Insight Focus

- Rising crude prices and continued RMB appreciation drives PTA and MEG futures higher.

- PET export prices hit three-month high buoyed by raw materials; margins remain low.

- Export availability tighter following recent COVID impact on PET production and logistics.

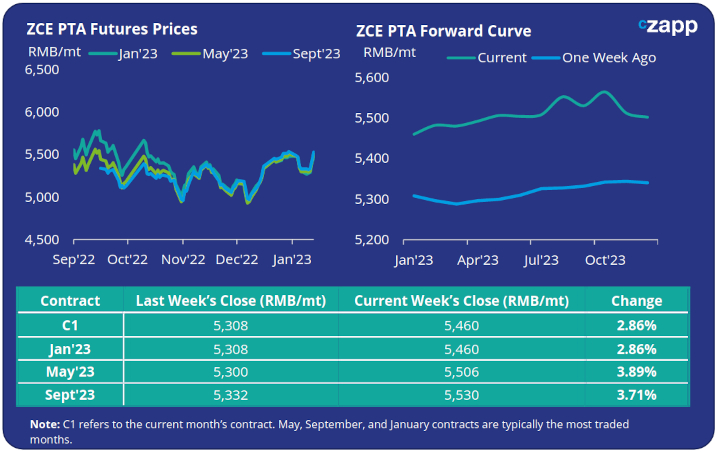

PTA Futures and Forward Curve

- PTA futures were buoyed by rising crude oil prices and continued Chinese RMB appreciation against the US Dollar, with the RMB exchange rate hitting a five-month high last week.

- Whilst some PTA units restarted over the last week, increasing operating rates and supply to market, downstream demand is likely to quieten in the run up to Chinese New Year, with low polyester operating rates and holiday shutdowns.

- As a result, supply is expected to outstrip demand through the remainder of January leading to a short-term increase in inventory levels that may weigh on PTA margins.

- Although remaining relatively flat, the current PTA forward curve is beginning to show a small forward premium, with the May’23 contract now trading at a RMB 46/tonne premium to the Jan’23 level.

MEG Futures and Forward Curve

- “A rising tide lifts all ships”, with MEG future prices also benefitting from the rebound in crude and RMB appreciation last week, with main month contracts up 5-6% on the week.

- Whilst East China main port inventories continued to increase, up 1.4% from last week, pre-holiday restocking helped lift the MEG market.

- Market sentiment shows signs of improving, with some traders building long positions on expectations of improved demand following the Spring Festival break.

- Although Chinese MEG units continue to run at reduced rates, the expected start-up of significant new Chinese and Indian MEG capacity will add pressure on the supply side and continue to suppress margins.

- The MEG futures forward curve remains in contango with the May’23 contract now at a RMB 171/tonne premium to the current Jan’23 contract.

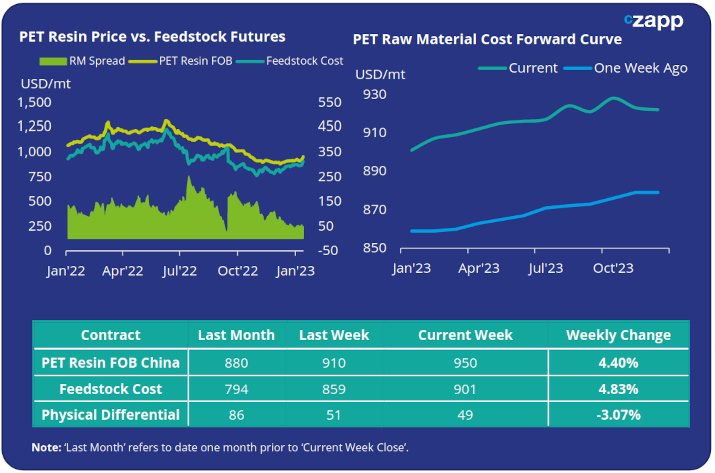

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices strengthened quickly through last week as the RMB appreciated against the US Doller, ending the week at an average price of USD 950/tonne, up USD 35/tonne on the previous week’s close and a three-month high.

- The weekly average PET resin physical differential to feedstock costs was relatively flat versus the previous week, averaging USD 50/tonne. By Friday, the daily spread was around USD 49/tonne.

- The PET resin raw material forward curve was lifted by higher feedstock prices and continued to exhibit a modest upward slope through Q3’23. At Friday’s close, the May’23 contract was showing a premium of USD 14/tonne to the Jan’23 contract.

Concluding Thoughts

- Following improved sales in November and early December, export demand has quietened into the New Year keeping the physical differential to raw material costs comparatively low.

- However, the combination of a surge in pre-Christmas exports, and the recent COVID wave in China impacting on logistics and PET production, has tightened availability.

- Chinese and other Asian suppliers are increasingly sold-out through February with prompt cargo scarce. Some producers report being behind on sales by 1-2 weeks due to the impact of the recent COVID wave.

- With buyers having taken advantage of the market bottom in November, many are now awaiting the market impact of new capacity additions, expected March/April, as well as clarity on any potential EU anti-dumping investigation.

- An additional 4.5MMt of new PET resin capacity is scheduled in 2023, although market conditions and lower margins compared to a bumper 2022 may see some postponements.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

Czapp Explains: Global PET Resin Capacity and Projects

European PET Market View: Potential EU Anti-Dumping Proposal Raises Risk on PET Resin Imports

PET Resin Trade Flows: EU PET Resin Imports Surge in Q3 Driven by Chinese Wave

European PET Market View: European PET Producers Face Difficult Q1 as Import Delta Widens