Insight Focus

- PTA Futures dragged down by PX, as crude continues its rally towards USD100/bbl.

- PET export deals face Chinese National Holiday slowdown, as markets close for week.

- Buyers look to lock in fixed prices for 2024, with spreads at historic lows.

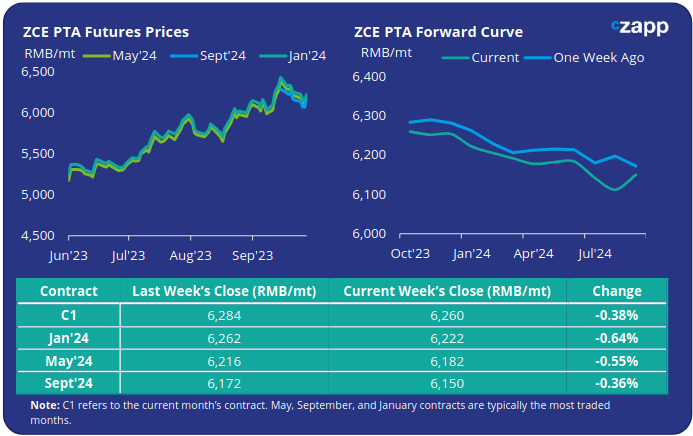

PTA Futures and Forward Curve

PTA futures weakened slightly through last week dragged down by lower PX values, despite crude prices hitting USD 97/bbl mid-week.

Sustained fundamental tightening in the oil markets continued to push crude towards the USD100/bbl marker, offsetting concerns around future rate hikes and a stronger US dollar.

PTA prices bucked the macro-oil trend due to a narrowing of the PX-Naphtha spread, resulting from weaker domestic sentiment and a decline in gasoline cracking.

Whilst PTA market fundamentals remained weak the PTA-PX spread stayed flat at just over USD76/tonne; levels this low were last seen at the beginning of the COVID outbreak, early 2020.

Although further production cuts are expected after the national holiday, the supply demand balance is expected to remain relatively balanced. All eyes will be on any further potential reduction in polyester production rates as the market moves past the traditional peak.

By Friday, the Jan’24 contract was at a RMB 38/tonne discount to the current month, with the forward curve slightly backwardated through H1’24.

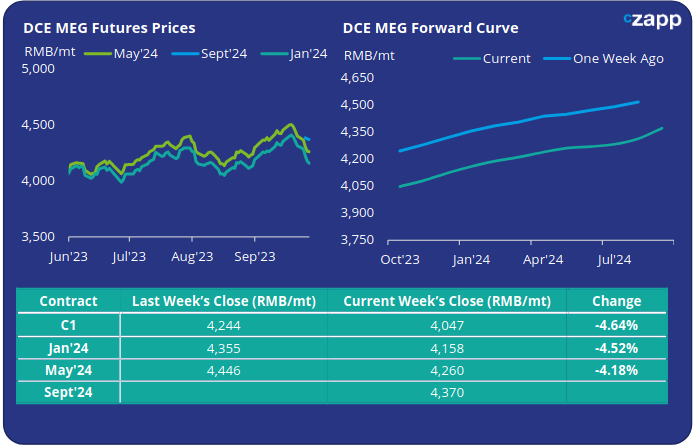

MEG Futures and Forward Curve

MEG Futures dropped sharply last week, dogged by high inventories and lacklustre buying ahead of the national holiday; the main Jan’24 contract fell by over 4.5% on the week.

East China main port inventories swelled by around 6.7% to 1,101k tonnes last week, reversing declines seen in recent weeks, with daily offtake also falling sharply.

With another massive wave of imports arriving in October and domestic producers slow to cut output, including some delayed maintenance, market sentiment is set to remain under pressure post-holidays.

Entering Q4, much of the focus will fall onto where polyester demand and operating rates go next.

The MEG forward curve remains in contango over the next 12-months. Although by Friday, the premium held by the Jan’24 contract over the current month contract had narrowed slightly to RMB 111/tonne.

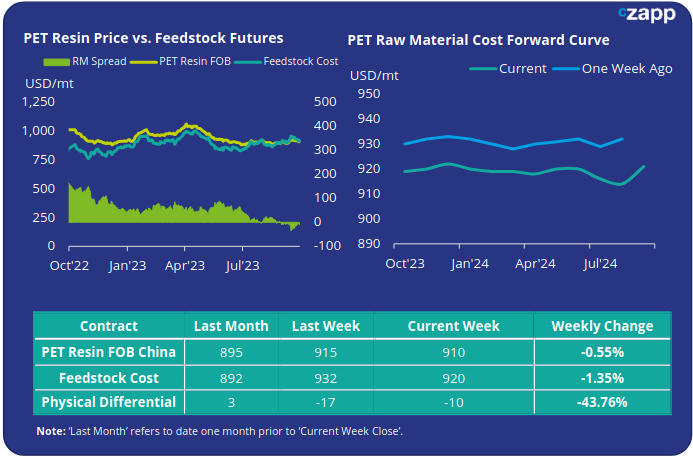

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET export prices eased very slightly with prices averaging USD 910/tonne on Friday, down just USD 5/tonne from the previous week. Some firming of prices towards the low end of the prices range was apparent ahead of the holiday period.

The weekly PET resin physical differential saw some additional improvement whilst remaining negative; the differential increased USD 14/tonne to average negative USD 6/tonne for the week. By end of Thursday (due to market holiday close) the daily spread had fallen back to around minus USD 10/tonne.

The raw material cost forward curve remains broadly flat through H1’24, with the most liquid contract months of January and May on par with current levels.

Concluding Thoughts

PET resin market activity last week ahead of China’s National Holiday and Golden Week (29th Sep – 6th Oct) with many deal makers taking time away.

As a result, PET resin prices plateaued, and were relatively non-reactive to feedstock movement.

Post-Holiday, further maintenance and production cuts are expected, which may help to partially stabilise the market following the massive new capacity additions over the last two-quarters.

Inventories have steadily been on the rise since the end of the summer and a further modest build-up is expected to persist through to late-November.

Given the flat raw material forward curve, and limited downside to operating margins, PET resin export prices are expected to remain relatively flat through the next quarter before rising modestly as seasonal demand picks up again post-Chinese New Year.

With expectations for Brent crude prices to remain in the USD90-100/bbl range, buyers are likely to seize the opportunity to lock in fixed prices for 2024, given the historically low spreads available.

Current market indications are for Chinese export prices to range between USD940-960/tonne in H1’24.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.