Insight Focus

- PTA futures move lower as PX tightness eases and crude slumps.

- PET resin export prices also soften, margins remain suppressed by weaker export demand.

- New capacity additions and raw material backwardation to pressure prices in H2’23.

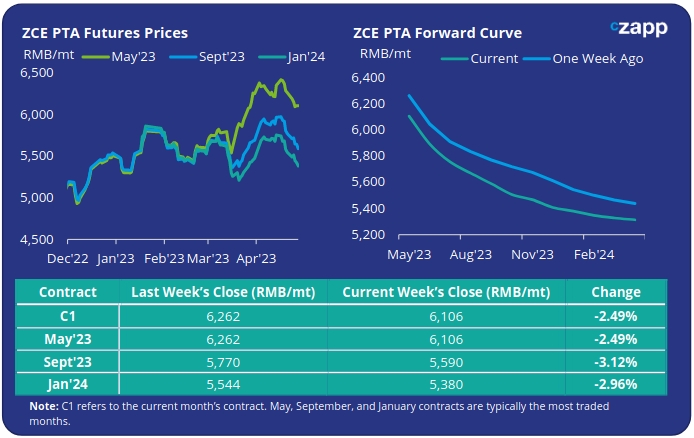

PTA Futures and Forward Curve

- PTA futures pressed lower through last week following the slump in crude oil prices, down around 4.7% on the week, and the subsequent decline in PX values.

- With some PX plants beginning to exit maintenance, operating rates are expected to increase, relieving the tightness in PX supply to PTA operations; the PTA-PX spread has already shown improvement over last week.

- Although several PTA producers are themselves completing turnarounds, some including Billion, Hengli, Zhongtai Chemical are scheduled to shutdown in May. By end May/early June, PX and PTA supply is expected to normalise.

- Support from downstream polyester demand has also weakened, with more polyester plants cutting back on production, as downstream demand remains muted, exacerbated by May Day holiday shutdowns.

- The forward curve remains heavily backwardated. By Friday, the Sept’23 contract was at a 516/tonne discount to the current month.

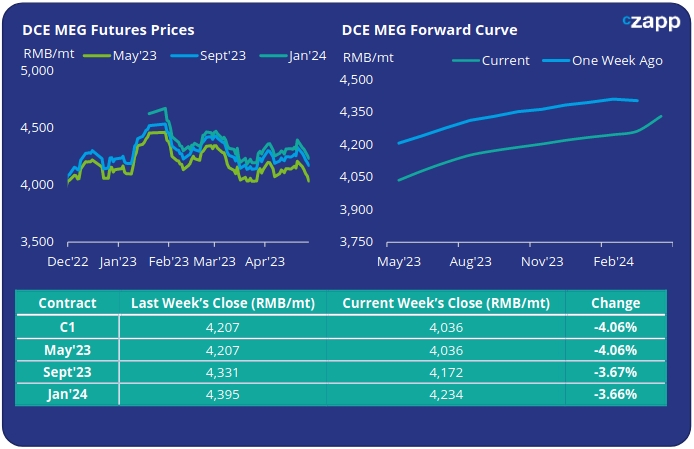

MEG Futures and Forward Curve

- MEG futures also came under pressure last week, with the current May’23 contract down by over 4% at week’s close.

- As anticipated, China’s total MEG imports fell sharply in March, down 25.7% from February with ample domestic supply, foreign plant shutdowns, and weak downstream performance.

- Although East China main port inventories decreased by around 5.4% last week, overall levels remain close to 2023 seasonal highs at 1.25Mt.

- The supply side is expected to tighten gradually, with further production cuts and switching to EO by some producers. Production from coal-based assets may also be affected by energy consumption limits.

- However, any curtailing of supply is also being met with demand weakness as polyester operating rates decline.

- The current MEG forward curve shows a modest increase in forward prices through the rest of the year. By Friday, the Sept’23 contract was at a modest RMB 126/tonne premium to the current month’s contract.

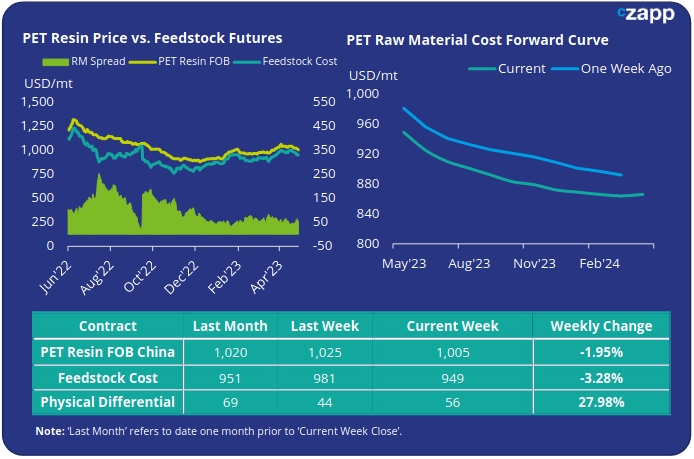

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET export prices softened last week, continuing to come off recent April highs, with prices averaging USD 1005/tonne last Friday, down USD 25/tonne on the previous week.

- The weekly average PET resin physical differential to feedstock costs increased by USD 14/tonne to average USD 56/tonne for the week. By Friday, the daily spread was at a similar level of USD 56/tonne.

- The PET resin raw material forward curve continues to be backwardated through the next 12-months. At Friday’s close, the Sept’23 contract was trading at a USD 57/tonne discount to the current month’s contract.

Concluding Thoughts

- Whilst one major Chinese PET resin producer is sold out for export through May and June, most others have ample availability for prompt shipment in May.

- Although domestic demand is reported to show continued improvement, export order intake is not coming through as expected.

- This is reflected in low spot margins and low physical differential to raw material futures, which remain far below traditional levels at peak buying season.

- Spot margins are now at 5-year lows, and suppliers are increasingly concerned about the impact of new capacity additions in H2’23.

- At least some previously announced projects are expected to face delays and rescheduling due to market conditions.

- However, even with a potential improvement in demand through the summer months, significant new additions are still expected in H2’23, generating greater export competition.

- Add to this the impact of the EU’s recent antidumping investigation against Chinese resin, and Chinese PET resin export prices look to ease through Q2’23, before coming under increased pressure in the off-season.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.