Insight Focus

- PTA futures plummeted after the National holiday, adjusting for a dramatic fall in crude.

- PET resin export prices weakened, suppliers and buyers wary of pricing during volatility.

- Further price drops could stimulate additional PET resin export demand.

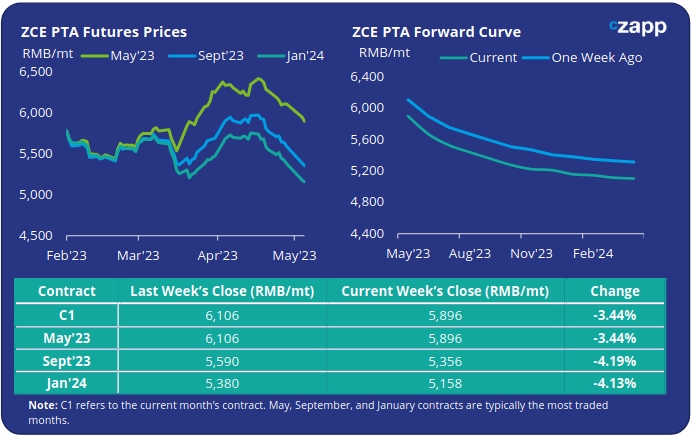

PTA Futures and Forward Curve

- PTA futures had a rude awakening last week, coming back after the Labour Day holidays to significant drop in crude oil prices.

- Weak US economic data and another 25-basis point hike by the Fed sent oil prices tumbling last week. Although a partial recovery was underway Friday, Brent had lost around 8.3% for the week, WTI was down closer to 10%.

- Whilst PTA production remains relatively high, downstream polyester operating rates experienced marginal declines. Last week’s price volatility is likely to further temper immediate demand with buyers moving to the side lines with comfortable inventory levels.

- Several PTA producers plan turnarounds in May, even this may be outstripped by further polyester cuts in the near-term creating cost pressure.

- The forward curve remains heavily backwardated; by Friday, the Sept’23 contract was trading at a RMB 540/tonne discount to the current month.

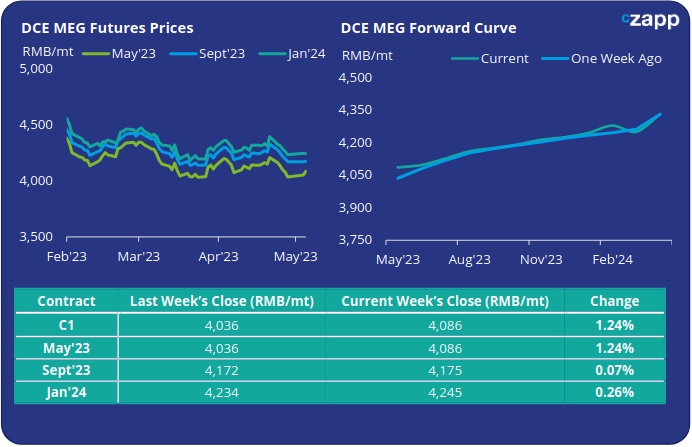

MEG Futures and Forward Curve

- MEG futures avoided the same fate as PTA with the fall in oil prices, closing the week with positive price movement.

- Prices gained support from another weekly decrease in port inventories, falling by around 2.1% last week. Overall levels have fallen close to 1Mt and could cross below this level in coming weeks.

- However, demand remains weak on decreasing polyester polymerization rate, with demand for downstream textiles feeling the pinch from high inflation and interest rates in key overseas markets.

- The current MEG forward curve shows a modest increase in forward prices through the rest of the year. By Friday, the Sept’23 contract was at a modest RMB 89/tonne premium to the current month’s contract.

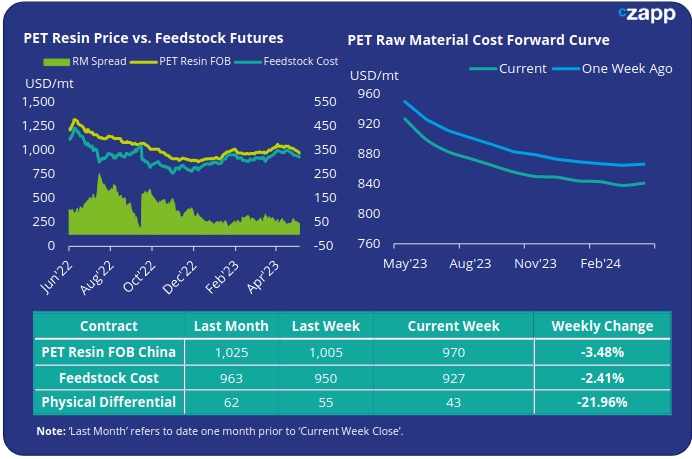

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET export prices fell sharply last week following the return to business on Thursday with prices averaging USD 970/tonne on Friday, down USD 35/tonne on the previous week.

- The weekly average PET resin physical differential to feedstock costs fell by USD 12/tonne to average USD 45/tonne for the week.

- By Friday, the daily spread was at a USD 42/tonne, but given the large fluctuations and the short trading week, spreads may recover some of this ground the following week.

- With prices falling heavily last week much of the near-term premium seen in recent weeks has been eroded. Nevertheless, even at current price levels the PET resin raw material forward curve continues to be backwardated through the next 12-months, flattening into the later month and 2024.

- At Friday’s close, the Sept’23 contract was trading at a USD 62/tonne discount to the current month’s contract.

Concluding Thoughts

- With most of last week on holiday, market activity was limited. Subsequent price volatility also gave producers pause for thought when returning Thursday.

- Other Asian exporters were hesitant to give offers amid the sudden price drop, unsure whether last week’s oil price drop would sustain or quickly bounce back.

- Once the dust settles, lower prices may stimulate some additional buying activity, potentially enabling Chinese PET producers to improve margins.

- European buyers may also seize the opportunity depending on the ability of domestic supplies to keep pace with price movement.

- Current margins remain low, far below traditional levels at peak buying season

- Beyond the near-term, suppliers are increasingly concerned about export demand and the impact of new capacity additions in H2’23.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.