Insight Focus

- A rebound in Chinese PET production and logistics operations enabled exports to surge in May.

- Q1 Brazilian exports were buoyed by the restart of Indorama’s plant and lower imports.

- South Korean Q1 PET resin exports leap on strong demand from the US.

China’s Bottle-Grade PET Resin Market

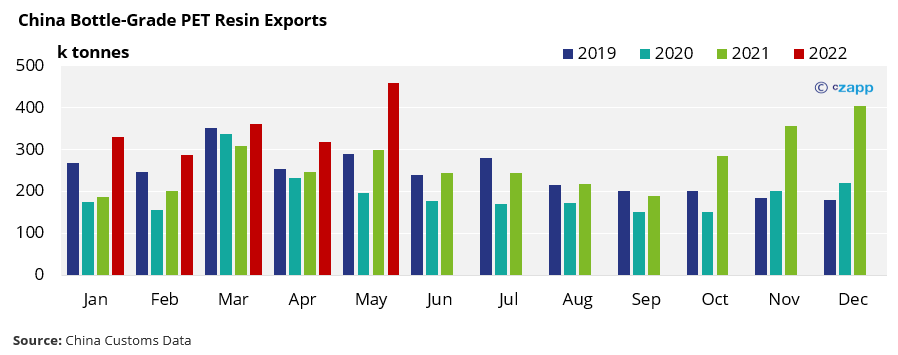

Monthly Exports

- Following months of disruption to both Chinese port operations and PET production from COVID restrictions, attempts to reboot manufacturing and logistics were prioritised by the government in May.

- Some delayed cargoes also shifted away from Shanghai to other ports, enabling producers to ramp up output.

- As a result, Chinese bottle-grade PET exports surged 44.5% month on month to a record high of 458k tonnes in May, and up over 53% on the year.

- Turkey was the once again the largest destination for Chinese PET resin exports in May, recording over 27k tonnes. Although down 23% from April, exports to Turkey were still up almost tenfold on the year.

- Exports to East coast Africa grew substantially, with over 24k tonnes destined for Tanzania, and 17k tonnes to Kenya, monthly increases of over five- and fourfold, respectively.

- Latin American volumes also rose significantly, with cargoes to Colombia, Peru, and Uruguay all soaring on the month by 264%, 434%, and 268% respectively.

- Despite PET resin flows to Russia remaining relatively robust in April, May volumes slumped as the backlash against the Russian invasion of Ukraine began to bite.

- Monthly exports to Russia fell by over 20% in May to less than 17k tonnes, down 38% from a year earlier.

Brazil’s Bottle-Grade PET Resin Market

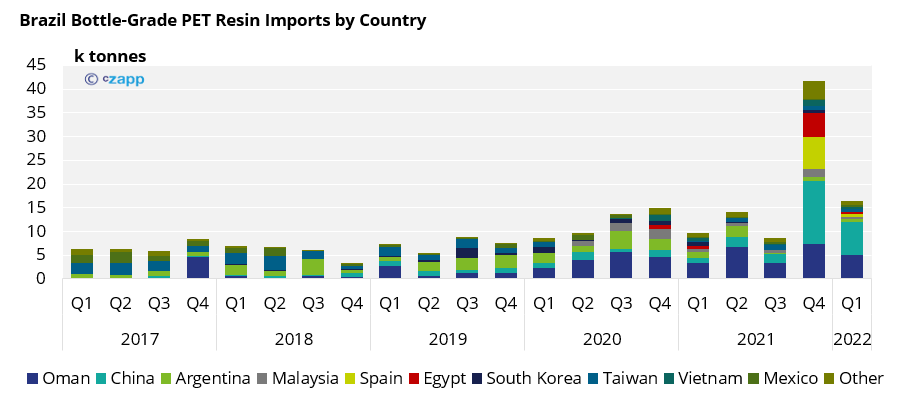

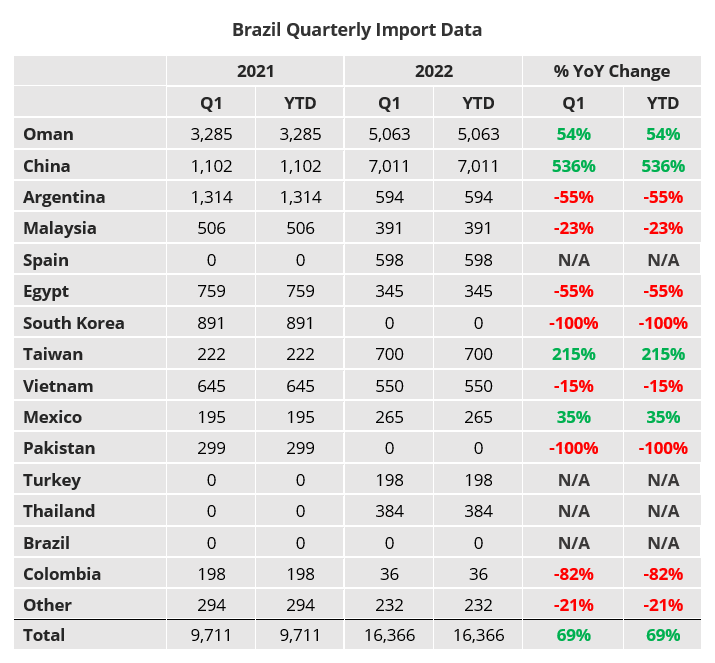

Quarterly Imports

- Following the resumption of production at Indorama’s PET resin plant in November, regional supply shortages eased into Q1, slashing the import requirement compared with Q4 2021.

- Brazil’s bottle-grade PET imports totalled just 16.4k tonnes in Q1, although representing a 61% decline in volume from Q4 2021, total imports in Q1 werestill up 68.5% year on year.

- Over 42% of Brazilian imports were from China, which remained the main supplier of bottle-grade PET resin, other major Q1 origins included Oman, Taiwan, Spain, and Argentina.

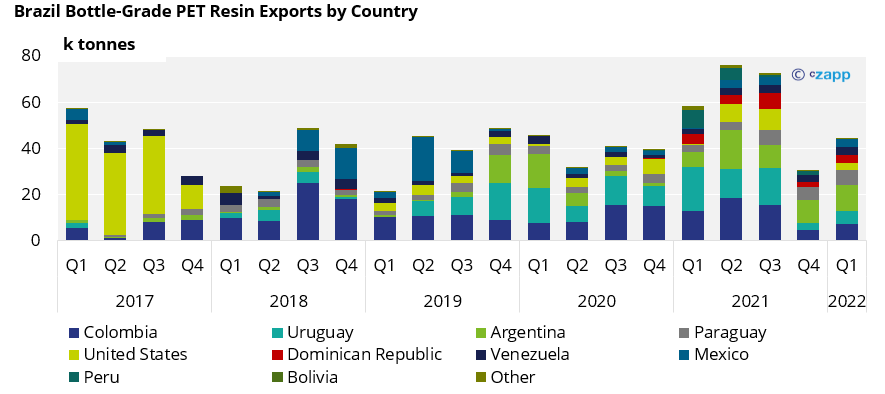

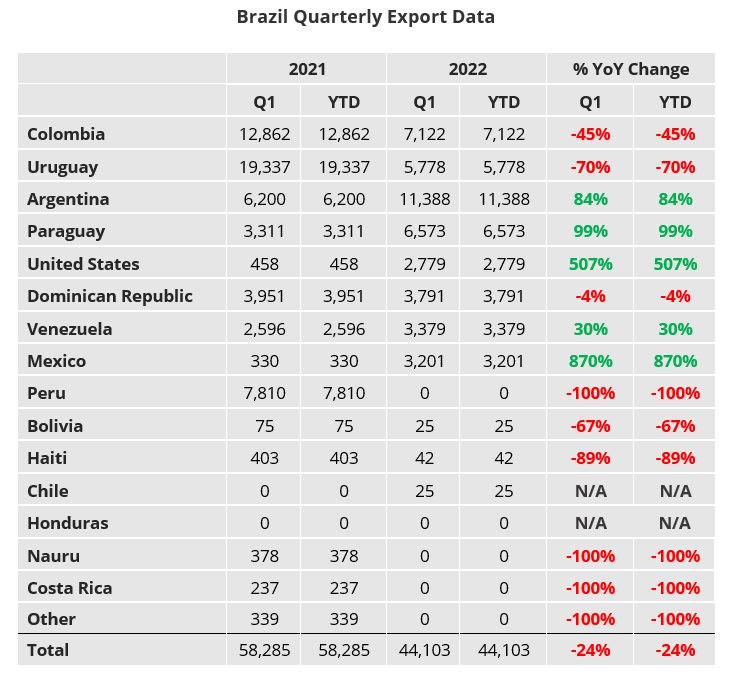

Quarterly Exports

- With domestic production at Indorama’s plant back online, exports rose 47% year on year in Q1 to around 44k tonnes.

- Largest Q1 destinations by volume included Argentina, Colombia, Paraguay, and Uruguay.

- Over a quarter of Brazil’s total exports were destined for Argentina in Q1, around 11k tonnes, up 14% from Q4 2021.

- Although smaller in volume, exports to Uruguay and the Dominican Republic also experienced sizeable increases, doubling from the previous quarter to 6k and 4k tonnes, respectively.

South Korea’s Bottle-Grade PET Resin Market

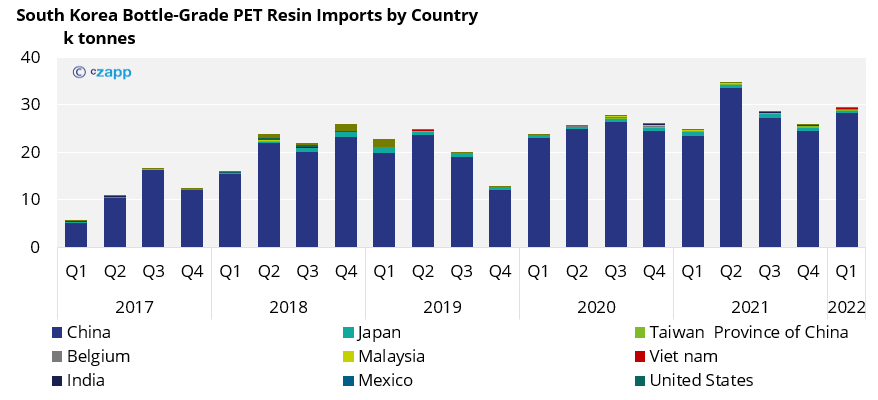

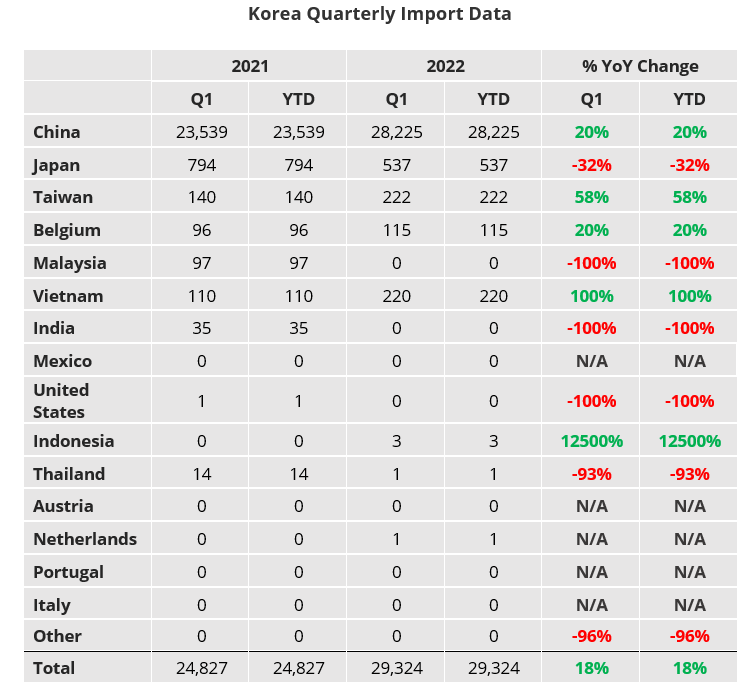

Quarterly Imports

- South Korea’s bottle-grade PET resin imports totalled 29k tonnes in Q1, an increase of around 14% on the previous quarter and more than 18% year on year.

- China remained South Korea’s main resin supplier, supplying over 96% of its PET resin imports, equivalent to around 28k tonnes in Q4 2021.

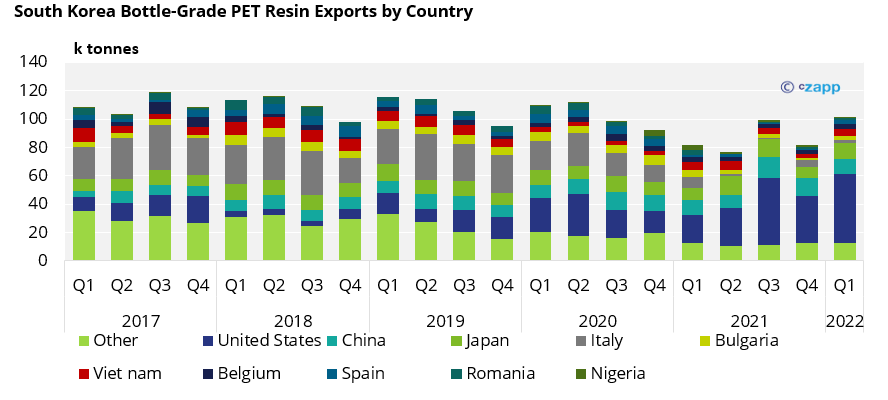

Quarterly Exports

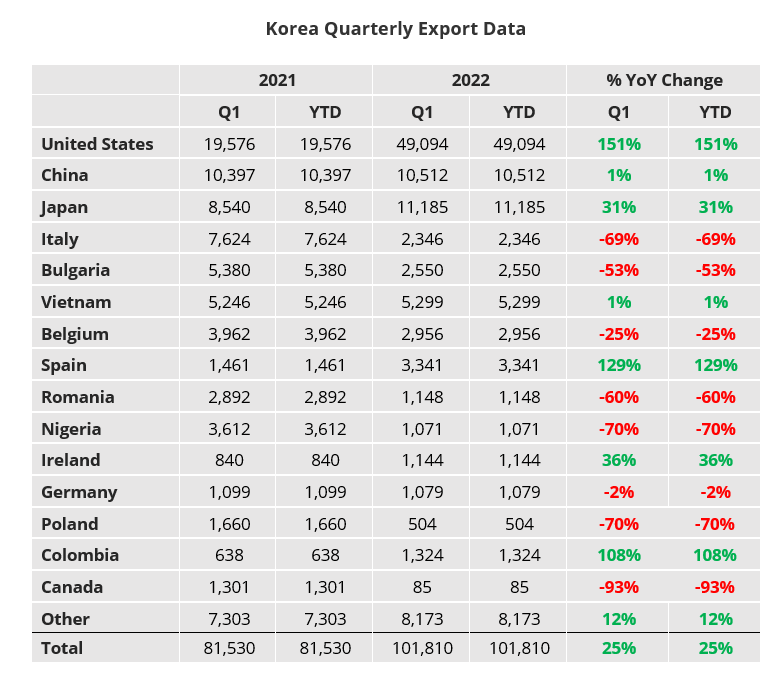

- Bottle-grade PET exports performed strongly in Q1’22, rising to 102k tonnes in Q1’22, a quarterly increase of around 25% and over 25% year on year.

- South Korea’s largest export market was the US, which accounted for over 49k tonnes in Q1’22, up 45% on the previous quarter and exceeding the previous record in Q3 2021.

- Japan and China were the next largest export destinations, recording around 11k tonnes each in Q1.

- Exports to China dipped by 16% in Q1, as value was seen elsewhere and COVID restrictions took hold, whilst a post-COVID recovery in Japan led to exports leaping 49% on the previous quarter, and 31% year on year.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com

Other Insights That May Be of Interest…

Asia PET Market View: Chinese Consumption Rebound Drives New PET Orders

Plastics and Sustainability Trends in June 2022

PET Resin Trade Flows: EU PET Imports Surge Despite Chinese Export Constraints