Insight Focus

- Short term tightness leaves PTA futures prices increasingly backwardated.

- Raw materials costs fall under increased downward pressure later in Q4 and into 2023.

- PET resin export demand remains slow, optimism remains for 2023 growth.

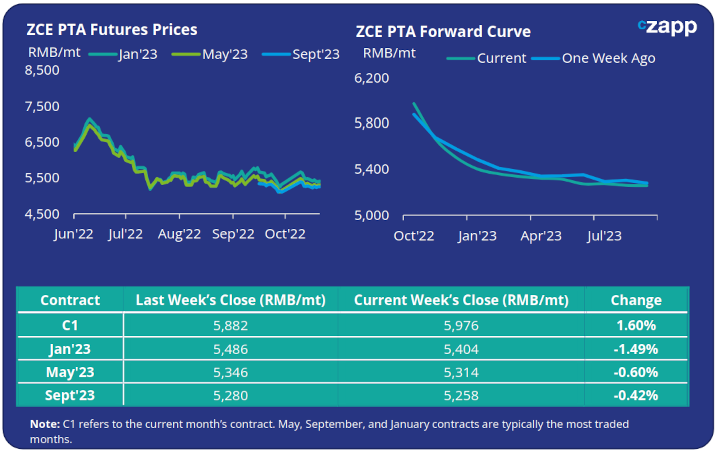

PTA Futures and Forward Curve

- Oct’22 PTA futures close the week higher, closing close to 6,000 RMB/mt.

- A softening of prices further down the board leaves the PTA forward curve increasingly backwardated. The Jan’23 contract now trades at over a 500 RMB/mt discount to the current month.

- This continues to reflect ongoing short term PX supply tightness.

- However, weakening demand and greater PTA liquidity is expected to keep pressure on PTA-PX spreads in the medium term.

MEG Futures and Forward Curve

- Front month MEG values have sharply weakened by close of trading this week. The Oct’22 contract is over 2% down and has broken below 4000RMB/mt.

- Operating rates are beginning to recover following the National holiday, however further increase in the short term is likely to be limited.

- With the exception of the Dec’22 contract, the rest of the MEG forward curve has flattened but remains in contango.

- Thus with several new Chinese MEG plants due to start-up in the coming months, a flattening forward curve reflects an expectation of inventory build and weakening fundamentals later in Q4 and into 2023.

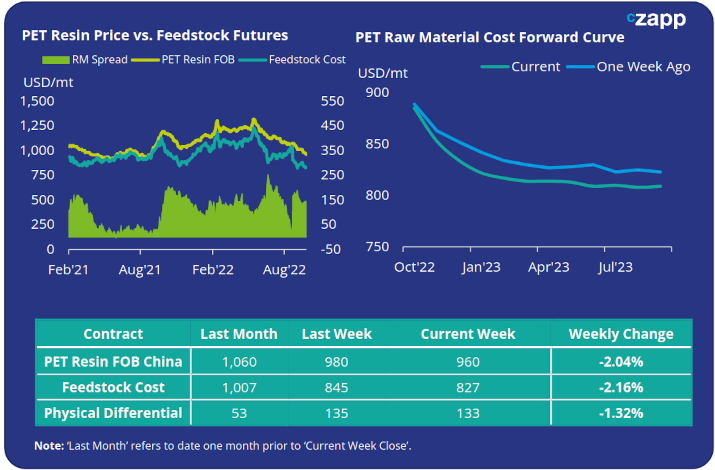

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices continue to weaken, falling a further 20USD/mt on the previous week and 100USD/mt in the last month to 960USD/mt.

- The differential to feedstock costs narrowed marginally too, falling to 133USD/mt by Friday.

- With greater resiliency in Oct’22 feedstock costs the PET Raw Material cost forward curve has become increasingly backwardated, seeing Jan’23 values falling 30USD/mt.

Concluding Thoughts

- Both PTA and MEG forward curves have weakened later in Q4’22 and into 2023, influenced by the rising threat of global recession and inflation.

- In addition, strengthening production capacity later in the year is expected to further this downward pressure.

- Downstream, sales by major PET exporters remains slow, this is negative for producer willingness to replenish inventory.

- However, with many target regions still in recovery from Covid-19, potential for Chinese export growth later in 2023 appears more positive.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

Plastics and Sustainability Trends in September 2022

PET Resin Trade Flows: Korean PET Exporters Eye Greater European Share in 2023

Will Plummeting Ocean Freight Boost Asian PET Export Demand?

European PET Market View: Downward Slide in European PET Prices Set to Continue