Insight Focus

- PTA and MEG futures recover slightly over the last week.

- Both raw materials are still in oversupply with downstream demand subdued.

- PET resin export margins remain strong with producers oversold for Q3.

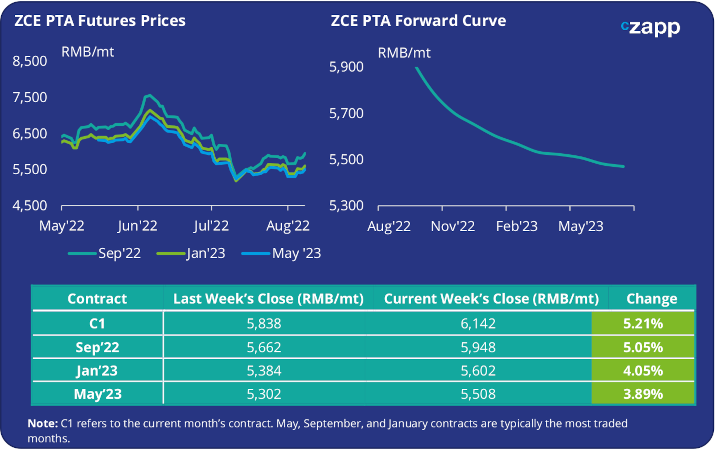

PTA Futures and Forward Curve

- PTA futures have recovered slightly by the close of last trading week.

- Supply expected to reduce through August as more PTA units announce turnaround plans.

- Downstream demand remains subdued but is expected to gradually improve through Q3 as polyester operating rates forecast to rise.

- The PTA forward curve remains backwardated through the remainder of 2022, flattening slightly into 2023.

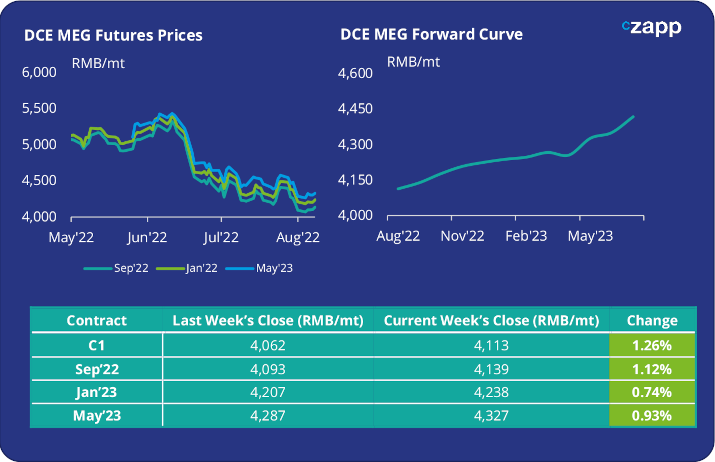

MEG Futures and Forward Curve

- MEG futures have strengthened slightly to the 12th of August with the front month contract up just over 1%.

- Despite this, bearish fundamentals and low margins continue to haunt the MEG market.

- Downstream demand is expected to pick up through as we head further into H2’22, as such the forward curve continues to trade in contango, steepening into Q1’23.

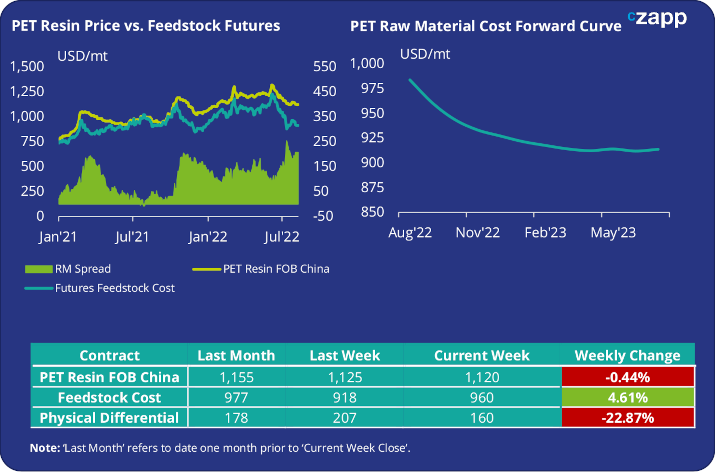

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices weakened by 5USD to 1120USD/mt then traded sideways till the end of last week.

- The weekly average PET resin–raw material physical differential fell almost 50USD to 160USD/mt this last week, over a 20% decline.

- The PET resin raw material forward curve is still backwardated across Q3, flattening into 2023.

Concluding Thoughts

- The raw material’s markets continue to be denied by oversupply and pressure margins, maintenance shutdowns is seeing production reduced.

- At the same time, fresh covid lockdowns in Hainan ensures polyester demand remains subdued for the time being. Situation expected to improve later into the quarter.

- Major Chinese PET producers continue in an oversold position for the next couple of months, leaving expected supply in Q4 tight as this position is resolved.

- Robust PET resin exports to Algeria and the UAE are indicative of the softening freight rates and a weaker USD are aiding competitiveness into key EMEA markets.

- More broadly PET resin exports continue to flow at near record levels in the current period.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

What Europe’s Deepening Energy Crisis Means for PET Resin

PET Supply Chains Groan Under Global Heatwaves

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs