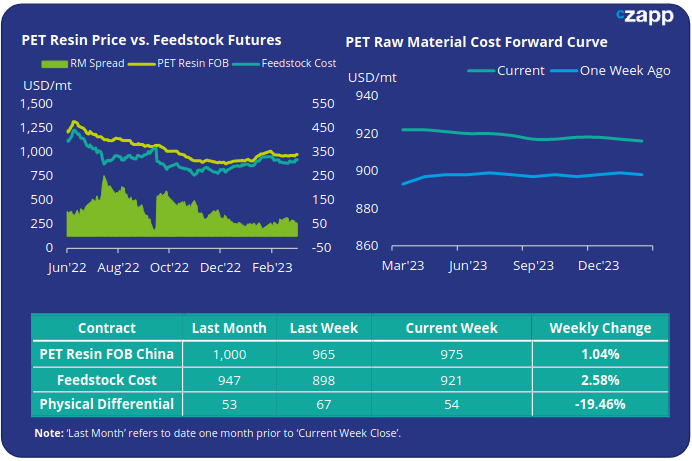

PET Resin Export – Raw Material Spread and Forward Curve

- After stagnating for the past three-weeks, Chinese PET resin export prices showed some signs of life last week, increasing USD 10/tonne to an average of USD 975/tonne last Friday.

- The weekly average PET resin physical differential to feedstock costs fell for a second week running, averaging USD 58/tonne, down USD 7/tonne on the week. By Friday, the daily spread was just USD 54/tonne.

- The PET resin raw material forward curve remained flat over the past week. At Friday’s close, the May’23 contract was at the same level as the current month’s contract.

Concluding Thoughts

- Recent indicators and optimism around a Chinese rebound coincide with positive reports from Chinese producers that demand both domestically and for export is steadily improving.

- However, despite tighter new term availability in March, the physical differential between PET export prices and raw material futures has fallen back to previous low levels.

- Although demand is expected to improve within certain key markets, producers are still keen to look for sales in April and beyond, which is reflected in the competitive pricing.

- Margins are expected to remain constrained going in Q2, as both buyers and producers navigate seek to mitigate the impact of new capacity additions.

- Sanfame is expected to add its first 750kta PET resin line by early April, with the second 750kta line due early July 2023.

- Further significant capacity additions are also anticipated through the rest of 2023, potentially totalling 4.5MMt.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.