Insight Focus

- PTA and MEG futures dropped last week as commodities fell on recession fears.

- Weak polyester demand is maintaining an oversupply of PTA and MEG.

- PET resin export margins remain strong with producers oversold for Q3.

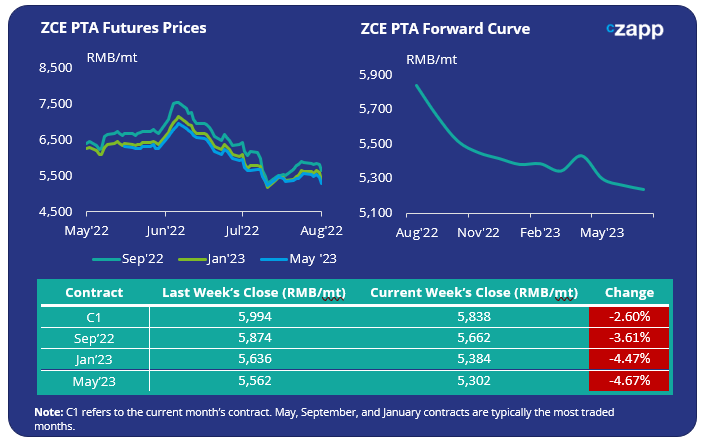

PTA Futures and Forward Curve

- PTA Futures fell once again last week, following crude’s reversal on global economic concerns.

- PTA operating rates have fallen to the lowest levels so far this year low, following a slew of fresh turnarounds due to low margins, PX supply tightness, and unexpected technical issues.

- Whilst downstream demand remains weak, polyester operating rates are expected to increase steadily over the coming months, supporting PTA demand and reducing oversupply.

- The backwardation in the PTA forward curve steepened. The November contract is now close to a RMB 400/tonne discount to the current month.

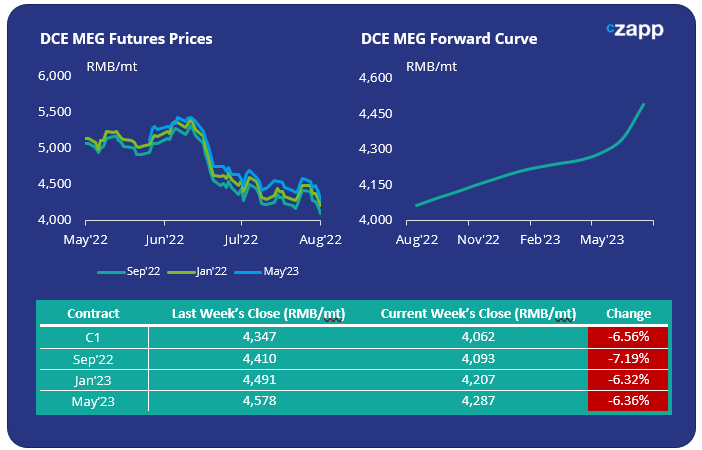

MEG Futures and Forward Curve

- MEG futures dropped by over 7% on the main September contract last week, erasing previous gains.

- MEG market continues to struggle due to low margins and bearish fundamentals.

- Although downstream demand is expected to pick up through H2, traders continue to sell into higher prices given stubbornly high inventories.

- Future MEG contracts continue to trade at a modest premium to current prices, rising through H1 2023.

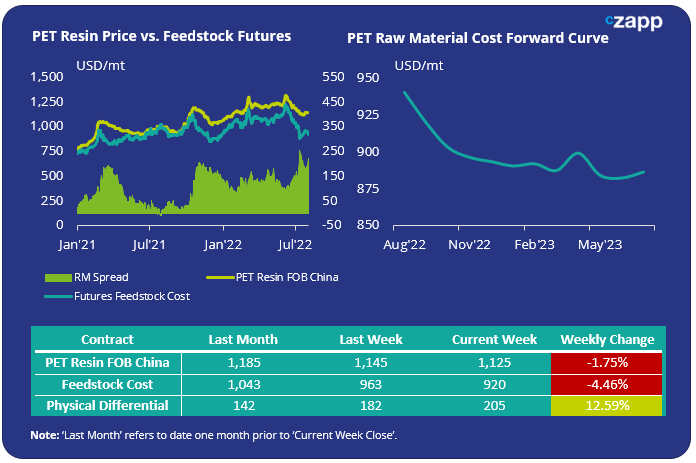

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices softened slightly last week to USD 1125/tonne by Friday, an average weekly decrease of USD 20.

- The weekly average PET resin–raw material physical differential increased USD 8 from the previous week to USD 192/tonne. By Friday, the daily spread had risen to USD 205/tonne.

- The PET resin raw material forward curve remains slightly backwardated through Q3; The November contract shows a USD 45/tonne discount over the current month.

Concluding Thoughts

- Lower raw material prices have enabled both PET resin domestic and export margins to strengthen after last week’s decline.

- Major Chinese PET producers continue to report an oversold Q3, with full order books for August and September.

- As a result, expectations are that spreads will remain high thorough to October. At present ,the level of forward orders producers may receive in Q4 remains unclear.

- However, indications from buyers in key export markets suggest a potential repeat of Q4 2021, although recessionary headwinds are also gaining strength.

- PET resin export prices are expected to fall through Q3 due to backwardated raw materials costs, which may in turn lead to a rush for cheaper exports in Q4.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

What Europe’s Deepening Energy Crisis Means for PET Resin

PET Supply Chains Groan Under Global Heatwaves

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs