- PTA futures leap 6% on Monday’s market reopening following the Chinese Dragon Boat Festival.

- PET resin supply is expected to improve as logistics recover with easing restrictions.

- PET resin export prices projected to remain firm through Q3 ’22.

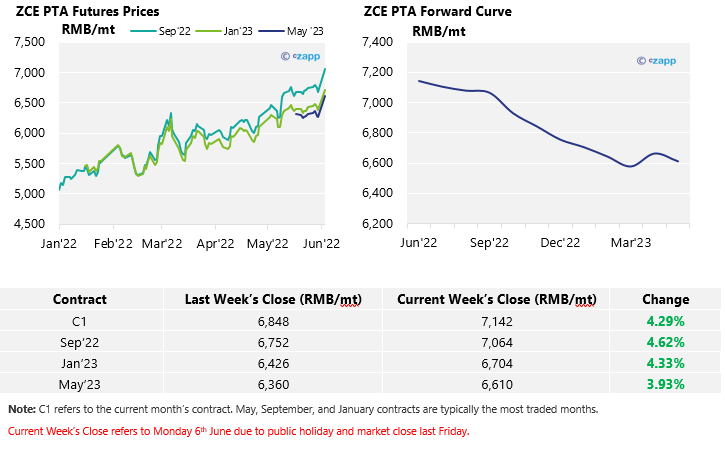

PTA Futures and Forward Curve

- PTA futures leapt Monday as markets resumed following a break for last week’s Chinese Dragon Boat Festival (3 June), driven by higher PX prices.

- PX supply remains tight with several major PX producers under maintenance, and the market continuing to see robust global demand for refined oil products.

- Whilst PTA margins have improved in recent weeks, operating rates are now expected to rise through June as units previously in maintenance or experiencing cuts are restarted, lengthening supply, and again pressuring margins.

- The PTA 12-month forward curve remains backwardated, falling away sharply from August into 2023.

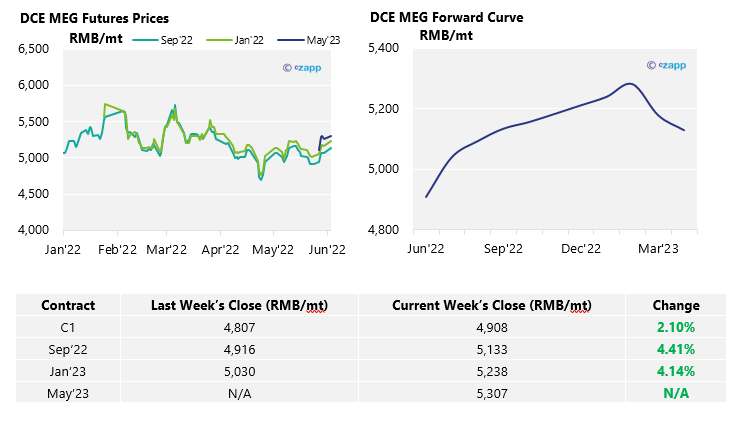

MEG Futures and Forward Curve

- MEG futures lifted through last week, following higher crude

- and expectations for improved demand following the easing of restrictions in Shanghai.

- Whilst spot buying ahead of last week’s holiday was brisk, traders were quick to sell at higher prices.

- Overall, the market remains relatively balanced, with ample supply and stubbornly high port inventories.

- MEG forward curve remains in contango, with future contracts trading at a premium to current levels.

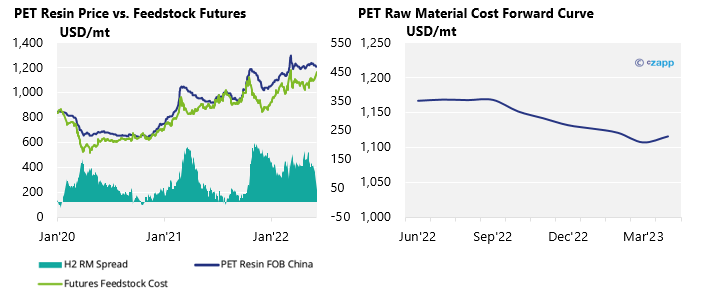

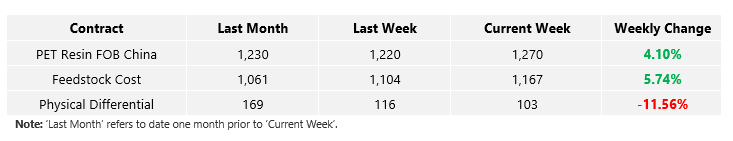

PET Resin Export – Raw Material Spread and Forward Curve

- Export prices for Chinese PET resin rebounded on Monday reopening, averaging over USD 1270/tonne.

- Higher feedstock prices continue to erode the PET resin physical differential for exports, falling to USD103/tonne on Monday, a sharp decline from USD 165/tonne a month earlier.

- The PET export-raw material forward curve remains modestly backwardated over the next 12 months.

Concluding Thoughts

- Volatile feedstock costs and supply constraints are causing headaches for PTA and PET producers alike, as margins are pressured through the chain.

- However, with tight availability for PET resin, producers are resistant to sell low and may attempt to recoup margins through the week.

- PET resin supply is expected to increase through June with the easing of restrictions and improvement in logistics and trucking availability.

- Whilst major exporters are sold-out through June and July, forward availability is expected to steadily improve.

- Given the flat raw material forward curve and robust demand, PET resin export prices look set to remain supported at elevated levels through the next quarter.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

Plastics and Sustainability Trends in May 2022

Could Chinese Restriction Easing Boost PET Demand?

uropean PET Market Loses Momentum as Demand Slows

China’s zero-COVID Approach Hampers PET Resin Exports

Explainers That May Be of Intere

st…