Insight Focus

- PTA futures continued to fall, largely tracking the PX and crude markets.

- Having fallen sharply in recent weeks, PET export prices steadied last week on tight availability.

- Lower PET resin export prices are attracting additional forward interest from European buyers.

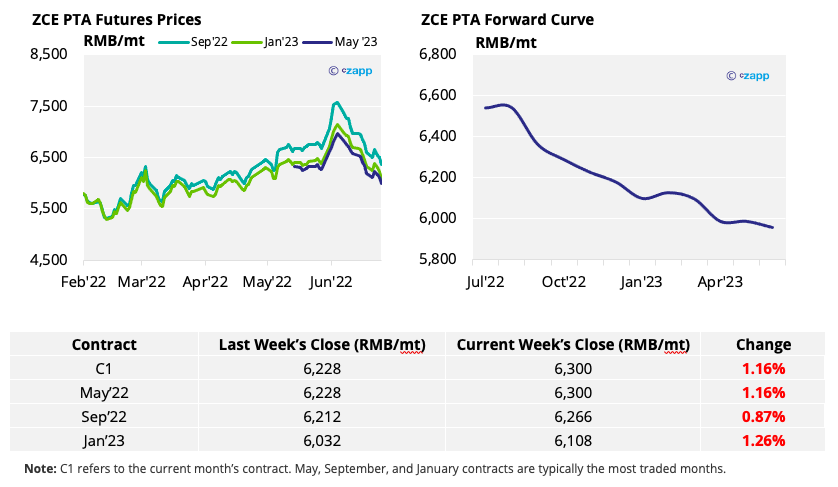

PTA Futures and Forward Curve

- PTA futures continued their slide, following PX and crude prices.

- Several PTA producers are expected to enter maintenance in July, supporting the PTA-PX spread.

- However, Chinese polyester producers may also decide to cut production in July due to lacklustre demand from the textile market, further dampening PTA demand.

- The PTA 12-month forward curve remains steeply backwardated into 2023.

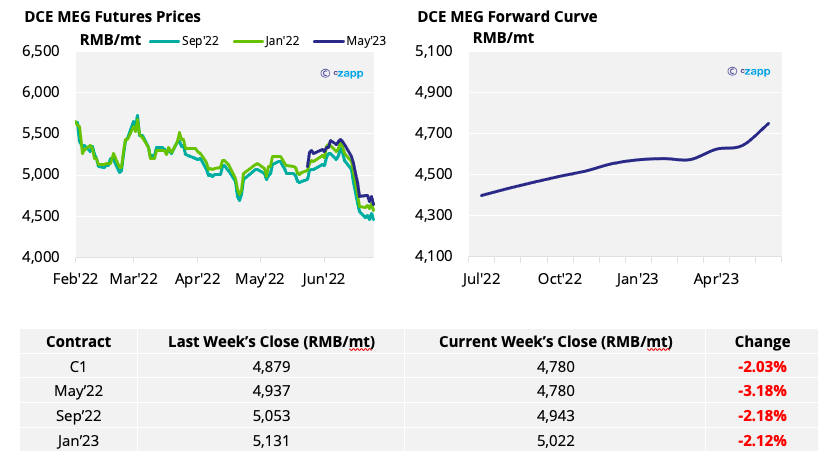

MEG Futures and Forward Curve

- MEG futures fell further towards the end of last week, following the previous week’s sharp drop.

- Coal-based MEG producers cut output at some units due to low MEG prices.

- However, the market is likely to remain weak due to slow textile demand and persistently high inventory.

- The MEG forward curve remains in contango, with future contracts trading at a premium to current prices.

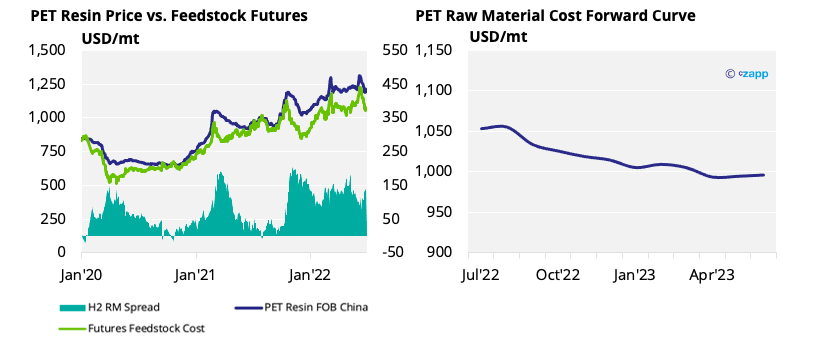

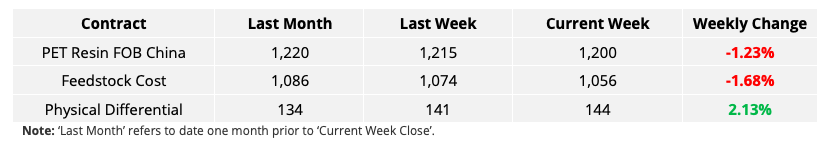

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices flattened out last week, settling around USD 1190/tonne by Friday.

- Producers enjoyed higher margins, with the weekly average PET resin – raw material physical differential widening USD 28 to USD 144/tonne. Friday’s daily spread was higher still at USD 156/tonne.

- The PET export-raw material forward curve remains partially backwardated through Q3 2022, flattening out into 2023.

Concluding Thoughts

- With export demand helping to support overall PET resin sales through much of H1, resurgent domestic demand, following an easing of restrictions, is returning the favour.

- Although PET export margins have fallen 15-20% since April, PET export margins could stabilise through July and August due to tighter supply caused by strong domestic restocking.

- Whilst some short-term margin support may be evident, forward feedstock costs are expected to ease gradually through H2, pointing to continued softening in projected PET resin prices through Q3.

- However, with PET prices surging in the European market, and remaining high across the Americas, increased price competitiveness is expected to generate strong demand in Q4; following a similar pattern to Q4 2021.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

Asia PET Market View: Chinese Consumption Rebound Drives New PET Orders

Plastics and Sustainability Trends in June 2022

Initial European PX Settlement Rocks PET Market

European PET Market View: Will Revenge Spending Boost European PET this Summer?

Explainers That May Be of Interest…