Insight Focus

- PTA futures have weakened over the last week amid crude losses.

- MEG futures prices closed higher by Friday last week following news of new facility commissioning delays.

- The PET resin physical differential has fallen to its lowest level since January as export prices weaken.

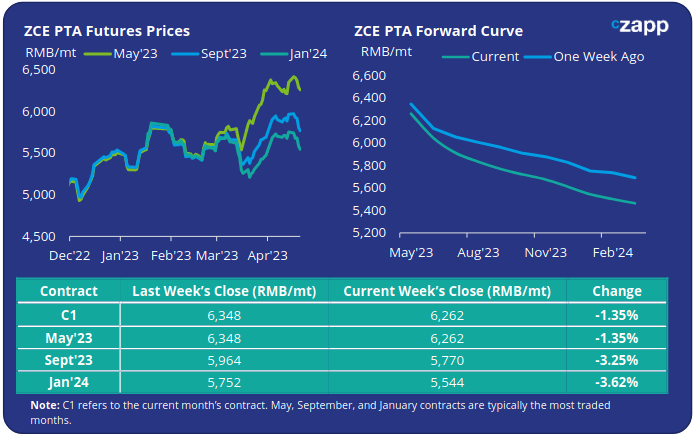

PTA Futures and Forward Curve

- Following a decline in crude oil prices over the last week May’23 PTA futures fell almost 1.4% from the previous week, closing at 6262RMB/tonne by Friday.

- With later-dated contracts softening by more the PTA futures forward curve remains strongly backwardated until at least Feb’24.

- This is reflective of current near-term market tightness we think should begin to resolve from May, with weaker downstream demand already potentially beginning to become apparent.

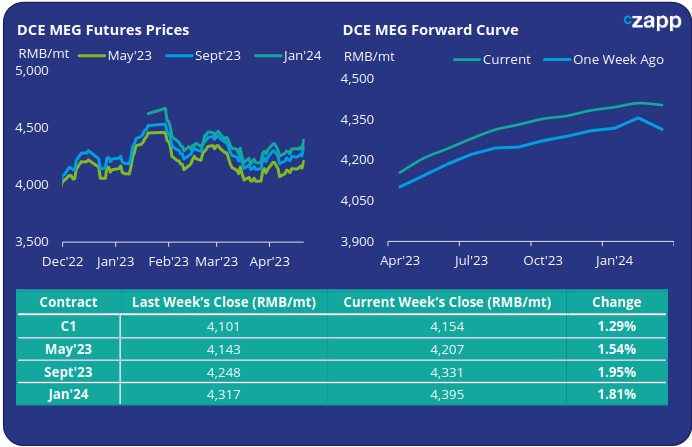

MEG Futures and Forward Curve

- Helped upwards by news of the delayed commissioning of the new Sanjiang Chemical facility, April’23 MEG futures strengthened slightly toward the end of last week, reaching over 4150RMB/tonne by Friday.

- With inventory at East China ports still high, even if decreasing, the MEG futures forward curve remains in contango with the later-dated Sept’23 and Jan’24 contracts both strengthening in excess of 1.8% by Friday.

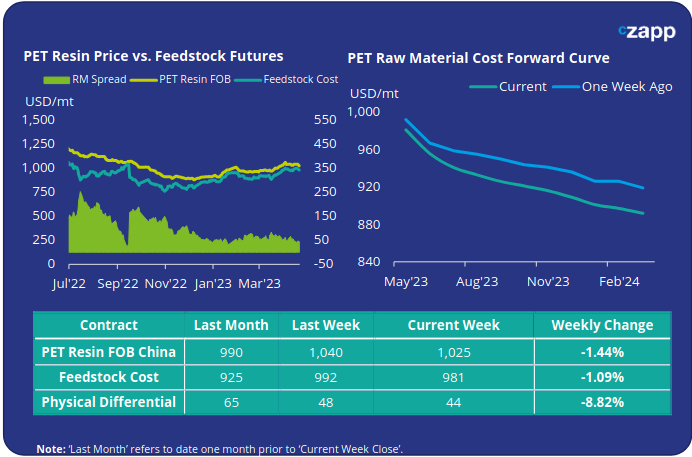

PET Resin Export – Raw Material Spread and Forward Curve

- PET resin FOB prices gradually moved downwards over the last week, closing at 1025USD/tonne by close of trading on Friday.

- PET raw materials costs retreated too, falling almost 1.1% week-on-week by the end of last week. The feedstock cost now stands at 981USD/tonne.

- The raw materials forward curve remains inverted throughout 2023, the Jan’24 contract now trades at an 80USD/tonne discount to the front month contract.

- With export prices softening by more than feedstock costs the physical differential shrank by almost 9% by Friday. Now at only 44USD/tonne, it is at its narrowest since January earlier this year.

Concluding Thoughts

- Despite peak season approaching the PET resin physical differential continues to shrink, now at it’s lowest since January.

- With PET producers all continuing to make new sales this should begin to provide support for the physical differential.

- Likewise, the raw material forward curve is still strongly backwardated, particularly to June’23. As these contracts expire this should help improve margins over feedstock costs.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.