Insight Focus

PTA futures see a sharp decline as upstream costs drop and PTA-PX narrows.

Chinese PET resin export prices soften following downwards raw material prices.

Asian PET resin export margins expected to see further downside in off-season.

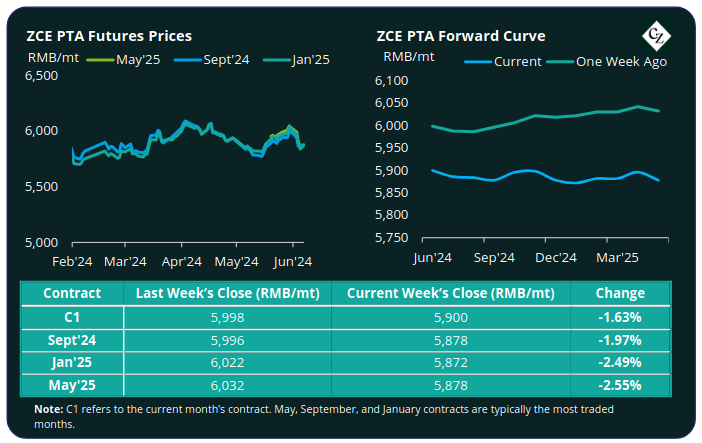

PTA Futures and Forward Curve

PTA futures experienced a sharp decline last week, with the main Sept contract dropping by around 2%.

Crude oil prices posted a third consecutive weekly loss after OPEC+’s latest meeting surprised markets with the possibility of voluntary cuts being eased in Q4, although base cuts will remain through 2025.

Brent crude oil prices dropped from USD 81/bbl on Sunday to below USD 77/bbl, before the market judged the sell-off to be overdone, prices rebounding to just under USD80/bbl by Friday.

Even though PX prices softened through the week, the PXN spread widened to average USD 370/tonne due to declining inventory levels following plant production issues.

Despite PTA spot liquidity remaining tight due to extensive maintenance shutdowns in May and increased overseas demand, the PTA-PX spread narrowed to USD 81/tonne.

Current tight PTA supply is expected to see relief through June, with planned restarts, and fewer maintenance turnarounds than observed in May.

If polyester operating rates can remain stable, even at current reduced levels, further significant drawdown in PTA stocks seems unlikely.

The forward curve lost any forward premium, looking flat to very slightly backwardated through to year-end. The Sept’24 contract is priced at a RMB 22/tonne discount to the current month, while Jan’25 holds a RMB 28/tonne discount.

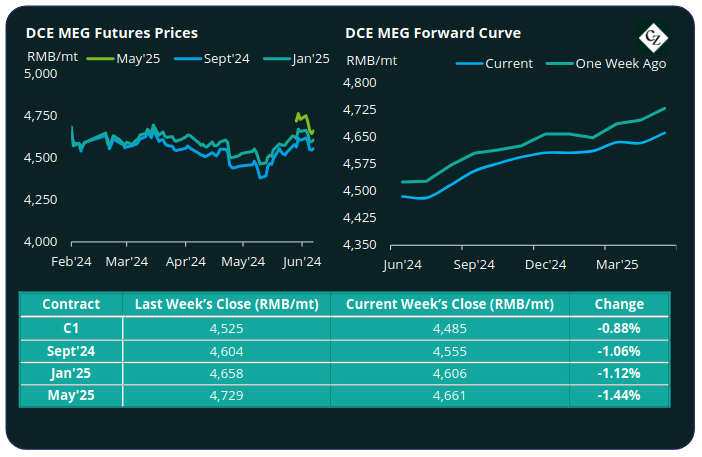

MEG Futures and Forward Curve

MEG Futures also declined last week, with the Spet’24 main forward contract months down by around 1%, shielded from further downside due to falling inventories.

East China main port inventories fell by around 1% to 731k tonnes last Friday, as daily offtake remains high and Middle East imports limited.

High rates and freight disruption, coupled with slower domestic deliveries from some coal-based plants is driving higher inventory offtake, providing price support.

Whilst polyester operating rates have declined through May, they have now steadied and are expected to remain stable through June, supporting demand.

The MEG forward curve remains in contango, with the Sept’24 contract holding a RMB 70/tonne premium over the current month; the Jan’25 premium over the current month narrowed to RMB 121/tonne.

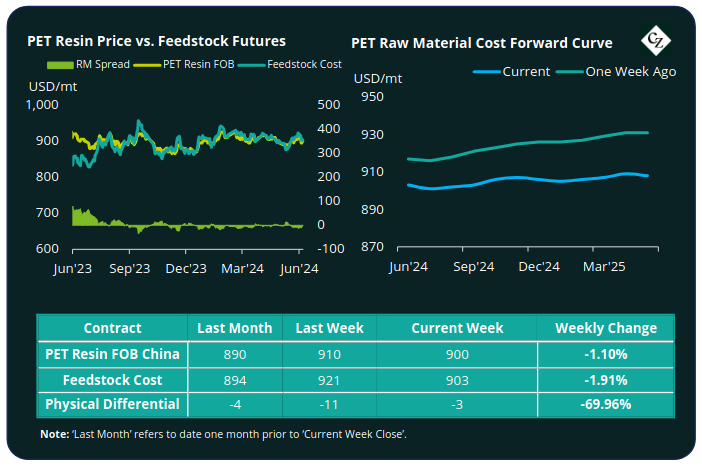

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices weakened last week, with the average price dropping below USD 900/tonne again, before recovering to average USD 900/tonne by Friday.

The PET resin physical differential against raw material future costs increased slightly by USD 2/tonne, to average minus USD 7/tonne last week. By Friday, the differential was USD 3/tonne.

The raw material cost forward curve fell completely flat through to year end; Sept’24 contract was on par with the current month, Jan’25 showed just a USD 2/tonne premium.

Concluding Thoughts

Chinese PET resin profitability continues to be dented by weaker demand and over-supply. Although the physical differential remains highly compressed, most Chinese PET resin producers are still suspected of remaining above cost.

Whilst some producers have indicated that smaller, older lines may be shutdown, further additional new capacity is expected in Q3’24.

Several existing lines are also expected to restart following maintenance periods lengthening near-term supply.

With a flat raw material forward curve and room for downside to the physical differential into the off-season, PET resin export prices are projected to fall into modest backwardation through to Dec’24.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.