Insight Focus

- PTA futures continue their sharp downward trajectory as crude plummets.

- Whilst prices face downward pressures, domestic and export PET resin margins grew.

- Risks around potential reimposition of lockdowns in China rise on new COVID cases.

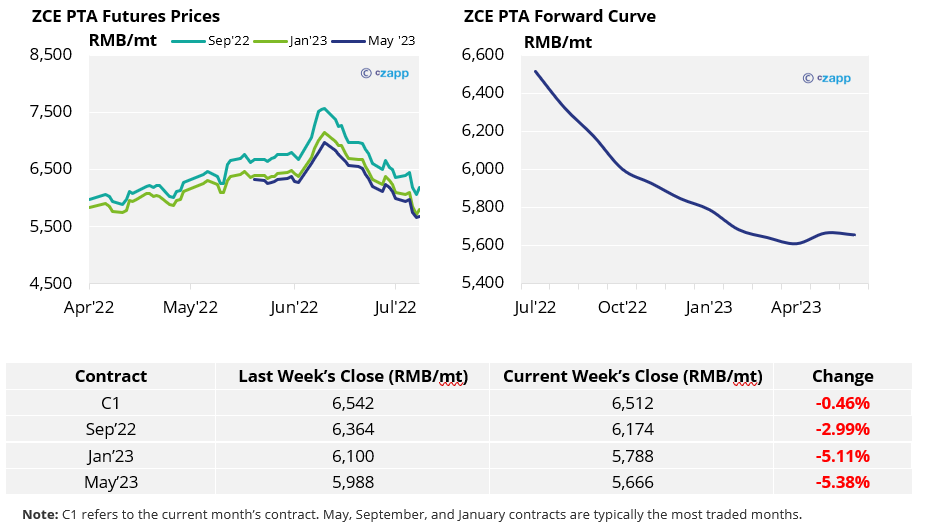

PTA Futures and Forward Curve

- PTA futures chased falling upstream costs through last week, with September contracts down nearly 3% on the week.

- Whilst prices have dropped, PTA spot availability has tightened with lower inventories at main ports, supporting higher PTA margins.

- Although some producers still have maintenance plans for July, any reduction in supply may be more than offset by expected polyester production cuts, keeping the PTA market in oversupply.

- The backwardation of the PTA 12-month forward curve has steepened over the last week.

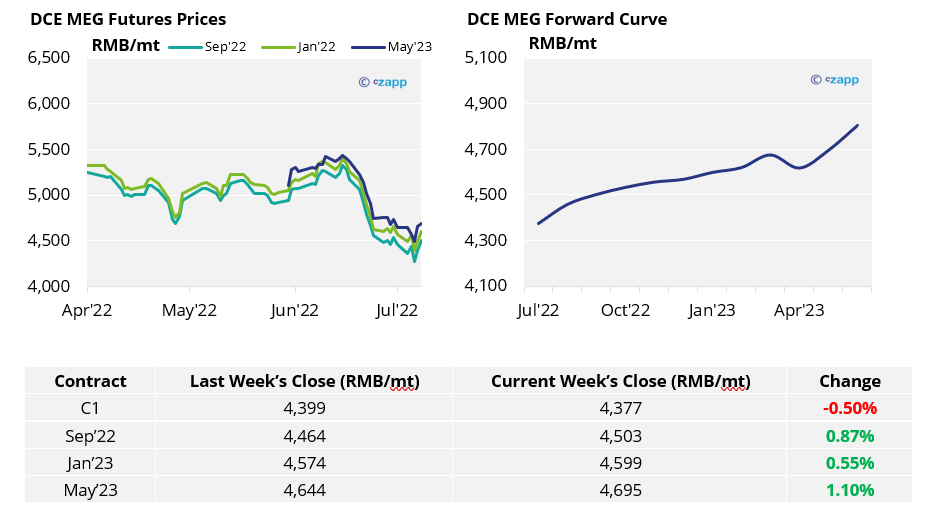

MEG Futures and Forward Curve

- MEG futures plunged last week to their lowest since January 2021, following the sharp downturn in crude oil and weaker downstream demand from textiles.

- Whilst supply cuts and restocking enabled a slight rebound at the end of the week, high port inventories and slow demand continue to plague the market.

- Future MEG contracts continue to trade at a premium to current prices.

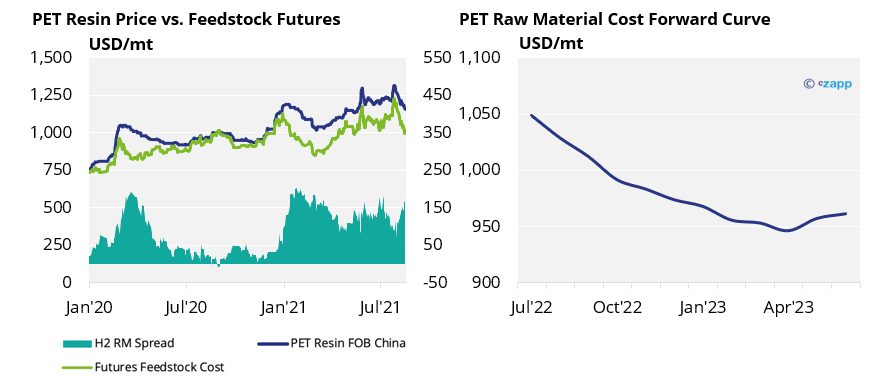

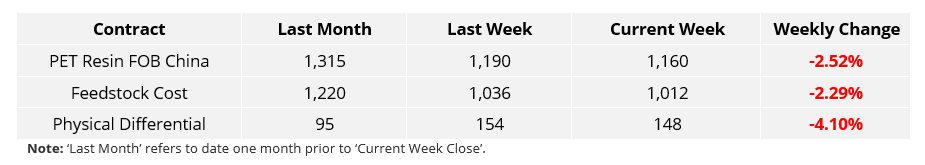

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices continued to fall through last week to around USD 1160/tonne by Friday, an average weekly fall of USD 30.

- Despite the drop in prices, producer margins increased, with the weekly average PET resin – raw material physical differential widening to USD 154/tonne, up another USD10 from the previous week.

- By Friday the daily spread had eased back slightly to USD 148/tonne.

- The raw material forward curve remains backwardated through Q3 2022.

Concluding Thoughts

- Domestic restocking and increased buying interest for export continues to push up PET resin producers’ margins.

- Export margins have now recovered to where they were last April and look set to remain supported through July and August by tight availability.

- However, with forward feedstock costs expected to ease gradually through H2, PET resin export prices are projected to continue to fall through Q3.

- With reports of new COVID measures being implemented in number of Shanghai’s districts, any move to reimpose broader lockdown restrictions in Shanghai, may kneecap the current domestic recovery.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

PET Resin Trade Flows: China’s PET Exports Surge as Logistics Ease Post-COVID

Asia PET Market View: Chinese Consumption Rebound Drives New PET Orders

Plastics and Sustainability Trends in June 2022

Initial European PX Settlement Rocks PET Market

Explainers That May Be of Interest…