Insight Focus

- China’s PET resin exports cooled ahead of Lunar New Year, COVID outbreaks begin to slow shipments.

- Brazilian imports jumped nearly 400% in Q4’21 on regional production outages.

- US remains South Korea’s largest buyer, taking 38% of its PET resin exports in 2021.

China’s Bottle-Grade PET Resin Market

Monthly Exports

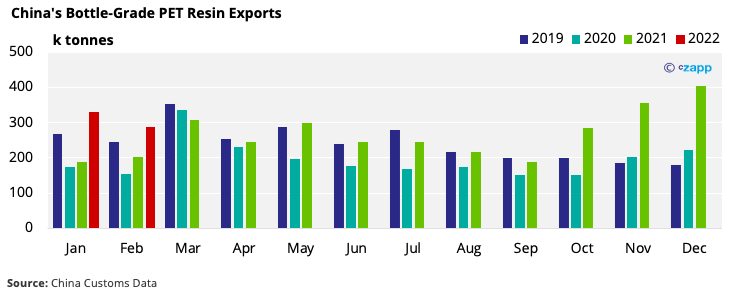

- Chinese Customs released trade data for January and February in March.

- Bottle-grade PET exports rose 76.5% on the year in January and 42.6% in February to 331k and 287k tonnes, respectively.

- These figures mark a sharp drop from December’s record high of 403k tonnes.

- The declines were largely attributed to slower shipments in the run up to Chinese New Year.

- COVID controls and disruption to subsequent shipping and internal logistics may have also had an impact.

- Latin American demand was huge last quarter following production issues; Peru, Chile and Colombia became the largest destinations for Chinese exports.

- However, in January and February, more traditional countries such as Russia, Uzbekistan and the Philippines became top destinations again.

- Following a surge in demand from Africa and South America in Q4’21, exports to these destinations have returned to more normal levels.

- Restarted production at Indorama’s plant in Brazil following the fire in August, and lower volumes following previous large breakbulk cargoes to some destinations were contributing factors.

Brazil’s Bottle-Grade PET Resin Market

Quarterly Imports

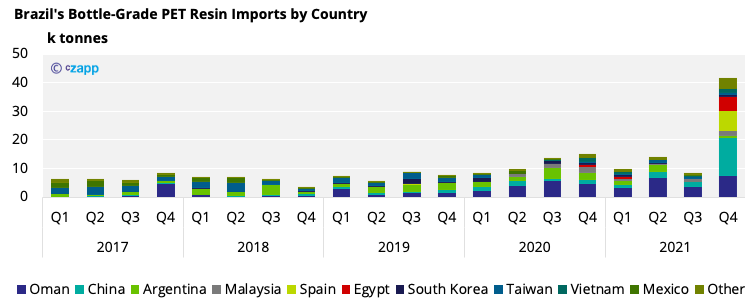

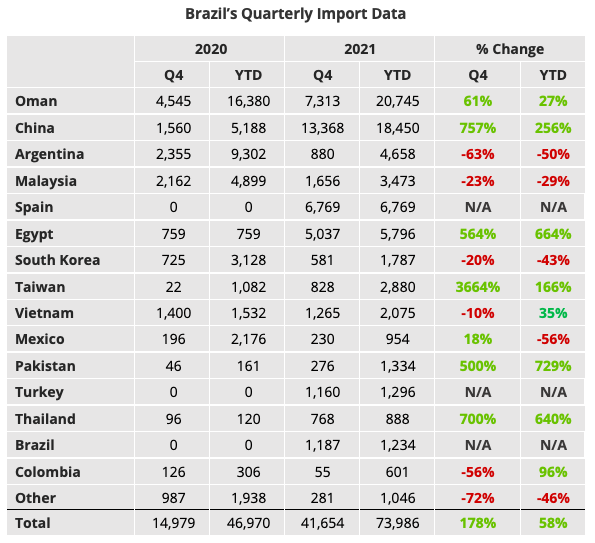

- Brazil’s bottle-grade PET imports totalled 41k tonnes in Q4’21, up 387% from Q3 and 178% year on year.

- China was the main supplier but other sources of origin, including Oman, Spain and Egypt grew dramatically.

- Lack of production at Indorama’s Brazilian plant between August and November last year resulted in regional supply shortages, boosting overall import demand in Q4.

- Oman has become a key source for Brazil over the years; imports from Oman jumped 61% in Q4’21.

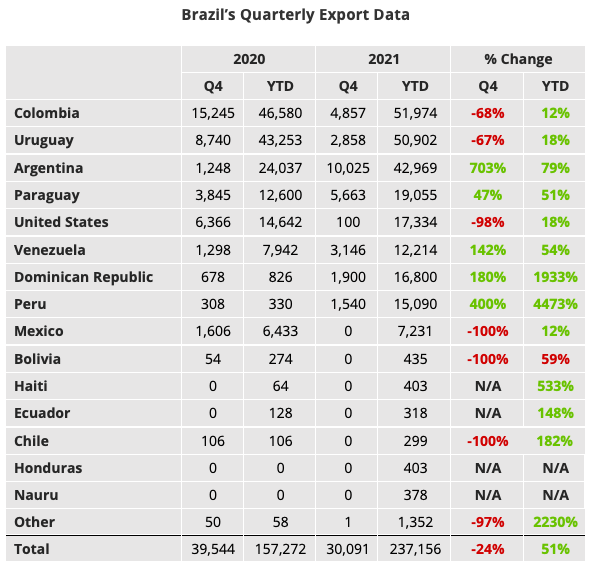

Quarterly Exports

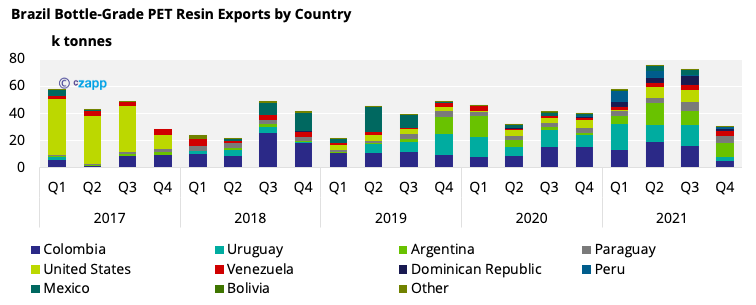

- With Indorama’s outage, Brazilian PET resin exports fell sharply in Q4’21, dropping 58.6% on the quarter and 24% year on year.

- Exports to Argentina, Paraguay and the Dominican Republic held stable.

- Exports to some nations, however, collapsed completely.

- For example, flows to the United States dried up almost entirely due to Brazilian production issues.

- Brazilian exports to Uruguay also fell to their lowest level since Q1’19, down 82.2% on Q3’21.

Korea’s Bottle-Grade PET Resin Market

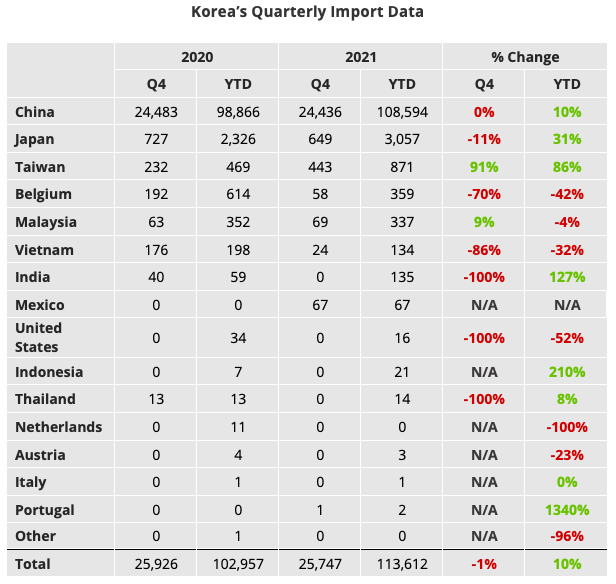

Quarterly Imports

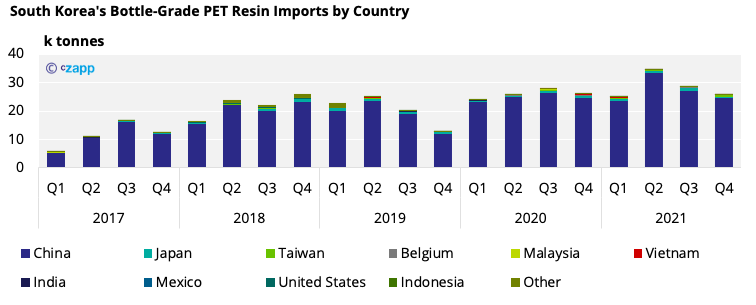

- South Korea’s bottle-grade PET resin imports totalled 25k tonnes in Q4’21, down 1% on the quarter and less than 1% year-on-year.

- Q4 imports remained higher than pre-COVID levels.

- China is still South Korea’s main resin supplier, supplying 24k tonnes of its imports in Q4’21.

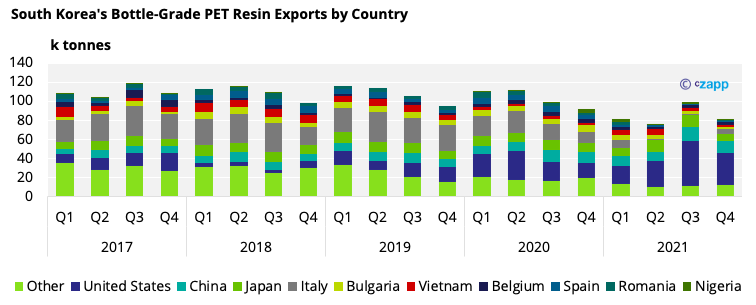

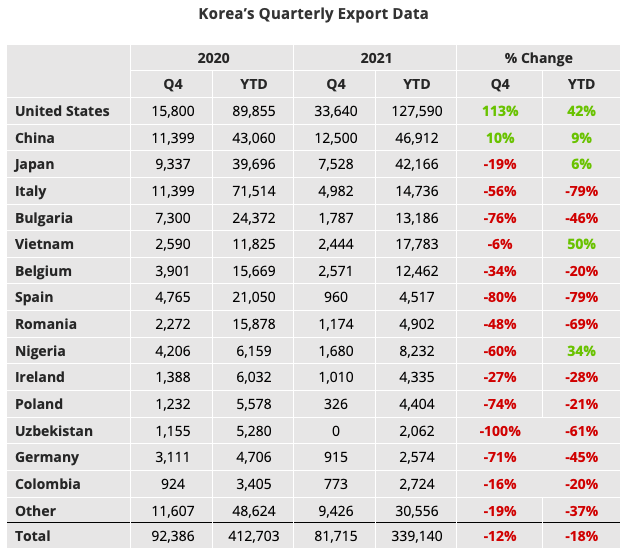

Quarterly Exports

- South Korea’s bottle-grade PET exports hit 82k tonnes in Q4’21, down 18% on the quarter and 12% year on year.

- South Korea’s largest export market was the United States, which accounted for 33.6k tonnes of Korea’s flows in Q4’21, down 29% on the record Q3’21.

- The next largest export destination was China, with 12k tonnes shipped there.

- On balance, South Korea remains a net importer from China.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com

Other Insights That May Be of Interest…

PET Resin Trade Flows: Europe Awaits Asian Shipments

What the Ukraine Crisis Means for PET