Insight Focus

PET and Raw Material Futures posted weekly losses as crude oil prices reversed. PET resin export prices also softened as trading activity quietened ahead of CNY. Futures forward curves continued to show minimal forward premiums through to Sept’25.

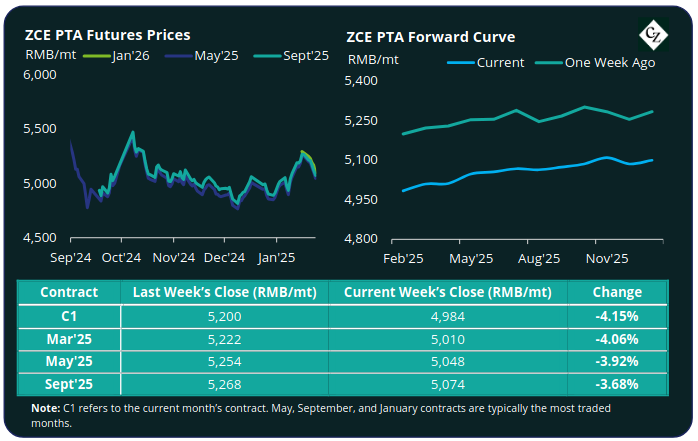

PTA Futures and Forward Curve

PTA Futures retreated by over 4%, conceding most of the previous week’s gains following the reversal in upstream feedstock costs.

Brent oil prices were around USD 78.5/bbl by Friday, down nearly 3% on the previous week’s close.

Crude oil prices trended lower through last week, reversing some of the New Year gains, as traders braced for a US production boom whilst the new US administration also called on Saudi Arabia to lower oil prices.

The PX-N CFR spread softened slightly, as supply remained ample, down a couple of dollars to around USD 181/tonne. The PTA-PX CFR spread also kept relatively steady, with the weekly average spread at USD 80/tonne.

PTA operating rates decreased slightly following a planned shutdown at Yisheng’s Ningbo plant. However, polyester operating rates fell faster, as growing surplus undermines support for higher values.

The PTA forward curve remains in slight contango, with the May’25 contract holding a RMB 64/tonne premium over the current month’s contract. Sept’25 holds a RMB 90/tonne premium.

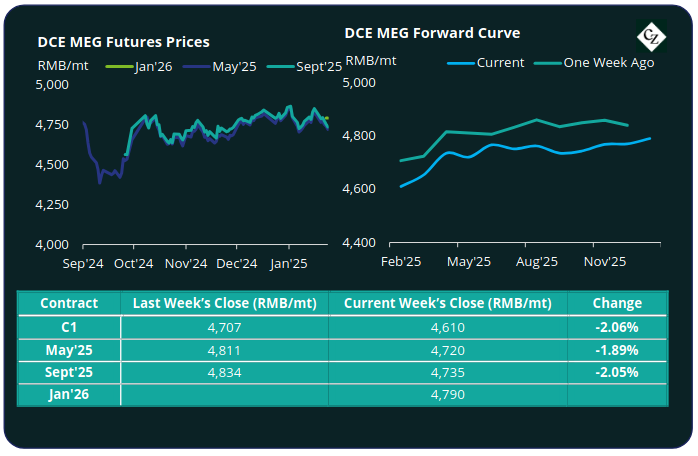

MEG Futures and Forward Curve

MEG Futures also posted a weekly loss, albeit less than PTA, down around 2% keeping within the tight range seen since late 2024. Trading activity also faced a slowdown as CNY approached.

East China main port inventories fell sharply on higher offtakes and delayed import arrivals, down by around 5.2% to 477,000 tonnes.

Domestic operating rates are projected to increase through February, moving the market towards inventory accumulation.

Whilst MEG supply and demand fundamentals are likely to be weakened further by the continued reduction in downstream polyester operating rates, particularly with plants suspending production during Chinese New Year.

The MEG Futures forward curve kept in carry with the May’25 contract having a RMB 110/tonne premium over the current month’s contract. Sept’25 was at a RMB 125/tonne premium, widening slightly on the previous week.

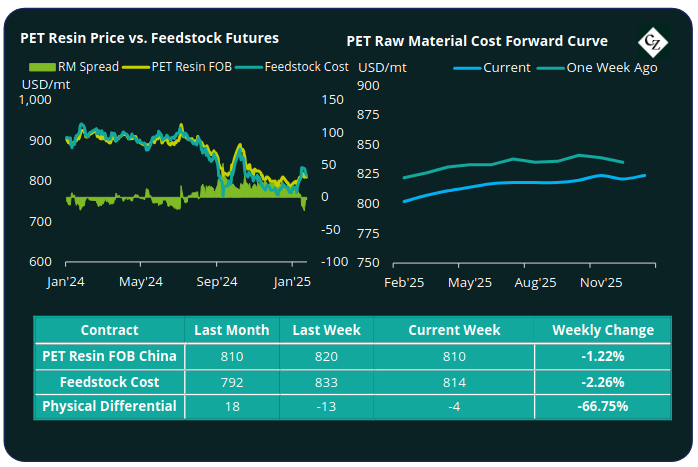

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices softened slightly, dropping average of USD 810/tonne, down USD 10/tonne on the previous week.

The average weekly PET resin physical differential against raw material future costs fell to negative USD 10/tonne last week, as trading eased ahead of CNY and buyers reluctant to accept higher values. By Friday, the daily differential had strengthened somewhat to negative USD 3/tonne.

The raw material cost forward curve remained broadly unchanged with a slight contango through 2025 with May’25 holding a USD 12/tonne premium over the current month’s contract, and Sept’25 holding a USD 16/tonne premium.

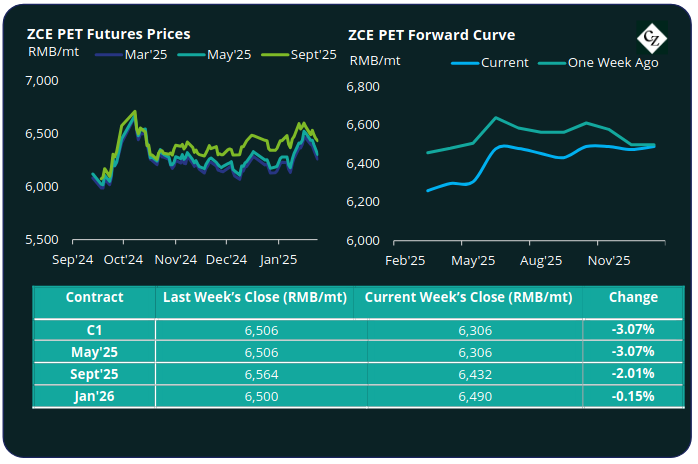

PET Resin Futures and Forward Curve

PET Resin Futures also gave ground, dropping 3%, following weaker raw material costs and last week’s correction in upstream oil prices.

The Mar’25 contract, the first contract month of these new futures, decreased to RMB 6260/tonne (USD 862/tonne), equating to an FX adjusted loss of USD 21/tonne versus the previous week.

The average weekly premium of the Mar’25 PET Futures over Mar’25 Raw Material Futures increased very slightly to around USD 18/tonne, up USD 1/tonne. By Friday, the daily premium was USD 20/tonne.

The PET Resin Futures forward curve flattened moderately across the main contract months. May’25 holds just a RMB 48/tonne (USD 6/tonne) premium over the main Mar’25 contract. Sept’25 holds a RMB 106/tonne (USD 24/tonne) premium, up around USD 10/tonne on the previous week.

Concluding Thoughts

Chinese PET resin export prices kept relatively rangebound, as trading activity slowed ahead of the holidays and downstream restocking dissipated.

Post-CNY container freight rates are expected to ease slightly, further supporting additional export activity in the run up to the March/April buying season.

However. with several PET resin plants shut for turnaround, operating rates have declined sharply in January. Returning production in February/March will renew pressure on producer margins, negating potential gains as demand improves ahead of the buying season.

Forward curves for both PET resin and the raw material futures continue to show minimal carry through to May’25 (<USD 10/tonne).

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.