Insight Focus

- PTA Futures finish week on the back-foot, as both upstream costs and margins decline.

- China PET resin export prices keep soft, tracking raw materials downwards.

- Raw material forward curve has now flattened on recent near-term declines.

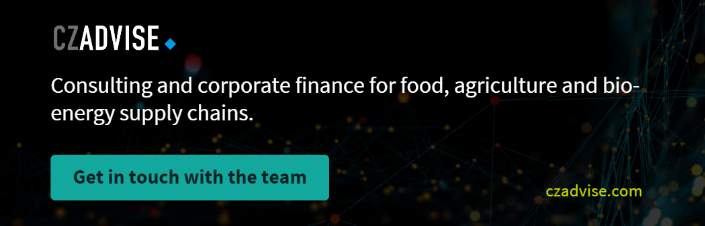

PTA Futures and Forward Curve

PTA Futures declined by around 1.7% last week, versus the previous week’s close, following softening in upstream costs.

Brent crude oil prices eased slightly Friday, ending the week around USD 82.40/bbl, down just over 1% versus the previous week’s close.

Polyester operating rates look to be on a recovery path following the CNY break, supporting PTA demand.

Looking at the supply-side of the equation, whilst planned PTA maintenance operations are expected in March, some are also facing delays keeping supply abundant.

On the other hand, PX turnarounds are tightening supply, supporting potential upside; PTA-PX spreads narrowed towards the end of last week, down to 91/tonne.

The forward curve turned flat last week, having previously been relatively backwardated from May onwards. The May’24 contract holds a RMB 14/tonne premium over the current month’s contract; Sept’24 is now at a RMB 16/tonne premium to May.

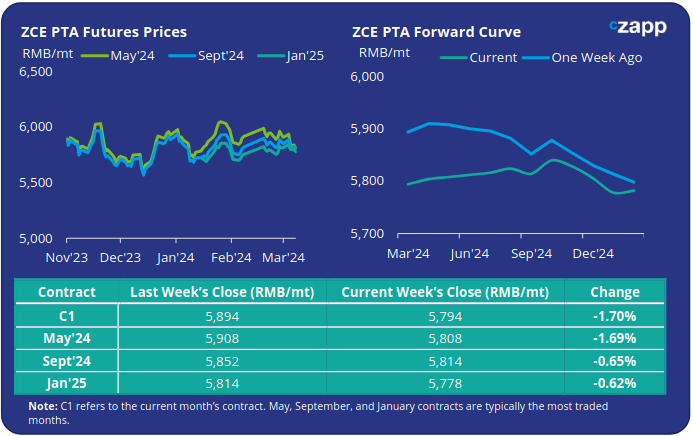

MEG Futures and Forward Curve

The main May’24 MEG futures contract weakened slightly, whilst further out Sept’24 and Jan’25 contracts gained around 1%, flattening the forward curve.

Main East China port inventories experienced a sizeable decline last week, down 7.7% to around 707k tonnes last Friday.

Whilst downstream demand is supported by increasing polyester operating rates, deep sea cargoes are expected to ramp up into April, following restarts at several Saudi Arabian plants.

Increased arrivals may be partially offset by domestic turnarounds, keeping prices rangebound. As such, the MEG forward curve shows some near-term strength into April, before becoming relatively flat thereafter.

The May’24 contract currently has a RMB 172/tonne premium over the current month, with Sept’24 then at a RMB 29/tonne premium to May’24.

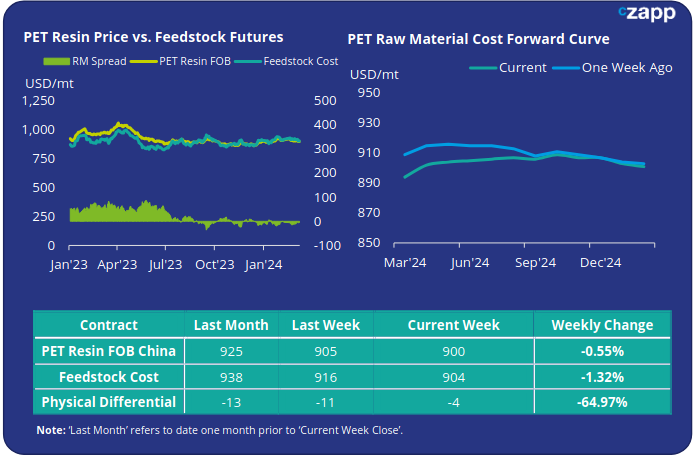

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices edged down again last week, shedding another USD 5/tonne to average USD 900/tonne last Friday.

The weekly PET resin physical differential against raw material future costs increased by around USD 7/tonne, to average minus USD 4/tonne for the week. By Friday, the daily spread had remained at minus USD 4/tonne.

The raw material cost forward curve has flattened out over the last few weeks, losing the near-term premium over forward contracts. As such, forward costs are now projected to be relatively consistent through much of the next-12 months.

The current May’24 costs were USD 8/tonne higher than the current month; Sept’24 had risen to a USD 2/tonne premium to May.

Concluding Thoughts

PET resin export prices continue to ebb downwards tracking falling raw material costs; prices at the low end of the range are once again being seen in the mid USD 880s/tonne range.

PET resin export spreads have improved marginally over the last week, with a combination of tighter availability from some producers, strengthening seasonal demand, and added interest in lower price offers.

Nevertheless, the physical differential to future raw material costs remains below zero, dogged by continued over-supply issues.

Operating rates are expected to be lifted as lines restart in the coming weeks; Yisheng is also expected to start up another 350k tonne line at the end of March.

The threat of additional new capacity although largely concentrated in H2 weighs on current market sentiment, even as demand recovers.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.