Insight Focus

- Chinese PET exports softened in Q4’22, still close to an all-time high.

- Taiwanese exports declined in Q4’22, although supported by greater US volumes.

- South Korean exports also buoyed by US demand; European flows improved.

China’s Bottle-Grade PET Resin Market

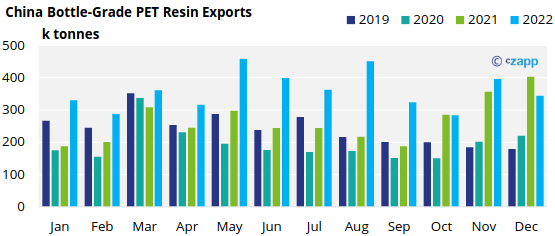

Monthly Exports

- Chinese Customs reported bottle-grade PET exports of around 344k tonnes (HS 39076110) in December, down around 13% on November, and nearly 15% less than the record exports a year earlier.

- Previously delayed shipments were partly responsible for November’s surge, with December 2022 experiencing a normalisation in flows that still far exceeded pre-2021 December levels.

- We now await the joint publication of January and February data, mid-March. However, the timing of Chinese Spring Festival and rise in COVID infections are expected to have impacted January levels.

- Russia was the largest destination for Chinese PET resin exports in December with around 39.8k tonnes, up over 83% from the previous month, and nearly 95% year-on-year.

- Despite the economic repercussions for Russia following the invasion of Ukraine, Chinese exports to the country increased to record levels in 2022 to around 274k tonnes, up 23% versus 2021.

- Latin American countries continued to be key destinations for Chinese exports, with Uruguay and Colombia 2nd and 3rd largest destinations in December.

- Chinese exports to Uruguay rose sharply in December, from almost nothing the previous month. The 27k tonnes is likely reflective of continued breakbulk delivery to the region.

- Exports to Colombia also leapt, by 140% in December versus the previous month, to 19k tonnes; total exports to Colombia for 2022 increase 93% to a record 156k tonnes.

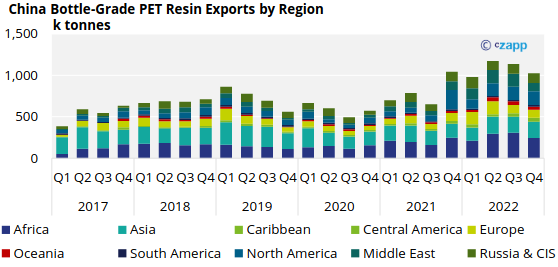

Quarterly Exports

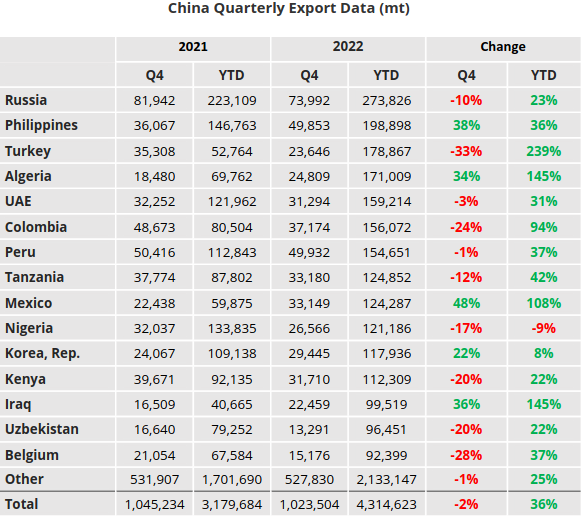

- Looking at the latest full quarter, Chinese bottle-grade PET Resin exports totalled 1.02 million tonnes in Q4’22, down 10% versus Q3’22, and around 2% down from the same quarter a year earlier.

- For the full 2022-year, China exported a total of 4.3 million tonnes of bottle-grade PET resin, up 36% on 2021 levels, and marking a record year for Chinese exports.

- Russia, Peru, and Uruguay experienced the largest quarterly increases, increasing 7%, 14%, and 23% respectively.

- Whilst export volumes to the UAE, Algeria, and Turkey all fell sharply on the previous quarter, decreasing 44%, 55%, and 57% respectively.

- However, for the full year 2022, volumes to Turkey and Algeria hit records of 179k tonnes and 171k tonnes, annual increases of 238% and 144% respectively.

Taiwan Bottle-Grade PET Resin Market

Quarterly Exports

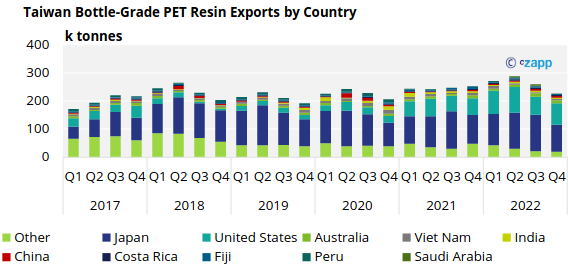

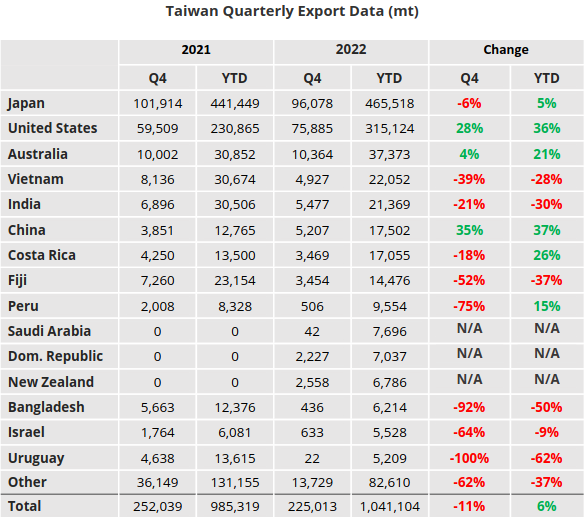

- Taiwanese PET resin exports totalled 225k tonnes in Q4’22, a decrease of around 13% on the previous quarter and down 11% year-on-year.

- Japan remained the largest destination for Taiwanese resin, accounting for around 96k tonnes in Q4’22, a decrease of 26% from the previous quarter, and down 6% versus Q4’21.

- Total exports to Japan for 2022 reached 466k tonnes, up 5% on 2021 levels.

- Exports to the United States rebounded in Q4, increasing by 17.5% to 76k tonnes.

- Total exports for the full-year 2022 to the United States reached 315k tonnes, an increase of 36% on the previous year.

- The United States and Japan made up over 76% of Taiwan’s total PET resin exports in Q4’22, and 75% for total exports in 2022.

- Amongst other smaller export destinations, Australia, India, and China all saw volumes decline in the final quarter of the year.

South Korea’s Bottle-Grade PET Resin Market

Quarterly Exports

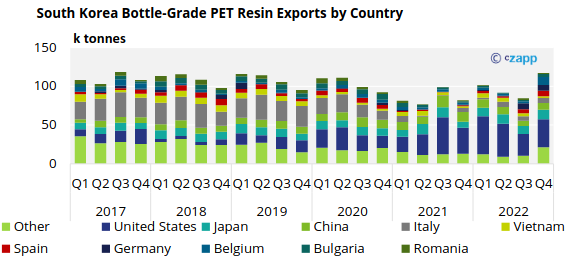

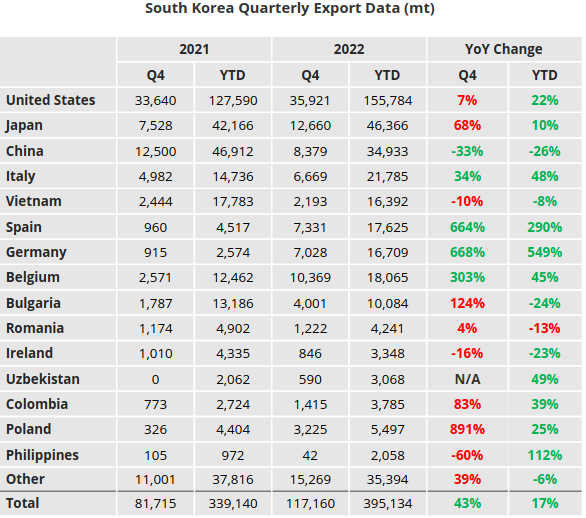

- South Korean bottle-grade PET exports jumped 39% in Q4’22, to over 117k tonnes for the quarter, an additional 33k tonnes versus Q3’22.

- For the full-year 2022, South Korean PET resin exports totalled 395k tonnes, an increase of 17% compared to the previous year.

- South Korea’s largest export market is the United States, which accounted for around 35k tonnes in Q4’22, down 7% on the previous quarter. For the full year, volumes to the United States were up 22% versus the previous year.

- Japan and Belgium were the next largest export destinations for Korean resin in Q4’22, recording 12.6k tonnes and 10.4k tonnes respectively.

- Aside from the United States, Japan, and China, the remaining Top 10 destinations for South Korean PET resin exports were all European countries.

- Exports to Belgium, Slovenia, Poland, Greece all saw triple figure percentage increases in quarterly volumes.

Quarterly Imports

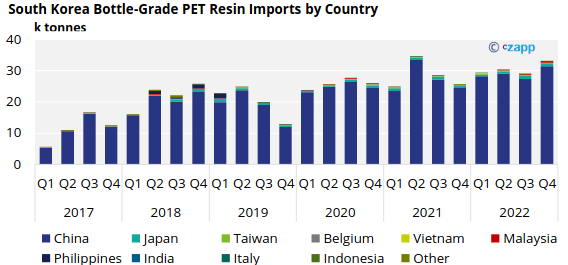

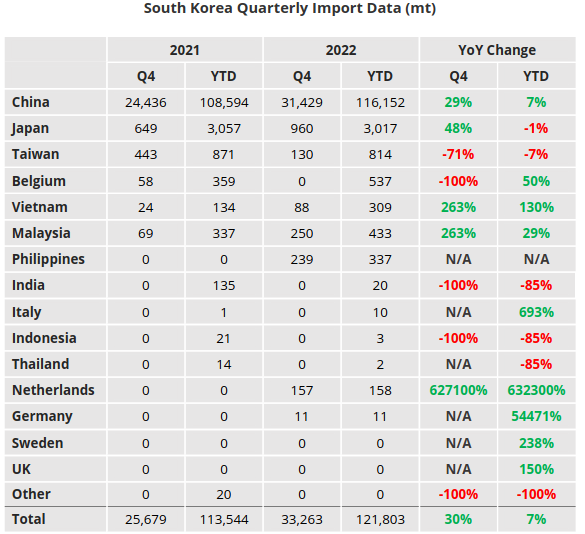

- South Korea’s bottle-grade PET resin imports totalled 33k tonnes in Q4’22, a 15% increase versus Q3’22, and up 29% versus Q4’21.

- China remained South Korea’s main resin supplier, supplying over 95% of Korea PET resin imports, over 31k tonnes in Q4’22.

- South Korean bottle-grade resin import volumes totalled 122k tonnes for the full-year 2022, a 7% increase versus 2021.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com.