Insight Focus

- PTA futures strengthened while front month MEG futures weakened slightly over the previous week.

- The raw material forward curve remains heavily backwardated throughout 2023.

- Major PET producers have been making new sales in light of OPEC+ supply cut announcement.

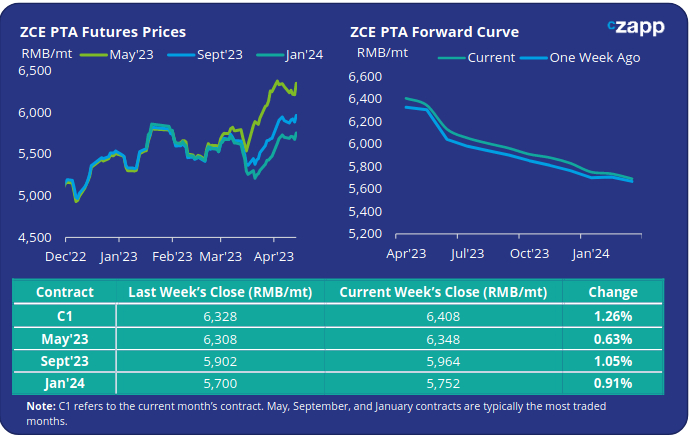

PTA Futures and Forward Curve

- PTA futures moved higher over the last week, coinciding with modest gains in crude oil prices.

- With polymerisation rates still high, downstream demand also continues to provide support for PTA prices.

- As such the current month contract price has strengthened by almost 100RMB/tonne to over 6400RMB/tonne and trades at a slight premium to the May’23 contract.

- The PTA forward curve remains strongly backwardated over the next few contracts, indicative of this near-term market tightness. We think Px and PTA flows will normalise from May.

MEG Futures and Forward Curve

- Front month MEG futures prices have weakened slightly over the last week, trading down almost 1% to just over 4100RMB/tonne.

- However, later-dated contracts out as far as Feb’24 contract have lifted. The May’23 contract now trades at a slight premium to the front month at almost 4150RMB/tonne.

- This means that, with MEG availability still high in the near term, the MEG futures forward curve remains strongly in contango.

- Whilst still high, MEG inventory at East China ports has fallen a further 0.8%, now at just under 1.04m tonnes.

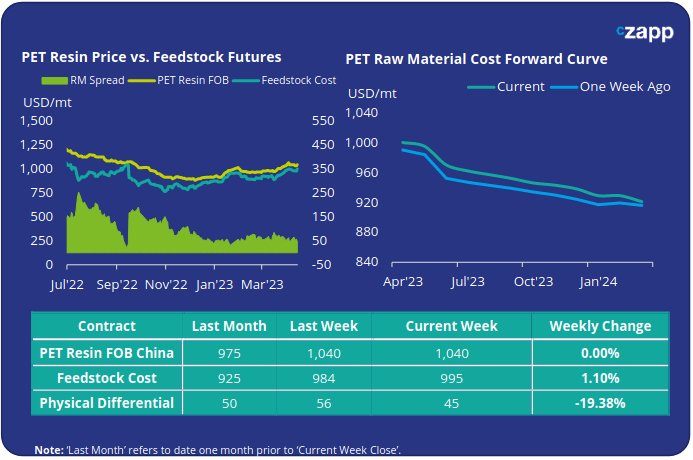

PET Resin Export – Raw Material Spread and Forward Curve

- Feedstocks costs softened over the course of last week before moving higher to 995USD/tonne by Friday, a one day rise of over 20USD.

- Export prices moved sideways, still trading at 1040USD/tonne by the end of last week.

- This means that the differential to feedstock costs has sharply narrowed by Friday, now only 45USD/tonne, almost a 20% week-on-week fall.

- The PET resin raw material forward curve remains steeply backwardated to at least Feb’24. The spread between the current month and the May’23 contract has narrowed slightly to 5USD/tonne.

Concluding Thoughts

- Heightened feedstock costs by Friday last week have narrowed the physical differential with PET FOB export prices. In general, with peak season approaching the physical differential should begin widening.

- Likewise, major PET producers all seem to be very busy making new sales. Some large volumes have been purchased following OPEC cut announcement, this normally helps generates a widening physical differential.

- Additionally, with the expectation of delay in new capacity, PET resin export prices and margins may see support in the near-term.

- The raw material forward curve is still strongly backwardated, particularly to June’23, as these contracts expire this should help improve margins over feedstock costs.

- EU published anti-dumping notice of initiation of investigation against Chinese resin. EU27 countries imported around 360k tonnes in 2022. For more, please read our latest European report.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.