Insight Focus

- Chinese PET exports drop sharply in September, led by weaker seasonal demand.

- Taiwanese PET exports remained strong in Q3’22, with additional Australian flows.

- Korean exports drift lower as key US and European markets move into off-season.

China’s Bottle-Grade PET Resin Market

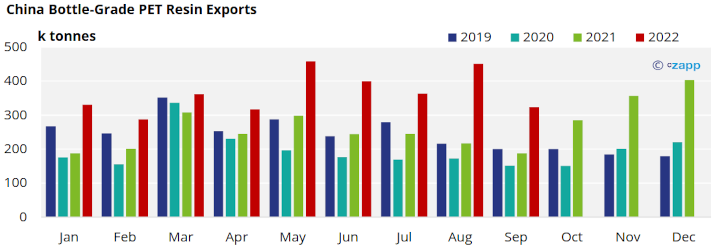

Monthly Exports

- Chinese Customs reported bottle-grade PET exports of over 323k tonnes (HS 39076110) in September, a 28% decrease on the previous month, although far exceeding monthly volumes in previous years.

- Whilst greater interest in Asian exports is being shown by some large foreign buyers, new order intake remains sluggish.

- As a result, expectations are for exports to continue to move lower through Q4 before buyers in the Northern hemisphere target an increase in deliveries ahead of the 2023 peak-season.

- Algeria was the largest destination for Chinese PET resin exports in September with over 21.6k tonnes, falling 7% from the previous month, but consistently one of China’s major export markets for PET resin.

- Exports to Russia, another tradition PET sink for Chinese resin, decreased to 19.4k tonnes in September. Year-to-date volumes to Russia are up 42% versus 2021 volumes.

Source: China Customs Data

- PET resin flows to Tanzania and Indonesia were China’s third and fourth largest export markets in September, with 42.3k tonnes and 36.8k tonnes respectively.

- Exports to Indonesia performed particularly strongly increasing 27% on the month, whilst Tanzanian volumes fell 21%.

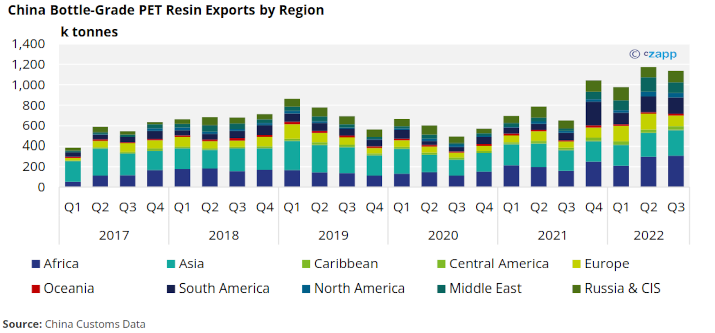

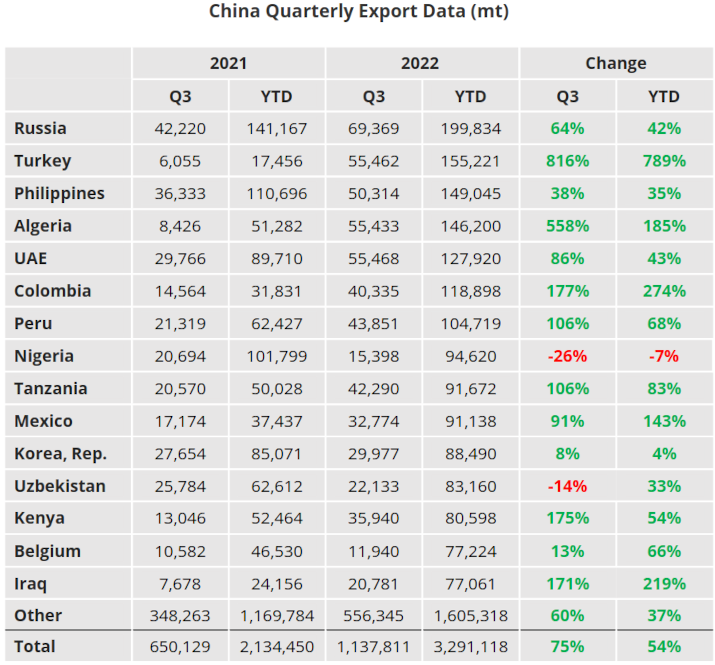

Quarterly Exports

- Looking at the latest full quarter, Chinese bottle-grade PET Resin exports totalled 1.14 million tonnes in Q3’22, down 3% versus Q2’22, whilst up 75% versus the same quarter a year earlier.

- Central America and Russia & CIS regions experienced the largest quarterly gains, up 41% and 10% versus Q2’22 respectively

- Whilst volumes to Europe and Middle East fell 34% and 22% respectively.

Volumes to South America also performed well increasing 5% and are likely to see some improvement in Q4’22 as the regions now moves into its peak summer season.

Taiwan Bottle-Grade PET Resin Market

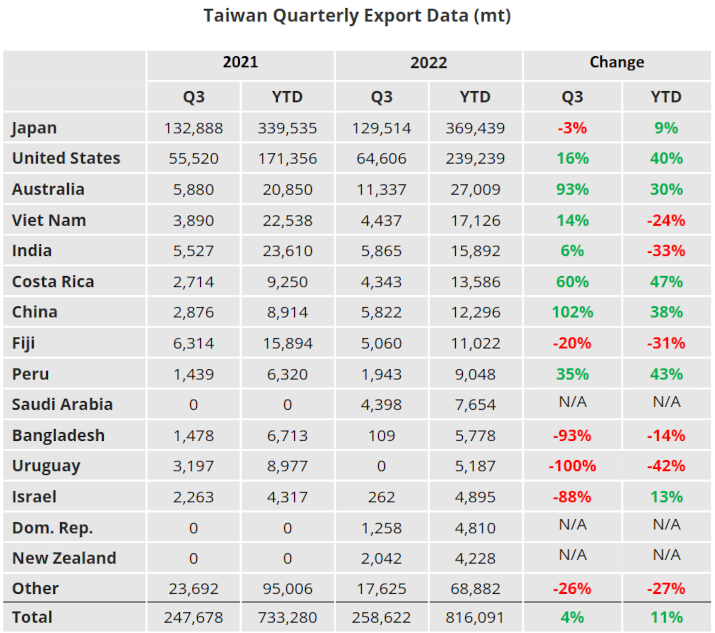

Quarterly Exports

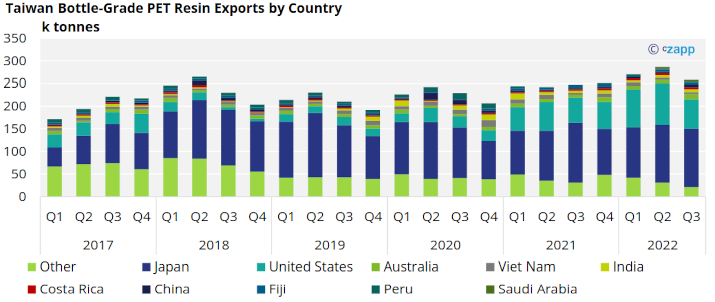

- Taiwanese PET resin exports totalled 259k tonnes in Q3’22, a decrease of around 10% on the previous quarter and 4% year-on-year.

- Japan remained the largest destination for Taiwanese resin, recording over 129k tonnes in Q3, a marginal increase of 1% on Q2’22, and up 9% for the first three quarters versus 2021.

- Exports to the United States fell back sharply in Q3, with a decrease of over 29% to 64k tonnes.

- Through the first three-quarters, exports to the United States had still recorded strong growth of nearly 40%.

- The United States and Japan made up over 75% of Taiwan’s total PET resin exports in Q3’22.

- Amongst other smaller export destinations, Australia, China, and Fiji saw some of the largest volume increases.

- Q3’22 volumes to Australia gained 34% on the previous quarter, increasing to 11k tonnes, almost double that recorded a year earlier, and up 30% year-to-date.

South Korea’s Bottle-Grade PET Resin Market

Quarterly Exports

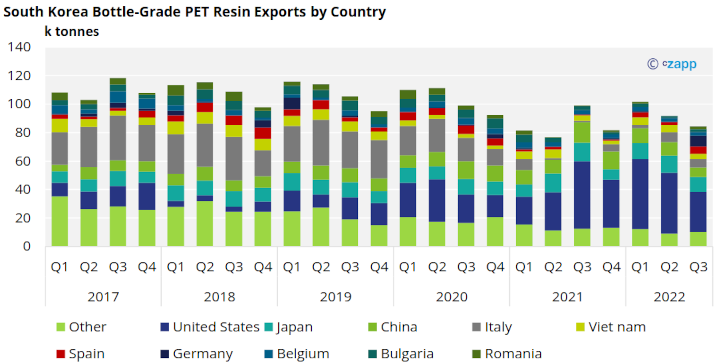

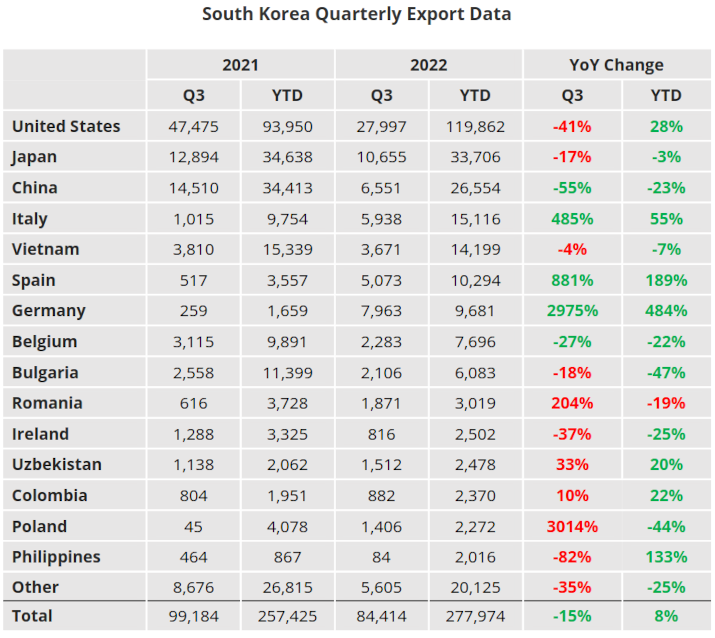

- South Korean bottle-grade PET exports drifted lower in Q3’22, falling to 84k tonnes for the quarter following a similar seasonal trend seen in previous years.

- Q3’22 export volumes represented a decrease of 8% on the previous quarter, and a 15% decline on Q3’21. That said volumes for the first three-quarters of 2022 were still up 8% year-on-year.

- South Korea’s largest export market is the United States, which accounted for around 28k tonnes in Q3’22, down 35% on the previous quarter, although up 28% over the first three-quarters of 2022 versus the previous year.

- Japan and China were the next largest export destinations for Korean resin, recording 10.6k tonnes and 6.5k tonnes respectively in Q3’22.

- Exports to European countries, including Spain, Germany, and Bulgaria recorded strong quarterly growth, with increases of 170%, 1147%, and 38% respectively, with improved Korean resin price competitiveness.

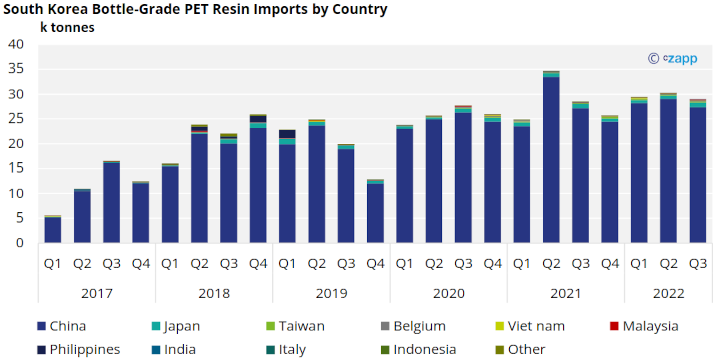

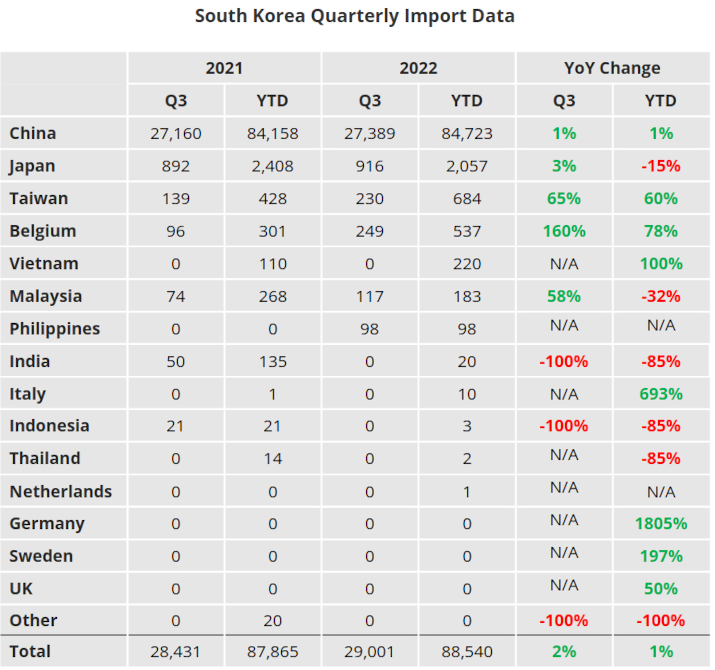

Quarterly Imports

- South Korea’s bottle-grade PET resin imports totalled 29k tonnes in Q3’22, a slight decrease of 4% versus Q2’22, and up marginally year-to-date versus 2021.

- China remained South Korea’s main resin supplier, supplying over 95% of Korea PET resin imports, over 27k tonnes in Q3’22.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

European PET Market View: European PET Producers Facing Losses Contemplate Further Shutdowns

PET Resin Trade Flows: Korean PET Exporters Eye Greater European Share in 2023

Asia PET Market View: Will Plummeting Ocean Freight Boost Asian PET Export Demand?