Insight Focus

- Lacking clear sign about China’s economic recovery, PTA and MEG futures fell after CNY.

- PET export prices struggled to hold onto early gains, followed raw materials lower.

- Forward direction relies much on the strength of restocking in coming weeks.

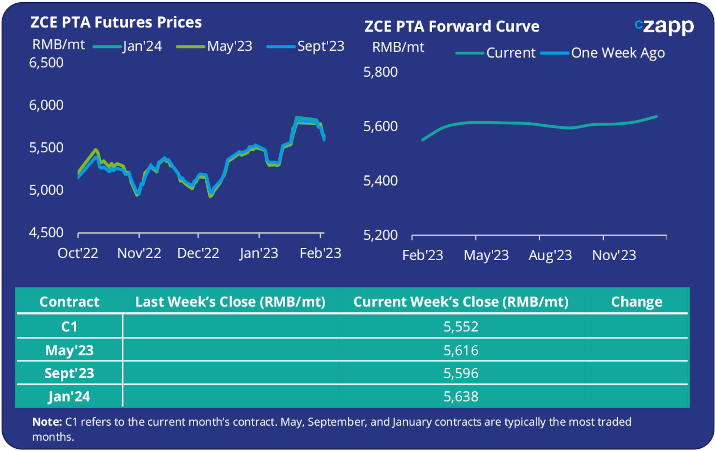

PTA Futures and Forward Curve

- PTA futures steadily declined after returning from Spring Festival, closing the week down 3.8% compared to the pre-CNY close on the 20 January. Trading was still relatively sedate in its first week back.

- Although operating rates remained low through the CNY holiday, several planted returned from maintenance increasing stock levels amid continued weak downstream polyester demand.

- As business and trading activity fully returns next week, all eyes will be on the level of restocking activity.

- Polyester textile demand is likely to have now bottomed out, and domestic bottle-resin demand is expected to accelerate in preparation for peak season. China reopening has set a new floor.

- The current PTA forward curve is relatively flat with a small forward premium through to May; the May’23 contract closed the week trading at a RMB 62/tonne premium to the current month’s contract.

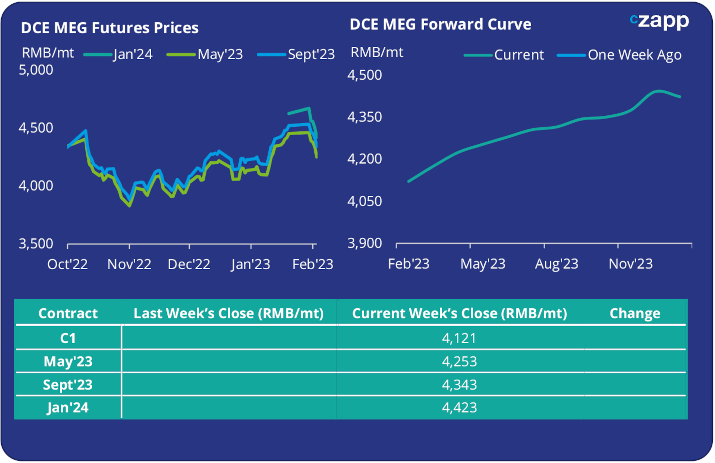

MEG Futures and Forward Curve

- Likewise, MEG futures fell back on weaker crude following their January rally. Prices were down 4.8% versus the 20 January, pre-Chinese New Year.

- Downstream demand has yet to pick-up with many downstream textile factories typically not fully returning until after the Lantern Festival on 4 February.

- East China main port inventories also rose sharply over the last week, increasing 13.8% since 20 January, due to a slower offtake during the CNY holiday.

- Although potential recovery in polyester demand over the coming weeks may add support for MEG, the start-up of significant new Chinese and Indian MEG capacity will add pressure on the supply side.

- The MEG futures forward curve remains in contango with the May’23 contract now at a RMB 132/tonne premium to the current Feb’23 contract.

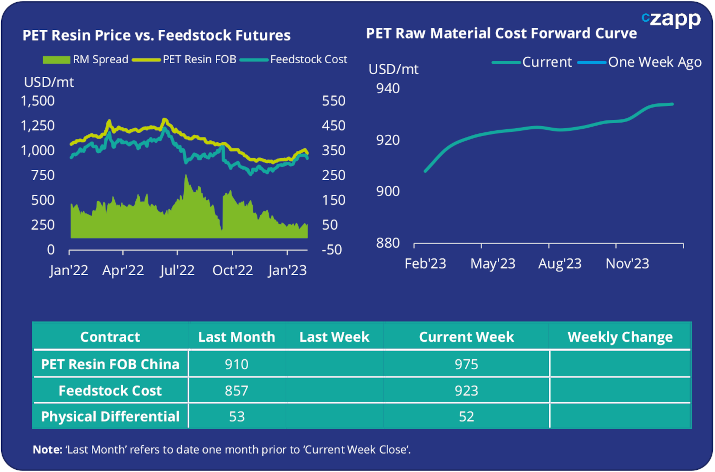

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices initially opened higher following the CNY break, pushing above the USD 1000/tonne level.

- By the end of the week PET resin export prices had quietened with falling raw material prices, closing the week at an average price of USD 975/tonne, down USD 5/tonne on 20 January close.

- The weekly average PET resin physical differential to feedstock costs improved slightly versus the last week pre-CNY, averaging around USD 50/tonne. By Friday the daily spread was around USD 52/tonne.

- The PET resin raw material forward curve continued to present a steady upward slope. At Friday’s close, the May’23 contract was showing a premium of USD 15/tonne to the current month’s contract.

Concluding Thoughts

- Impatience for a clear sign that China’s reopening will spur an economic recovery is creating additional volatility in the crude markets.

- Crude inventories have now posted increases for 4-weeks in a row.

- Despite the Chinese New Year coming to an end, many manufacturers, across a range of industries, will not fully return until after 4 February.

- Once business activity has returned to normal levels in the coming weeks, the strength of restocking may become clearer.

- China’s reopening will have undoubtedly set a floor for Chinese consumer demand, supporting stronger growth within polyester textiles and bottle-grade resin.

- Improvement in the physical differential between raw materials and the PET resin export price is expected, with major Chinese PET resin exporters increasingly sold out for February and March.

- However, further price gains may be constrained by new PET resin capacity additions. Buyers will be waiting for confirmation of the start-up schedule of Sanfame’s first 750k tonne line due March/April.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.