Insight Focus

- Latest surge in crude helps PTA regain upward momentum.

- Polyester raw material forward curve keeps flat through into H1’24.

- PET resin export margins recover slightly, future new capacity set to restrain further upside.

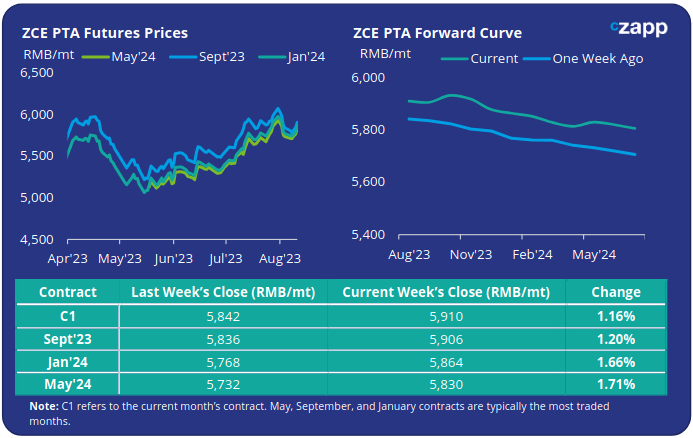

PTA Futures and Forward Curve

- PTA futures regained upward momentum through last week, driven higher by a surge in crude oil prices that looked to break the USD 88/bbl level on Thursday before easing early Friday.

- EIA’s latest short-term energy outlook forecasts Brent crude prices to average USD 87.65/bbl in Q4.

- Other crude analysts believe Saudi Arabia needs Brent at $90 to finance its diversification plans, meaning they may extend cuts in a bid to push prices higher.

- The PX-PTA spread narrowed to just USD 93/tonne, its lowest level since early February this year, with supply constraints from the previous week’s typhoon disruption easing.

- Given recent the recent maintenance cycle, there is little indication PTA producers will seek to cut production despite some pressure from accumulated stocks.

- High polyester operating rates continue to support PTA demand, with only a very marginal decrease over the last two-weeks.

- Operating rates are expected to remain high through the next quarter, with peak polyester season approaching, late-August through to October.

- By Friday the Jan’24 contract was trading at a RMB 46/tonne discount to the current month.

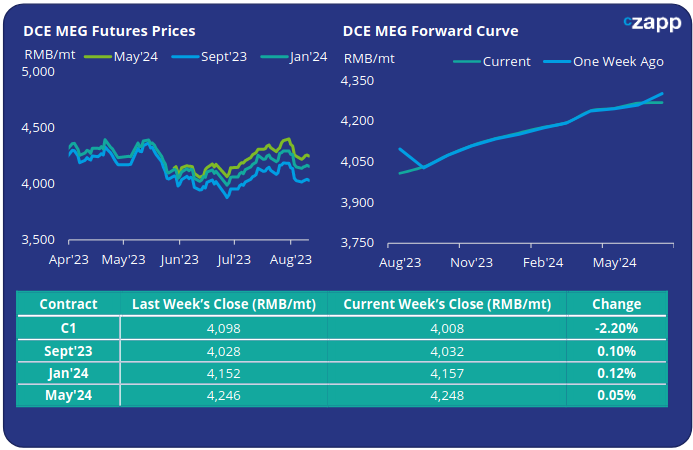

MEG Futures and Forward Curve

- Despite the rally in PTA, MEG Futures remained stubbornly resistant to any upward move due to rising port inventory.

- Main port inventories increased by 2.6% last week to 1,012k tonnes, breaching the 1MMt mark and set to climb higher. Market participants are anticipating import will continue to flood in through August.

- Traditionally, peak polyester season from late-Aug to October leads to a rapid consumption of port inventory.

- However, with high downstream textile inventories, the MEG market may see a repeat of last year’s relatively lacklustre demand. As a result, high port inventories may remain stubbornly high in the coming months.

- The MEG forward curve remains in contango over the next 12-months, with very little change in position. By Friday the Jan’24 contract was holding a RMB 149/tonne premium to the current month.

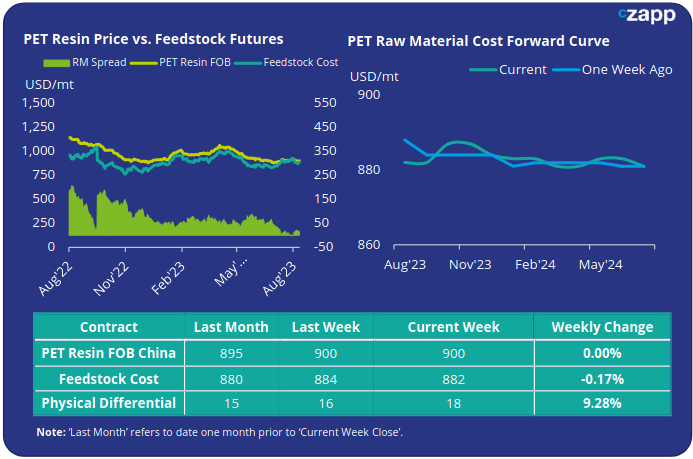

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices eased early last week then edged up on higher raw materials costs to average of USD 900/tonne by Friday, representing a USD 20/tonne weekly decrease.

- The weekly average PET resin physical differential to future feedstock costs showed a slight improvement, up USD 9/tonne to average USD 18/tonne for the week. By Friday the daily spread was also at USD 18/tonne.

- The raw material cost forward curve, whilst remaining at similar absolute levels for the main contract months as last week, began to show some minor fluctuation in the months between.

- At Friday’s close, Jan’24 raw material costs were flat against the current month.

Concluding Thoughts

- With the raw materials forward curve flat into the first part of 2024, future PET resin export prices will not only rely heavily on the future direction on crude but also where producer margins go next.

- Although the physical differential over future costs has eked out a slow recovery from being in a negative position a few weeks ago, the spread is still at historic low levels.

- Despite PET resin producer inventories still at relatively healthy average levels of slightly above 12 days, there is ample market availability and producers are keen to make additional sales.

- Further additions from Yisheng (500kta) and Billion (600kta) will also keep margins compressed through H2’23.

- Current expectations are for margins, and prices. to face sustained pressure into September and the off-peak season, before finding support as producers move into maintenance in Oct/Nov.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.