Insight Focus

- PTA futures hit record highs driven by surging crude oil, PX prices.

- PTA margins come under pressure as producers struggle to pass on PX costs.

- PET resin export margins are expected to stabilise, recovery to April/May levels unlikely.

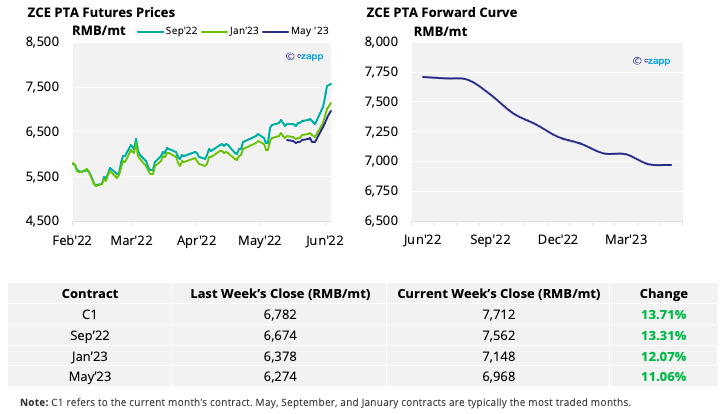

PTA Futures and Forward Curve

- PTA futures soared last week, with the main September contract closing up over 13% on the week due to a sharp increase in PX prices.

- Rising PX prices are now expected to heap pressure on already struggling PTA margins.

- Whilst PTA supply is expected to increase in June, additional production cuts and maintenance have been announced for July due to poor economics.

- The PTA 12-month forward curve remains backwardated, falling away sharply from August into 2023.

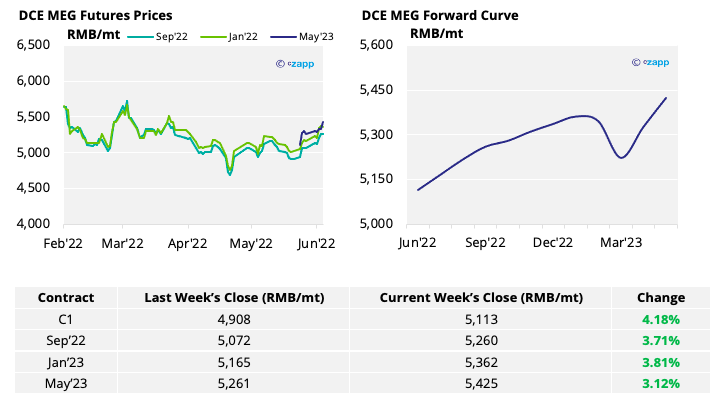

MEG Futures and Forward Curve

- MEG futures rose modestly last week, more bullish than in recent weeks but remaining rangebound.

- Despite lower operating rates, the market remains fairly balanced, with ample supply and port inventories slow to decrease.

- MEG forward curve remains in contango, with future contracts trading at a premium to current prices.

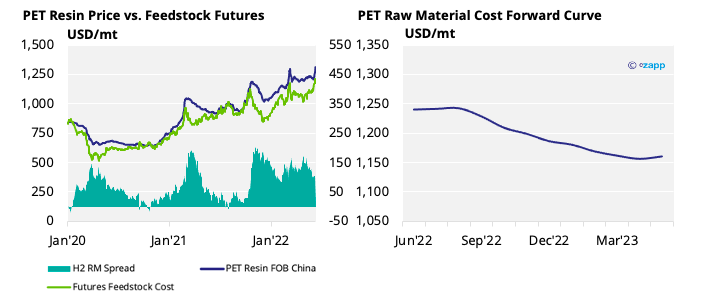

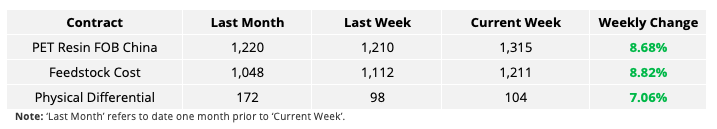

PET Resin Export – Raw Material Spread and Forward Curve

- Having made an initial jump on Monday’s reopening, export prices for Chinese PET resin followed raw material prices higher through the week to over USD 1315/tonne FOB by Friday.

- However, higher feedstock prices have eroded the PET resin physical differential for exports, dropping to just USD104/tonne from USD 172/tonne in May, back to levels not seen since January.

- The PET export-raw material forward curve remains flat through Q3 2022, then slightly backwardated into early 2023.

Concluding Thoughts

- Rapid increases in feedstock costs are squeezing both PTA and PET resin margins.

- Having fallen sharply in recent weeks, PET resin export margins are expected to stabilise, or even rise slightly in the next few weeks; recovery to April/May levels is unlikely and would not follow previous seasonal trends.

- PET resin supply is expected to grow through June with the easing of restrictions and improvement in logistics and trucking availability.

- Whilst major Chinese exporters are sold-out through June and July, forward availability is expected to grow steadily.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

PET Resin Trade Flows: EU PET Imports Surge Despite Chinese Export Constraints

Plastics and Sustainability Trends in May 2022

Could Chinese Restriction Easing Boost PET Demand?

European PET Market Loses Momentum as Demand Slows

Explainers That May Be of Interest…