Insight Focus

- PTA and MEG Futures fall on easing polyester rates and macro concerns.

- PET resin export prices in flux but rangebound, raw material spreads show improvement.

- Demand for raw materials and resin hinge on severity of fallout from Red Sea crisis.

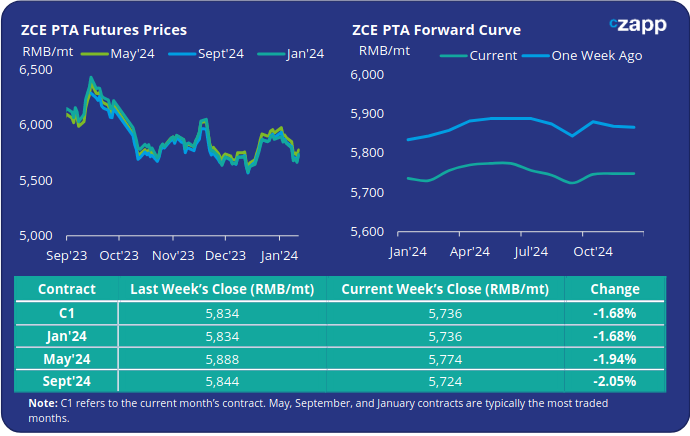

PTA Futures and Forward Curve

PTA Futures fell sharply last week, before rising oil prices helped a partial recovery. Nevertheless, the now main May PTA Futures contract ended Friday down nearly 2% on the week.

Brent oil prices touched USD 80/tonne last Friday following some of the largest attacks to date on Red Sea shipping, and US/UK strikes on Houthi targets. At time of writing, Brent crude oil prices were up 1.3% on the previous Friday’s close.

Short term volatility, and intra-daily swings, are expected to continue. Potential escalation of events, including further disruption of supplies moving through the critical Strait of Hormuz, will have serious implications on crude and downstream petrochemical products.

Polyester operating rates are beginning to ease gradually, and with PTA production on expected to undergo limited maintenance in January, availability is expected to lengthen modestly.

The longer the current Red Sea crisis continues, the more severe its impact on the broader macro-environment is likely to be, potentially fuelling global inflation and hampering medium-term demand.

The PX-Naphtha spread also continued to expand through December and into the New Year, resulting in the PTA-PX spread being squeezed, which averaged USD 92/tonne last week, down around USD 5/tonne from the previous week.

By Friday, the PTA forward curve has flattened slightly, but still shows a slight forward premium through to mid-2024; May’24 has a RMB 38/tonne premium over the current Jan’24 contract. Beyond May the curve has begun to move into backwardation.

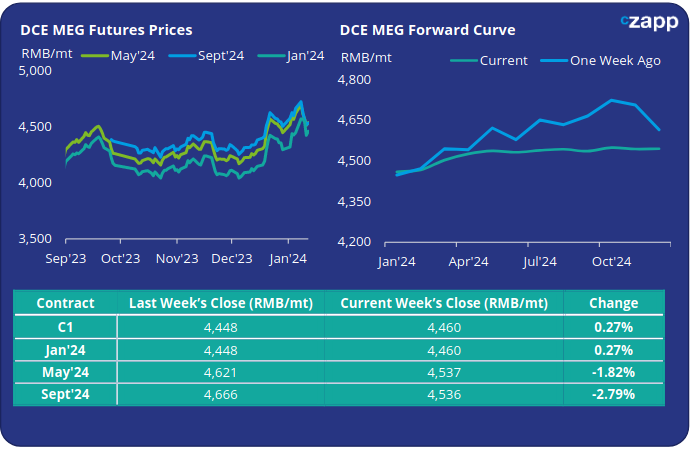

MEG Futures and Forward Curve

MEG Futures faced a similar decline, with the May contract dropping 1.8% on the week amid some profit taking, despite a further decline in inventories.

Main East China port inventories decreased 4.5% last week, to around 957k tonnes following reduced supply from the Middle East due to plant shutdowns, and production cuts in the domestic market.

With overseas arrivals continuing to slow through January-February, inventories are expected to drop to historical lows adding support to MEG prices.

However, additional demand uncertainty created from the Red Sea situation, coupled with an easing of polyester operating rates is expected to spur buyer caution, constraining upward price movement.

The MEG forward curve, whilst keeping in contango, has flattened considerably versus the previous week. The May’24 futures premium narrowed by around RMB 100/tonne to just RMB 77/tonne over Jan’24.

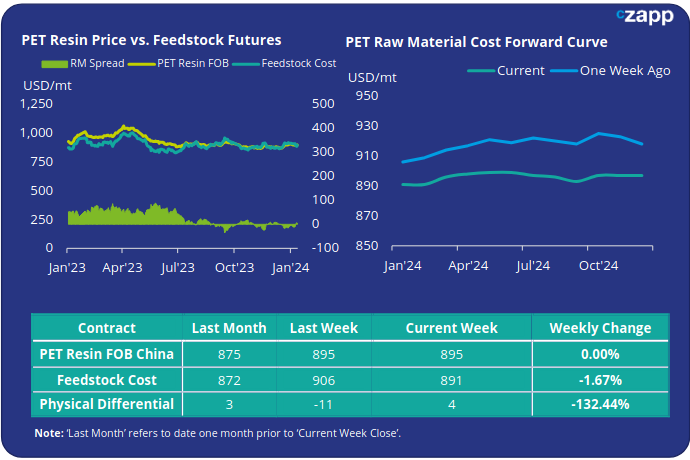

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices remain flat versus the previous week, averaging USD 895/tonne last Friday.

The weekly PET resin physical differential against Futures costs gained around USD 8/tonne last week to average nudging into positive ground at USD 1/tonne for the week. By Friday, the daily spread was around USD 4/tonne.

The raw material cost forward curve flattened slightly, although remaining in contango through to mid-2024. The May’24 and Sep’24 contracts were both just USD 6-8/tonne premium above Jan’24 contracts.

Concluding Thoughts

Despite the on-going disruption around global freight, Chinese PET resin producers resumed offers in the most heavily affected regions, having shown signs of caution the previous week.

However, PET resin export demand is likely to be heavily impacted by transit delays and price increases because of rocketing freight rates.

Buyers, particularly in the Northern hemisphere, where markets are still subdued in the off-season, are taking a cautious approach, awaiting any signs of an end to the hostilities.

Beyond the immediate timeframe, many buyers are likely to prioritise supply security going forward; the market could see sizeable restocking, when freight rates ease, and prices make sense.

However, given recent capacity additions and further sizeable expansion in 2024, countries continue to put up barriers to Chinese PET resin.

Following in the footsteps of the EU, South Korea has initiated an anti-dumping investigation on several main Chinese PET resin suppliers, including Yisheng and CRC. Last year, China exported over 120k tonnes of PET resin to South Korea.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.