Insight Focus

- PTA and MEG Futures retreat as a potential Gaza ceasefire agreement is touted.

- Buyers also see relief from recent rising prices as PET resin export prices also ease.

- PET process margins stable/firm as market slows heading into the festival period.

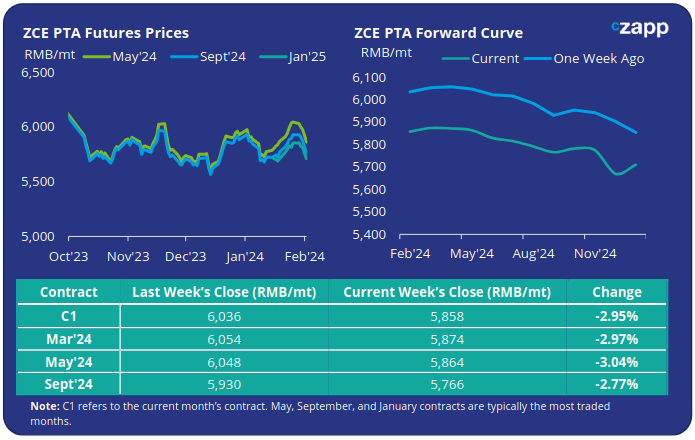

PTA Futures and Forward Curve

PTA Futures prices retreated by around 3% last week, following a sharp decline in crude and upstream costs.

Oil prices began dropping sharply at the back of last week on reports of a potential ceasefire agreement between Israel and Hamas. Although details were scant, crude benchmarks were down 6% mid-Friday versus a week earlier.

Both the PX-Naphtha, and PTA-PX spreads showed some improvement; the PTA-PX CFR spread averaged USD 91/tonne last week, broadly in line with recent weeks.

Reduced production and limited improvement in liquidity has tightened supply, whilst downstream restocking ahead of Chinese New Year (10-17 Feb) has lent support on demand.

Continued short-term demand strength is expected to continue through February and into March.

The PTA forward curve kept relativity flat through H1’24, before falling into backwardation. The May’24 contract has a RMB 16/tonne premium over the current month’s contract.

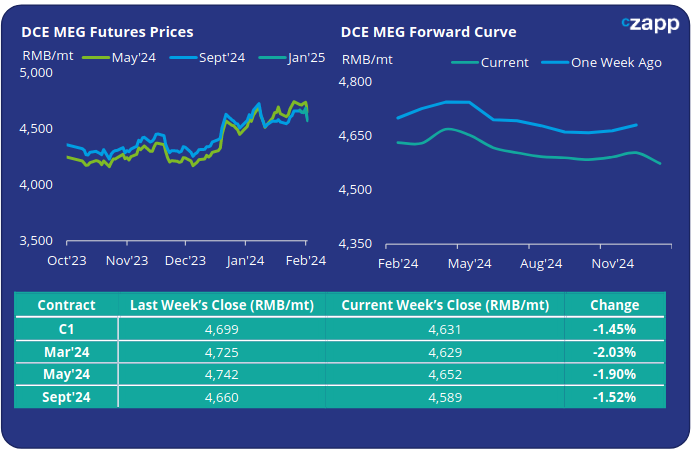

MEG Futures and Forward Curve

MEG Futures also weakened, but not by as much as PTA, with main contracts falling by less than 2% overall.

Bullish market sentiment propped up the market, as main East China port inventories continued to decrease, falling by a further 5.6% last week, to around 782k tonnes.

Plant shutdowns in Saudi, and freight disruption in and around the Red Sea, continue to delay cargoes, with further destocking expected in February.

However, sharp increase in domestic production have largely offset the reduction in imports. As a result, further upside to prices may be constrained.

The MEG forward curve shows a small near-term increase, before easing into H2’24. The May’24 futures premium increased to RMB 21/tonne over the current month’s contract.

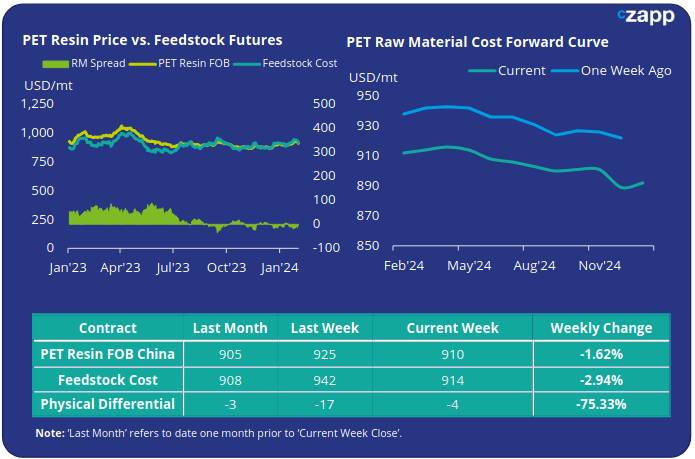

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices begun to ease on Friday, reflecting changes in raw material costs, averaging USD 910/tonne last Friday, a decrease of USD 15/tonne on the previous week.

The weekly PET resin physical differential against raw material future costs recovered USD 7/tonne last week to average minus USD 9/tonne. By Friday, the daily spread was minus USD 4/tonne.

The raw material cost forward curve remains relatively flat in the near-term, before sliding into a steepening backwardation through H2’24.

The current May’24 contract was only USD 2/tonne above the current month, with Sept’24 around USD 15/tonne below May.

Concluding Thoughts

Geopolitics are once again in the driving seat with regards to pricing, creating uncertainty and increased volatility in crude and upstream petrochemical markets.

Chinese PET resin export prices are expected to continue to track raw materials closely, with margins showing only slight improvement over the last week.

PET resin producers are expected to see stronger demand after Chinese New Year, as the market moves into the pre-season, downside risk to process margins is expected to be limited.

Beyond Chinese New Year, any resolution to the Red Sea situation, and lowering of global freight rates, could result in a sizeable return in demand, as buyers look to restock and boost supply security.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.