Insight Focus

- PTA futures drop as global commodities ease, producers face margins loss.

- Typhoons cause delays and congestion at Chinese ports.

- Approaching peak polyester season may provide crucial support for PTA and MEG.

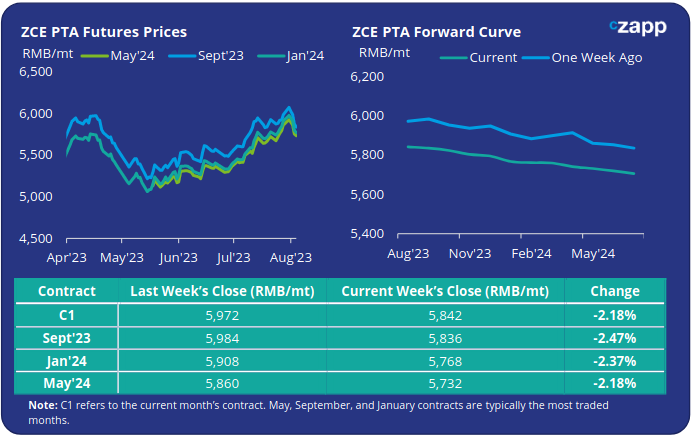

PTA Futures and Forward Curve

- PTA futures followed the mid-week dip in global commodities markets. However, failed initially to respond to crude’s rebound on Friday morning, as the oil market regained upward momentum.

- Crude oil analysts are predicting global supply deficits will continue until the first quarter of 2024, leading to falling inventories and higher oil prices, some predicting $100/bbl by year-end.

- Typhoon disruption continues to be a threat to PTA supply, as Typhoon Kanu currently bears down on eastern ports, following on the back of Super Typhoon Doksuri.

- Container operations in Ningbo-Zhoushan, and some smaller ports on the Yangtze face are likely to be impacted, with some lifting and barges suspended.

- Whilst PTA availability is currently experiencing limited impact, congestion at Chinese ports is expected to remain elevated in coming weeks.

- The PX-PTA spread narrowed further, dropping below USD 100/tonne, indicating losses for PTA production, as PTA plants operate at high rates following earlier maintenance shutdowns.

- However, downstream polyester demand remains robust providing support to PTA, despite significant pressure on textile exports.

- Operating rates are expected to remain high through the next quarter, with peak polyester season approaching, late-August through to October.

- By Friday the Jan’24 contract was trading at a RMB 74/tonne discount to the current month.

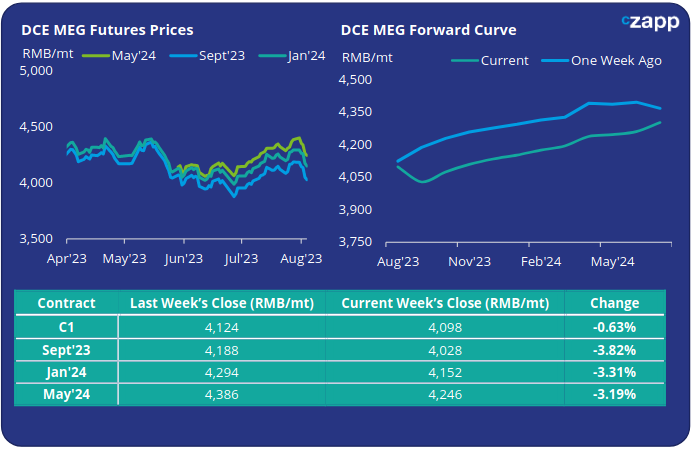

MEG Futures and Forward Curve

- MEG Futures fell heavily last week as recent support from the continual rise in crude oil prices put into question following interest rate rises from the FED and BoE.

- The current MEG market currently lacks momentum, a heavy wave of new import arrivals expected in August will continue to add pressure on the market.

- Main port inventories increased very slightly, rising 0.14% to 987k tonnes last week, and are forecast to rise to their highest levels this year over the next month.

- Traditionally, peak season for polyester leads to a rapid consumption of port inventory. However, with high downstream textile inventories, the MEG market may see a repeat of last year’s relatively lacklustre demand.

- The MEG forward curve remains in contango over the next 12-months, although the forward curve has flattened over the last week. By Friday the Jan’24 contract was holding a RMB 54/tonne premium to the current month.

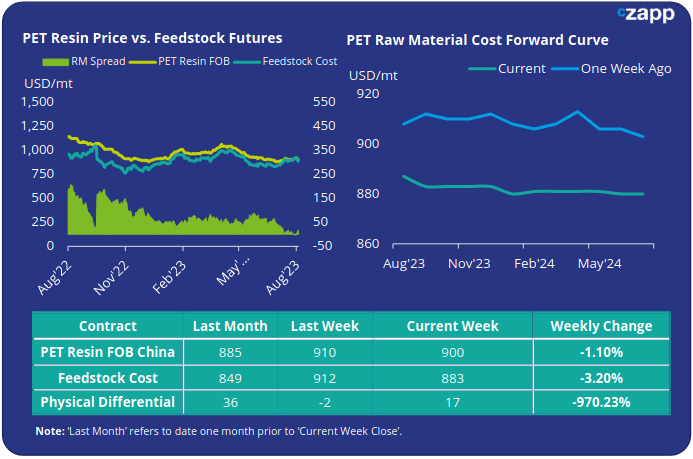

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices started on a stronger note on Monday, rising to an average of USD 920/tonne, before following raw materials lower through the week to an average of USD 900/tonne by Friday, representing a USD 10/tonne weekly decrease.

- The weekly average PET resin physical differential to future feedstock costs increased marginally, up USD 5/tonne to average USD 9/tonne for the week. By Friday the daily spread had recovered further to USD 17/tonne.

- The raw material cost forward curve, whilst moving downwards, remains relatively flat through the next 12-months. At Friday’s close, Jan’24 raw material costs were at a USD 7/tonne discount to the current month.

Concluding Thoughts

- The relatively sharp downturn in PTA and MEG futures outpaced PET resin price movements leading to a slight recovery in physical differential over future costs.

- However, given the ample availability of material margins are expected to remain compressed.

- If Friday’s recovery in crude oil sustains into next week the physical differential may well reverse, keeping rangebound as these low levels.

- Export sales have been slow through July and into early August, with producer stocks edging up slightly, although still averaging below the two-week level.

- Producers are now keen to make additional export sales to slow any potential inventory build entering the off-season.

- Further additions from Yisheng (500kta) and Billion (600kta) are expected to keep margins low through H2’23.

- As a result, PET resin export prices are expected to track raw material costs closely through to Q1’24.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.