- PTA producer margins fell last week, with polyester production down due to COVID controls.

- PET resin export prices remained flat, but the physical differential over feedstock narrowed.

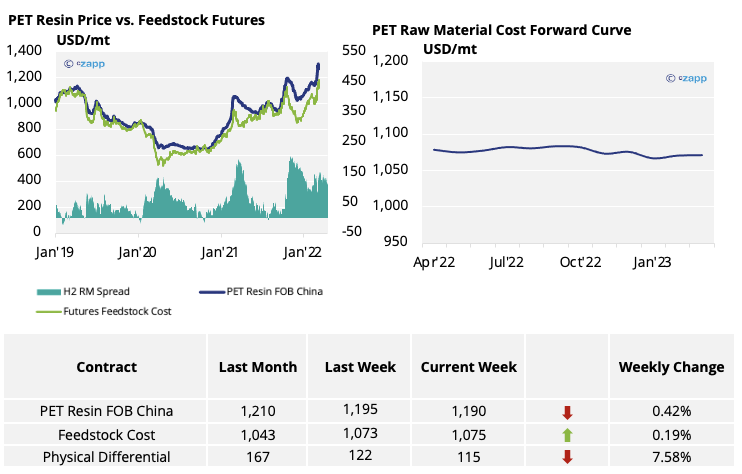

- The raw material forward curve remains flat, slightly backwardated over the next 12 months.

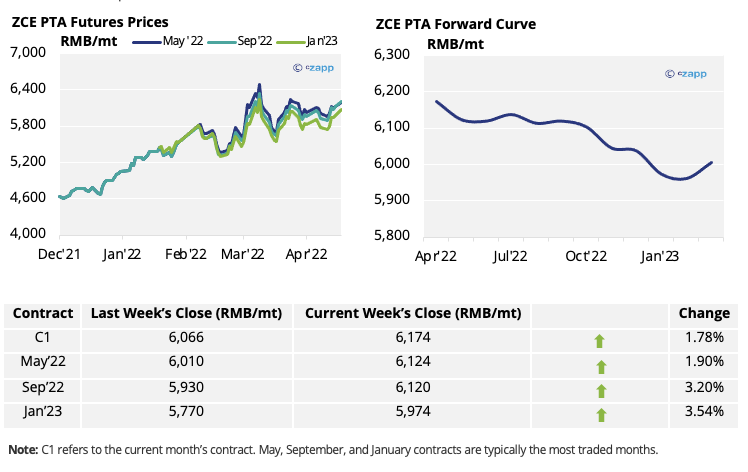

PTA Futures and Forward Curve

- PTA futures followed crude oil higher last week, but the PTA-PX spread narrowed, highlighting more bearish fundamentals.

- China’s PTA demand has sharply dropped in recent weeks, as COVID controls have reduced polyester production.

- The PTA 12-month forward curve remains backwardated, with future months trading at a discount to the current April contract.

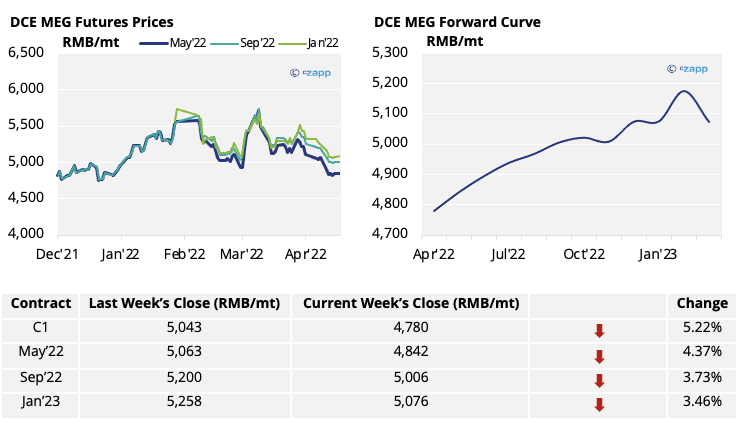

MEG Futures and Forward Curve

- MEG futures continued their downward trajectory last week, following weaker demand.

- Polyester production cuts and a drop in demand from the apparel sector have dampened MEG demand.

- Strict logistics controls due to COVID outbreaks in Shanghai and other cities added to the decline.

- The MEG forward curve remains in contango with future contracts, trading at a premium to current levels.

PET Resin Export – Raw Material Spread and Forward Curve

- With China’s PET resin export prices closing the week at 1,190 USD/tonne, the current physical differential over feedstock futures has fallen by around 7 USD/tonne to 115 USD/tonne.

- The PET export-raw material forward curve remains flat, slightly backwardated over the next 12 months.

Concluding Thoughts

- COVID controls within China have severely impacted polyester production and consumption.

- Official figures show that China’s consumer spending fell, and unemployment rose last month.

- Weaker domestic demand is becoming a concern for PET producers; whilst PET export prices have remained firm, the physical differential over feedstock continues to erode.

- Increased export availability may become more apparent if the domestic market fails to stimulate demand.

- Chinese PET producers face prospect of weaker export demand with lower sales to Russia and Ukraine.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

European Buyers Under Pressure as PET Prices Hit New Highs

PET Resin Trade Flows: China’s COVID Response Slows Exports

Chinese PET Industry Faces Biggest COVID Outbreak Since 2020

European PET Market Rocked by War in Ukraine

Explainers That May Be of Interest…